TipRanks Smart Dividend Newsletter – Edition #8

Hello and welcome to the eighth edition of TipRanks’ Smart Dividend – a weekly Newsletter providing you with investment ideas for safe-bet quality stocks that are outstanding dividend payers, compared to their peers.

Today’s dividend stock recommendation is a company that remained a leader in innovation for over 50 years. A research-and-development trendsetter, this company has been integral to many cellular wireless and video developments that have become essential to daily life and enable the next generation of connected ecosystems. This company relies on its highly skilled workforce to continue powering connectivity throughout the world and reinvests half of its revenue into R&D.

But first, let’s delve into a short update on the market developments.

Macro & Markets: Valuable Technology

Technology stocks have spearheaded market gains this year, despite challenging market conditions and a lukewarm economic forecast. At the start of the year, a mere handful of mega-cap companies accounted for virtually all the gains. However, we’re now seeing a broad rally that spans the entire IT sector.

The drivers behind this year’s tech bull run have varied from month to month. Some investors have sought refuge in cash-rich mega-caps to weather inflation and rising interest rates, while others have been buoyed by a surge in investor sentiment towards AI, largely due to the success of ChatGPT. Nonetheless, the overarching impetus behind the technology sector’s strength remains consistent: technology now fuels our world, enabling us to live and work in ways that were once unimaginable. Following last year’s doom and gloom, we are merely reverting to this long-term trend.

The tech resurgence, however, is not devoid of risks. Despite the rally’s broadening scope, the seven tech giants still account for approximately 70% of the S&P 500’s year-to-date gains. This suggests that these giants have reached outsized valuations. Many other tech companies also appear significantly overvalued, with an increasing number likely to hit overbought levels as the bull run persists. Such inflated valuations increase these stocks’ vulnerability to a market correction. While we remain confident in the upward trajectory of technology stocks, mean reversion could erode many investors’ bottom lines.

Conversely, the market’s obsession with AI-related stocks and large-cap tech has left several promising investment opportunities unnoticed. Despite their robust metrics, these stocks are currently undervalued. Some of these overlooked tech jewels even offer respectable dividends and reward investors through buybacks. Our mission is to unearth these hidden gems for our esteemed investors.

Quality Dividend Stock – This Week’s Top Pick

InterDigital, Inc. (IDCC) specializes in designing and developing wireless, visual, and other related technologies. These innovations enhance connectivity and immersive experiences across various communication and entertainment products. IDCC’s portfolio spans cellular technologies for a wide array of wireless networks, mobile devices, automobiles, wearables, smart homes, drones, and other electronic products. The company is also engaged in artificial intelligence research and development.

As a leading entity in its industry, InterDigital boasts a portfolio of roughly 30,000 patents related to wireless communications and video technologies. The company licenses these patents to global wireless and consumer electronics manufacturers. It re-invests around 50% of its revenue into R&D, with over half of its employees being engineers.

In 2023, for the second consecutive year, LexisNexis acknowledged InterDigital as one of the World’s 100 Most Innovative Businesses. The company is collaborating with scientists from the University of Surrey to expedite the development of 6G technology. InterDigital has also procured funding for eight U.K. and EU-led 6G research programs to accelerate innovation and outline the roadmap for 6G development.

Revenue sources for InterDigital primarily include patent licensing and sales, technology solutions licensing, and engineering services. Nearly 90% of the company’s revenues are recurring, providing a stable and predictable income stream. Boasting quality leadership, InterDigital has licenses and strategic partnerships with many of the world’s premier technology, electronics, wireless equipment, automotive companies, and others. Among its licensees are Apple (AAPL), Samsung, LG Electronics, Alps Alpine (APELF), Panasonic, Xiaomi, HTC, ASUS, Sony (SONY), Fujitsu, Alphabet (GOOGL), Audi, BMW (BMW), General Motors (GM), Ford (F), and more. It also supplies advanced technological solutions to U.S. government agencies, supporting Department of Defense projects and government communication needs. The company expects to generate solid recurring revenues from the patent licensing business in the forthcoming quarters, as it did in the past quarters.

Originally incorporated as International Mobile Machines Corporation in 1972, the company went public in 1981. After acquiring two telecommunication companies in 1992, it rebranded to InterDigital Communications Corp., before settling on InterDigital, Inc. in 2007. Currently trading on Nasdaq under the ticker ‘IDCC’, InterDigital, with a market capitalization of $2.6 billion, is a mid-cap company belonging to the Information Technology Sector (Industry: Software).

