Core Health

In this edition of the Smart Investor newsletter, we look closely at one of the most prominent companies in the global pharmaceutical distribution industry, providing investors with the necessary information to make informed choices in a constantly changing environment. But first, let us delve into the latest Portfolio news and updates.

1

Last Week’s Portfolio Movers

❖ Jabil (JBL): Shares dropped despite a surge in quarterly net earnings, which exceeded estimates by a wide margin even after accounting for large proceeds from the sale of its mobility division. Investors were spooked by a miss on sales and softer guidance, as the management adjusted its outlook to account for only the core business. However, analysts from Goldman Sachs and Barclays were unfazed, reiterating their “Buy” ratings due to the company’s strategic positioning in fast-growing markets and strong long-term growth prospects.

❖ Ulta Beauty (ULTA): Shares fell even though the company’s Q4 and full-year 2023 earnings strongly surpassed analysts’ expectations, thanks to an increase in sales year-over-year in both periods. However, the company issued cautious guidance for this year, citing an uncertain macro environment. Top-rated analysts from Piper Sandler and TD Cowen reiterated a “Buy” rating on Ulta Beauty, citing strong growth potential despite short-term headwinds. Meanwhile, analysts from Morgan Stanley and Deutsche Bank raised their target price for the stock.

❖ Super Micro Computer (SMCI): The stock officially joined the S&P 500 index on Monday. The company’s shares slid as investors took profits, following the traditional “buy-the-rumor/sell-the-news” modus operandi. Another factor that strongly pressed down on the stock was SMCI’s announcement of its plans to sell 2 million of additional shares to finance expanded production and R&D. The stock may encounter additional selling after a surge of over 820% in the past year. However, analysts are increasingly optimistic regarding SMCI’s medium- to long-term potential thanks to its continued innovation. The company has just revealed its new SuperCluster portfolio, which includes a liquid-cooled system designed to support Nvidia’s Blackwell GPUs announced on Monday at the annual GTC conference.

❖ Oracle (ORCL): Shares continued their upward climb after the company’s joint announcement with Nvidia at the GTC conference on Monday. The firms said they have expanded their collaboration to enable fast and secure local deployment of AI solutions by governments and companies worldwide. Oracle said it will incorporate Nvidia’s latest Blackwell super-chip across its cloud infrastructure systems.

❖ Stellantis (STLA): Shares rose strongly over the week as analysts from Piper Sandler initiated coverage with a “Buy” rating and a price target suggesting a 37% upside. The company has announced a record investment of $6.1 billion in South America, STLA’s fastest-growing end market, where it enjoys a 25% total market share.

❖ Cigna (CI): Shares surged as the company was initiated as a “Buy” at Barclays, after announcing the industry’s first financial guarantee for employers and health plans covering GLP-1 medications. Within the initiative, Cigna signed deals with Eli Lilly and Novo Nordisk, the manufacturers of the drugs.

Portfolio Earnings and Dividend Calendar

❖ The Q4 2023 earnings season for Smart Investor Portfolio companies has ended, but companies whose fiscal year differs from the calendar year continue to report their results. Thus, Accenture (ACN) will report its FQ2 2024 on March 21st.

❖ The ex-dividend date for Broadcom (AVGO) is March 20th.

w

w

Weekly Portfolio Trades

Today, we are adding a leading drug distributor Cencora, and removing Electronic Arts, which has been under review for deletion for some time.

New Buy: Cencora, Inc. (COR)

Cencora (formerly AmerisourceBergen) is one of the world’s largest pharmaceutical service companies. It is focused on providing drug distribution and related services, helping healthcare providers, as well as pharmaceutical and biotech manufacturers, improve patient access to products. COR sources and distributes branded, generic, and specialty pharmaceutical products to pharmacies, hospital networks, and healthcare providers. In addition, it offers equipment, home healthcare supplies, outsourced compounded sterile preparations, and related services.

The company traces its history to 1907. Throughout the years, the company has grown exponentially through acquisitions and market expansions, changing its name several times. The latest change was in 2023 when AmerisourceBergen Corporation became Cencora. Today, Cencora is a Fortune 500 company, commanding a market capitalization of $48 billion and annual revenues of $262 billion.

