Dividend Investor Portfolio #2: Shopping For Resilience

1

Dear Investor,

Welcome to the 2nd edition of TipRanks’ revamped Dividend Investor Newsletter. In addition to providing a stable dividend income, our newly created Dividend Portfolio outperformed the S&P 500 in March, increasing your total return.

We look forward to investing alongside you and hope you enjoy our newly minted Dividend Investor!

1

1

Market-Moving News: April 1, 2024

Markets closed with mixed results at the end of the holiday-shortened week, as investors took profits after a record-setting stock run. However, all major indexes marked a blockbuster month and quarter, as investor enthusiasm was spurred by resilient profits at large companies, optimism regarding Artificial Intelligence (AI), and an improving economic outlook.

The new economic data releases confirmed the economy’s strength, as Q4 2023’s GDP grew faster than was previously estimated, consumer confidence rose to its highest levels in almost three years, and the weekly unemployment claims fell, underscoring the strength of the job market. The Core PCE – the Federal Reserve’s preferred inflation gauge – cooled down from last month in line with expectations. However, consumer spending surged, providing additional evidence that the inflation decrease is not yet sustainable.

The Fed members’ comments that the central bank is “in no rush” to lower interest rates, as the labor market remains tight, and inflation continues to worry policymakers, seemed to do little to reduce investor enthusiasm, as a robust economy is expected to continue propping up corporate earnings. Investors are bracing for the Q1 2024 reporting season, which begins in less than two weeks, to either confirm or disprove these expectations.

1

1

This Week’s Quality Dividend Stock Idea

Target Corporation (TGT) is a U.S. general merchandise retailer, with a wide presence in all 50 states and the District of Columbia. The company operates a chain of discount department stores, hypermarkets, and e-commerce channels, offering clothing, household goods, electronics, toys, and other products, as well as groceries.

Founded in 1902 and headquartered in Minneapolis, Minnesota, Target is America’s seventh-largest retailer and the third-largest discount chain operator in the U.S. and globally. With a market capitalization of $82 billion and annual revenues of over $107 billion, the company ranks #33 on the Fortune 500 list of the largest U.S. companies by revenue.

1

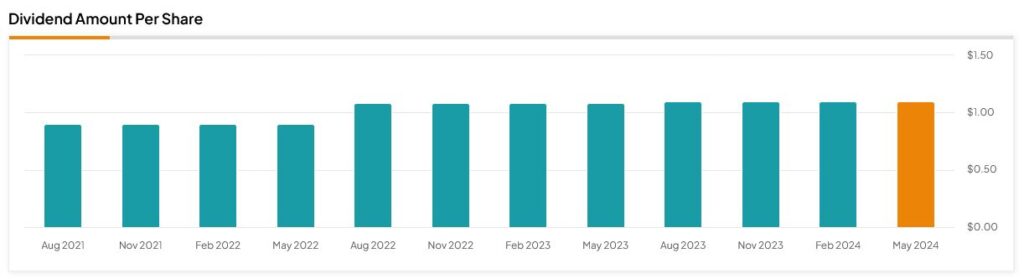

56 Years of Dividend Growth

Target Corp. has been paying dividends since it began publicly trading in 1967, consistently raising the annual payout over the past 56 years. This track record makes Target a member of the Dividend Kings cohort, a select group of stocks that have been growing their dividend payments for at least 50 consecutive years.

As of its current cash payout of $1.10 per share, TGT’s current dividend yield stands at 2.5%, above the Consumer Staples sector’s average and almost twice the average for the U.S. retail industry.

In addition to the long history of payout raises, the rate of dividend growth has also been impressive, registering a CAGR of 11% in the past decade and accelerating to a CAGR of 17.6% during the past three years. This outstanding rate of growth compares favorably to the industry’s average of 5%.

Notably, over the past two years the non-grocery retail industry, which had just begun to rebound after the pandemic’s restrictions, has encountered strong macroeconomic headwinds suppressing consumer spending. Against this backdrop, Target’s relentless and strong dividend increases are further testament to its robust business model and growth prospects.

The safety of TGT’s dividends is supported by its modest low earnings-based payout ratio of 49% and cash flow payout ratio of 53%, which leave the company with ample capital and cash to pursue business growth and support the outlook of further annual dividend increases for years to come.

1

Improving Financial Performance

Target Corp. is a financially sound company, whose strong market position, robust cash flow generation, and modest financial leverage (as measured by net debt-to-EBITDA) support its “A” credit rating at S&P Ratings and Fitch. TGT’s capital efficiency ratios are also very strong, compared to its peers.

The company’s revenues grew at a CAGR of 4.2% in the past decade, while earnings-per-share growth stood at almost 8%, faster than all of its direct competitors. Target’s resilient business model and forward-thinking management are among the primary factors behind its success. The company recognized the importance of e-commerce early on and invested in its digital shopping experience. As a result, Internet sales now account for almost 20% of overall sales, distinguishing Target in the discounted retail space.