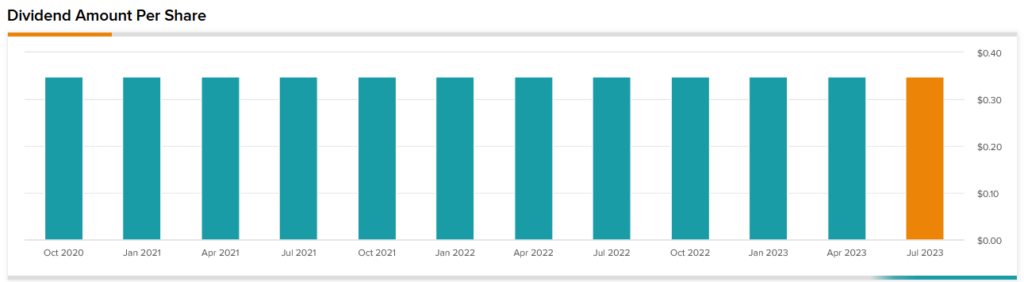

InterDigital has consistently paid stable dividends since 2013, which is unusual among software companies. Although the payout isn’t increased every consecutive year, the total amount distributed to shareholders over the past decade has surged by 250%. InterDigital’s current dividend yield of 1.5% is twice the Software industry average of 0.7% and surpasses the average for the IT sector as a whole, at 1.1%. Given the company’s low payout ratio of 23%, strong cash generation, impressive earnings growth, and stable recurring revenues, the outlook for future dividend growth is promising.

In addition to dividends, InterDigital rewards its shareholders with generous stock buybacks. From 2019 to the end of Q1 2023, the company bought back $500 million worth of shares, resulting in a 20% net reduction in the basic share count. In the first five months of 2023, buoyed by exceptional financial results in Q4 2022 and Q1 2023, the company spent $230 million on buybacks.

InterDigital consistently surpasses analysts’ revenue and earnings estimates without a single EPS miss on record. However, Q1 2023 results were particularly noteworthy even after accounting for a revenue surge following a litigation win against Chinese firm Lenovo. The court ruled that Lenovo must pay a lump sum of $139 million for the use of patented technology. This verdict led to a 100% year-on-year increase in total revenues, significantly boosting the bottom line, with EPS soaring by over 500%. However, high earnings growth is not uncommon for the company: for example, in Q4 2022, its EPS rose 54% year-on-year.

Of course, IDCC’s EPS growth has been positively affected by share buybacks, but it is far from being the main reason for growth. The company has a Return on Equity (ROE) of 26.4%, significantly higher than the industry’s average of 19.7%, indicating efficient management of shareholder equity. Its Return on Assets (ROA) of 11% is twice the industry’s average, suggesting effective use of assets to generate earnings. Furthermore, IDCC has strong profit margins. It has a net profit margin of 32.8% and an operating margin of 43%, both more than double the industry’s average. Additionally, IDCC’s EBITDA margin of 57.5% is notably higher than its peers, signaling its superior operational efficiency.

In terms of its capital structure, IDCC’s financial situation seems robust. Its short-term assets surpass both its short- and long-term liabilities, indicating good liquidity. Although the company has a high debt-to-equity ratio of 97%, this is offset by IDCC’s cash and short-term investments, which cover about 160% of its total debts. This suggests that while the company has leveraged debt, it also has ample liquidity to cover this debt if necessary. Moreover, IDCC’s debt is well covered by its operating cash flow, and its earnings before interest and taxes (EBIT) comfortably cover its interest payments, indicating a manageable debt burden. The company’s extraordinary cash flow generating power supports a favorable outlook for its dividends and share repurchase programs.

Strong financial metrics are reflected in IDCC’s stock performance in recent quarters. Year-to-date, the stock has surged 75%, strongly outperforming its industry, as represented by SPDR S&P Software & Services ETF (XSW), which has risen 28% in the same period. In the past 12 months, IDCC rose 61%, while XSW returned 25%. Longer term, most of IDCC’s outperformance versus the sector is attributable to the past three years, while in the five-year period, the company underperformed as it didn’t have as large a run-up in 2020/21 as the Software industry as a whole.

Despite the outstanding performance year-to-date, InterDigital has remained undervalued versus its peers in the industry and the broad IT sector. IDCC is trading at a TTM P/E of 16.0 and a Forward P/E of 16.6 representing almost 40% discount to its sector’s rich valuations, and they are just a fraction of the Software industry average of 49.2. Taking into account the favorable earnings outlook, financial stability supported by recurring revenues from a sticky customer base, and generous buybacks, we believe that this undervalued innovator’s stock has a lot of room for potential upside. A combination of revenue stability, financial health, earnings growth, and low valuation is a rare find in the IT sector.

InterDigital is rated 9/10 (“Outperform”) by TipRanks’ Smart Score system with a “Strong Buy” recommendation:

IDCC’s analyst coverage is quite low for a great-performing software stock. Currently, it is only covered by four analysts, three of whom attribute it to a price target. While all analysts agree on a “Buy” rating, their 12-month upside outlooks vastly differ, from Bank of America’s 8.8% to Roth MKM’s 18.2%. Individual investors are exceptionally bullish about the stock, and technical indicators point to a strong upward trend.

Overall, we view IDCC as an attractive income investment opportunity, as well as an excellent total return choice. With its stable customer base, robust financial position, exceptional cash-generating abilities, promising dividend growth, and buyback plans, it holds the potential for further investment returns. We believe InterDigital, an undervalued innovator, still has significant room for potential upside, presenting a rare combination of quality, growth, and value.

Disclaimer

The information contained in this article represents the views and opinions of the writer only, and not the views or opinions of TipRanks or its affiliates and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices, or performance.