The Most Innovative Drug Wholesaler

Throughout its history, the firm remained an innovation leader in its industry. It was the first wholesale drug company to use computerized punch cards for inventory tracking, and later to employ computers for inventory control and accounting. It pioneered the electronic transmission of purchase orders, reducing distribution times, and later introduced an electronic ordering system for retail pharmacy customers.

At present, Cencora invests in cutting-edge cell and gene therapies, biosimilars, digital therapeutics, and a host of other healthcare innovations. In addition, COR’s integration of technology into its supply chains and operations offers numerous strategic advantages. Thus, leveraging AI/ML to support data analytics allows significant optimization of inventory and logistics, customer service improvement, and cost reduction.

U.S. Market Dominance and International Expansion

Cencora is a leader across the global pharmaceutical supply chain. In the U.S., COR supplies roughly one-third of the drugs distributed on in the market.

With a diverse portfolio that encompasses branded, generic, and specialty pharmaceuticals, as well as medical devices and animal health products, the company has a distinct edge in the market. Its provision of services to various healthcare sectors mitigates the effects of market fluctuations and supports revenue stability.

Demand for pharmaceuticals is accelerating globally, driven by secular trends such as population aging and increased focus on health and wellness. Cencora’s broad offerings, strong connections with suppliers and healthcare providers, as well as its broad distribution network, position the company at the forefront of meeting the growing demand and capitalizing on these trends.

In 2021, Cencora acquired Alliance Healthcare, a pharmaceutical supplier to over 11 European countries. The buyout has not only diversified Cencora’s revenue base but also bolstered its international presence, positioning it for continued growth in the global pharmaceutical distribution market. The company’s International Healthcare Solutions division has contributed 10% to total revenues in 2023, and this number is expected to continue growing.

In January 2023, COR acquired PharmaLex, a German healthcare and life sciences consulting and outsourcing service provider. The buyout is part of the company’s growth strategy, advancing its leadership in specialty services and increasing its capabilities of global pharma manufacturer services.

Cencora’s proactive business development tactics allow it to quickly seize opportunities and capitalize on emerging trends. Thus, the company has already seen a strong contribution to its revenues from the recently approved GLP-1 drugs for diabetes and weight loss. Accelerating demand for these drugs is expected to continue contributing to COR’s top lines, given that they are expected to be approved for other medical conditions.

Strong Fundamentals, Robust Delivery

Cencora took on a large amount of debt to acquire Alliance Healthcare, but it has since meaningfully reduced leverage, reaching a moderate level of Net Debt / EBITDA, despite a $1.4 billion acquisition of PharmaLex. COR’s debt is well-covered by operating cash flows, while the interest is covered by EBIT many times over.

According to Fitch, which rates COR’s debt at “A-”, the company’s management has the ability to maintain moderate leverage, given Cencora’s robust financial flexibility and solid liquidity, supported by its strong business profile, expanding global reach, and stable revenue growth.

Over the past five years, COR’s revenue has increased at a CAGR of 9.5%, while its earnings-per-share rose by 11%. As a result of its recent acquisitions and other business developments, the company’s top and bottom lines have seen accelerating growth.

Thus, in its fiscal Q1 2024 (ended January 31, 2023) release, Cencora reported a 15% year-on-year revenue growth, a 21% surge in operating income, and a 21% jump in adjusted EPS, far exceeding analysts’ expectations. In fact, the company’s earnings have surpassed estimates in all quarters for which they were available.

As a result of a blockbuster quarter, Cencora’s management has lifted its fiscal year 2024 revenue and EPS guidance to reflect its expected strong business performance for the full fiscal year.

1

Total Return Outlook

Cencora’s stock has returned 108% in the past three years, underperforming its main competitor McKesson (MCK), which is also a Smart Portfolio holding. However, in the past 12 months, COR surged by 57%, slightly outperforming its rival. Both stocks feature much lower volatility than the overall market.

