Analyst Rankings

How to Access and Interpret the Analysts’ Ratings on TipRanks

Wall Street analysts popularly rate stocks as a Strong Buy, Moderate Buy, Hold, Moderate Sell, or Strong Sell, after thoroughly studying a company and the sector that it caters to. The analyst ratings can be accessed from each individual company’s forecast page. Along with stock recommendations, the analysts assign a 12-month price target that will imply if a stock’s price is likely to go up or down from the current price levels, in turn implying the percentage gain or loss on a stock if we buy/hold/sell now.

A Strong Buy rating means analysts expect the stock will far exceed the average return on the stock market. Thus, that implies an upward trend in the price performance.

A Moderate Buy means analysts expect that the stock will outperform the overall stock market, with a related increase in the stock’s price.

A Hold means analysts recommend neither buying nor selling the stock (if you already own it). A Hold rating is usually given due to strong volatility in the stock market, the performance of other stocks in the same sector, or uncertainty about the stock.

A Moderate Sell means analysts expect the stock to perform slightly lower than the overall stock market, implying a downtrend in the stock’s price.

A Strong Sell means analysts expect the stock to perform much lower than the overall stock market, along with a related fall in its price.

How to Compare the Performance of Different Analysts – Top Wall Street Analysts page

Before deciding to follow the stock recommendations of a particular analyst it is advisable to study the analyst’s historical performance. At TipRanks, we consolidate the past performance of analysts and rank them based on the average returns earned per transaction, and their success rate of giving the right calls on stocks. To study that, visit the Top Analysts page on TipRanks. Navigate to the page from the top menu, by clicking on Experts – Top Analysts.

On the Top Analysts page, you will find a list of all analysts in the TipRanks universe, ranked based on the proprietary TipRanks Star Ranking System. The list will give you the Analyst Names, the Research Firms they work for, the Sectors they specialize in, their Buy/Hold/Sell rating Distributions, Success Rates, Average Returns earned, and Followers. You can sort the list as per the parameter you want, by simply clicking on the tab.

A high rating for an analyst signifies that he/she has a proven track record of generating attractive returns on stock picks. Depending on your investment strategy, you can choose to follow an analyst based on parameters such as the success rate, average return, or the sector. If you are not keen on a specific sector exposure, the highest success rate and average returns would be a good point to start with.

On the other hand, if you are interested in investing in a specific sector, select an analyst with the highest ranking in that sector. This way you are sure of following one of the best sectoral experts, thus increasing the probability of making successful investments.

Once you have selected the analyst to follow, you can click on the analyst’s name to further study their performance. The analyst page will give you a list of stocks for which the analyst has given recommendations, along with the average return and success rate generated for each stock. Additionally, you can study the analyst’s returns and success rate compared to the benchmark index. You can choose to follow an analyst by clicking on the “+Follow” button on the consolidated list or from each analyst’s page. By doing so, you will receive regular email alerts each time the analyst gives a new rating on a stock.

How We Rank the Experts – The TipRanks Star Ranking

We developed a 3-tier unique proprietary formula called the TipRanks Star Ranking System to rank all experts in our universe. The three factors considered are the experts’ success rates, the average return per transaction, and statistical significance. We use the formula to rank all experts including Wall Street Analysts, Financial Bloggers, Research Firms, Corporate Insiders, Hedge Fund Managers, and Individual Investors.

Success Rate – An expert’s success rate is measured by the number of times a transaction wins or loses money. Success is defined as a binary – win or lose – as the transaction either makes a profit or loss after a defined period. The default period is one year, or until the expert changes their recommendation. The average is the win-to-loss ratio. We add this to ensure that an expert does not have 10 losing transactions offset by one winning transaction with a high profit – making his or her performance unreasonably high. This measure is often referred to as the hit ratio.

Average Return – At TipRanks, we consider the average return of all transactions as the best measure of an expert’s performance. By doing so, we rule out the possibility of single lucky hits and focus on the expert’s overall performance. For each rating or transaction an expert makes, we measure their return over a defined period. The default period is one year, or until the expert changes their recommendation. We then present the expert’s average return per transaction.

Statistical Significance – A higher number of recommendations ensures the expert’s consistency. For this reason, an expert with more recommendations will have his or her ranking scored higher than an expert with fewer recommendation counts (with all other things being even). In the same way, an expert with a 1,000% average return but one recommendation would rank very low, while an expert with just a 2% average return across hundreds of recommendations would rank very high.

How We Measure Analyst Success Rates and Average Returns

If you have decided to follow a particular analyst’s recommendations, it will be worthwhile to study how the analyst fares compared to his/her peers. TipRanks makes this easy for you by ranking analysts as per the proprietary TipRanks Star Ranking System.

Success Rate – An analyst’s success rate is measured by the number of times a transaction wins or loses money. Success is defined as a binary – win or lose – as the transaction either makes a profit or loss after a defined period. The default period is one year, or until the analyst changes their recommendation. The average is the win-to-loss ratio. We add this to ensure that an analyst does not have 10 losing transactions offset by one winning transaction with a high profit – making his or her performance unreasonably high. This measure is often referred to as the hit ratio.

Average Return – At TipRanks, we consider the average return of all transactions as the best measure of an analyst’s performance. By doing so, we rule out the possibility of single lucky hits and focus on the analyst’s overall performance. For instance, analysts in the biotech field will naturally have higher returns on their winning trades, but those will still have to compensate for higher losses on bad recommendations.

How the Benchmark Affects Analyst Rankings

While studying an analyst’s performance, it is always advisable to compare the analyst’s returns to those generated by a benchmark. A benchmark can be any of the leading indices, namely the Nasdaq 100 (NDX), S&P 500 (SPX), or the Dow Jones Industrial Average (DJIA). A suitable benchmark can also be the overall performance of stocks in a particular sector in which the analyst specializes. Comparing the performance with a benchmark can considerably change the analyst’s average return and success rate figures.

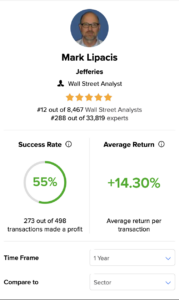

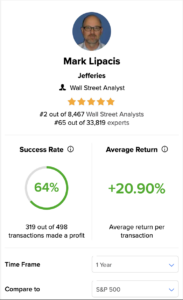

For instance, the charts below show the success rate of five-star analyst Mark Lipacis from Jefferies. The three charts display the varying success rates and average returns on a stand-alone basis, compared to the SPX, and compared to the Technology sector. The Time Frame considered can also change the success rates and average returns per transaction. You can select from among the 1 Month, 3 Months, 1 Year, and 2 Years time frames, with the default being 1 Year.