Target’s latest financial results, published in March, showed that after several difficult quarters, the company’s performance has turned the corner. From early 2022, the swift acceleration in inflation rates has caused a strong fall in U.S. discretionary spending. However, the improving macroeconomic outlook and slower price increases have helped Target produce stronger results during the past two fiscal quarters.

In FQ4, TGT reported a much smaller decline in sales year-over-year, thanks to accelerating store and website traffic. The company expects further sales improvement in the current fiscal year, helped by the strengthening economy as well as several Target initiatives, such as a paid membership program, new labels, same-day services, and partnerships with high-end design houses along with the introduction of an affordable private brand.

As for bottom lines, TGT has exceeded analysts’ EPS expectations in FQ4 for a fifth straight quarter; its fiscal-year results were also better than expected. In FY 2023 (ended January 28, 2024), net income surged by 49% from the previous year, thanks to lower logistics and other costs as well as an improvement in inventory management. The company’s efficiency efforts delivered savings of more than $500 million in FY 2023. Margins expanded, with many of the metrics almost reaching the stellar pre-2022 numbers. Cash generation also strongly recovered, with cash from operations returning to 2021 levels.

The company continues to proceed on its long-term target of cutting annual costs by $1.5 billion, along with expanding profitable locations and upgrading stores, as well as investing in its supply chain and technology. Target’s management has issued a very conservative EPS guidance for FY 2024, penciling in an increase of about 2%. However, as seen over the past several quarters, the company may well surprise on the upside.

1

Total Return Outlook

Target’s investors have enjoyed a total return of 145% in the past five years, accounting for both capital gains and dividends. TGT stock rose to a record high during the pandemic, as customers flocked to its delivery and pickup services. In 2022, inventory challenges weighed on financial results, while inflation took hold, causing lower sales as shoppers prioritized necessities. As a result, the stock dropped almost 60% from its 2021 high down to its October 2023 lows. However, it has since rebounded by over 65%. After this wild ride, TGT is still down by 11% for the past three years, and up by just 7% in the past 12 months.

Based on the apparent turnaround for the better in the financial performance and optimistic outlook, Target’s stock is set to continue its strong performance. However, for now, it is still very reasonably valued, displaying P/E ratios in line with the averages for the Consumer Staples sector and at the bottom of the valuation range for its peers in the Retail industry. Furthermore, based on projected cash flows, TGT trades about 25% below its fair value, placing it firmly within a value category.

Target Corp.’s stock performance is also expected to be supported in the near future by the company’s share repurchases. In the fiscal Q4 2023, the stock surged almost 30% without any such support, as the company has not performed any buybacks since FQ2 2022. The company’s management said that repurchases will return after the company has fully repaired its profitability and cash-generation growth metrics, a target that looks close to being achieved. TGT’s management said that buybacks may resume in the second half of this year. There is currently a $9.7 billion capacity remaining in the share repurchase program that was approved in August 2021, representing ~12% of TGT’s outstanding stock.

1

Investing Takeaway

Target Corporation is a Dividend King and an outstanding dividend grower. With a track record of strong financial performance, stemming from its robust business model, diverse offerings, wide presence, and superb financial management, TGT stands out as a top investment pick in its industry. These factors, coupled with the company’s commitment to shareholder value, make it a reliable income generator. At the same time, Target’s reduced valuations suggest that TGT combines both value and income proposition, and therefore is well-suited to be a part of long-term income portfolios.

1

1

Dividend Investor Portfolio

1

Portfolio News

¤ Philip Morris (PM) will launch its top-selling heated tobacco device IQOS in Texas, which will be the first testing ground for its U.S. entry. Given the country’s market size, the company hopes that its efforts at creating a domestic market for heated tobacco will result in a new, significant income stream. Meanwhile, PM’s freshly released annual Integrated Report for 2023 highlighted its progress towards its goals, including an increase of smoke-free products’ share in the total revenue mix, as well as expanding markets for these products.

¤ BlackRock (BLK) tokenized money-market fund, BlackRock USD Institutional Digital Liquidity Fund, has attracted more than $240 million within a week of its inception. The world’s largest money manager continues to build on its newfound success in digital assets. As a case in point, its iShares Bitcoin ETF has attracted more than $13 billion in inflows since its launch in January.

¤ JP Morgan’s (JPM) dividend, whose ex-date is April 4th, will be 9.5% larger than the previous payout. Other than a few quarters during the Covid-19 crisis, the world’s largest bank has been lifting its cash payouts annually since 2011.

1

Recent Trades

None at the moment, although we are considering adding a stock to our portfolio. Stay tuned.

1

Portfolio Attributes

1

Current Portfolio

1

1

1

Click here for more stock market analysis from TipRanks Macro & Markets research analyst Yulia Vaiman

1

Disclaimer

The information contained in this article represents the views and opinions of the writer only, and not the views or opinions of TipRanks or its affiliates and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment, and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices, or performance.