Despite the strong performance, the stock remains reasonably valued, trading below the Health sector’s valuations and in line with its peer average. Notably, based on projected cash flows, the stock is trading ~30% lower than its fair value.

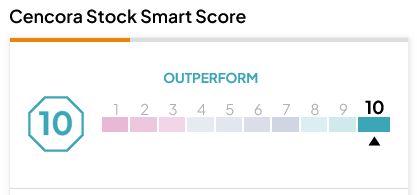

While TipRanks-scored Top Analysts see an average upside of just 5.4% for the stock over the next 12 months, the company may well surprise on the upside, as it did multiple times in the past. COR carries a TipRanks Smart Score rating of a “Perfect 10” with a “Strong Buy” recommendation:

Stock price appreciation is expected to continue to be supported by the company’s buybacks, which it performs on an opportunistic basis. In March 2023, the Board authorized a new share repurchase program, allowing the company to purchase up to $1 billion of its outstanding shares of common stock, subject to market conditions. During FY 2023, Cencora purchased shares for a total of $191 million, and in FQ1 2024 it performed buybacks amounting to $441.7 million.

COR’s shareholders are compensated not only through stock price appreciation: the company has been paying dividends since 2002, increasing them annually over the past 18 years. While its dividend yield is low at 0.83%, the company’s more-than-modest payout ratio, robust financial performance, and the stated alignment with shareholder interests allow for an outlook of further dividend growth.

1

Conclusion

Cencora is a global market leader in its industry, displaying proactive business management and prudent capital allocation. Its ability to adapt to and capitalize on long-term trends supports a positive market share and earnings growth outlook. The company is attractively valued and well-aligned with its shareholders, which makes it an enticing long-term investment opportunity. As such, we believe it can be a valuable addition to the Smart Investor portfolio.

1

New Sell: Electronic Arts (EA)

Electronic Arts is one of the top ten video game producers in the world and ranks as the second-largest pure-play game company after Nintendo. EA showcases stellar financial health with more cash than its total debt, as well as strong capital efficiency and profitability metrics.

Despite its large size, significant market share, and strong fundamentals, its stock has been trading sideways, pressured by macroeconomic and industry-specific developments. U.S. video game spending rose by just 1% year-on-year in 2023. This number is not projected to significantly rebound while the consumers feel the pinch of high interest rates and the economic outlook remains uncertain.

The videogames producer beat on EPS in the last quarter but missed estimates for net quarterly bookings. EA’s key product “Apex” experienced weak results, which offset gains for the EA Sports division. Meanwhile, overall competition in the industry stiffened with several blockbuster releases from other game developers.

Electronic Arts has recently announced that it will lay off 5% of its workforce and terminate the development of some new titles, including a high-profile Star Wars franchise. While these moves are in line with a broad trend of downsizing across the industry, it does undermine investor sentiment.

We may certainly reassess this great company in the future when the outlook for the industry brightens. Meanwhile, we find it prudent to sell the stock.1

1

Portfolio Stocks Under Review

This section will flag stocks that may be let go from the portfolio.

¤ Currently there are no stocks under review.

Charter Members of the 30% Winners Club

*The 30% Winners Club includes stocks from the Smart Investor Portfolio that have risen at least 30% since their purchase dates.

Our exclusive club’s ranks still include 15 stocks, as JBL, which fell through the 30% threshold, was replaced by ITT.

The Winners Club now includes SMCI, GE, AVGO, ANET, EME, ORCL, STLA, CDW, AMAT, TSM, MOH, GD, PH, ULTA, and ITT.

The next in line to enter the Winners’ ranks is now CHKP with a 28.8% gain since purchase. Will it close this minor gap, or will someone else outrun it to the finish line?

What’s Next?

Our next commentary will come out on Wednesday, March 27th, before the market opens.

Until then – we wish you a world of investment success!

Access the full Smart Investor Archive, including all historical stock picks and original newsletters.

Portfolio Snapshot

|

Disclaimer

The information contained in this article represents the views and opinions of the writer only, and not the views or opinions of TipRanks or its affiliates and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices, or performance.