TipRanks Smart Dividend Newsletter – Edition #4

Hello and welcome to the fourth edition of TipRanks’ Smart Dividend – a weekly Newsletter providing you with investment ideas for safe-bet quality stocks that are outstanding dividend payers, compared to their peers.

Today’s quality dividend stock recommendation is a company that is not just a Dividend Aristocrat, but a Dividend King, having continuously increased its cash payouts for over 50 years. But first, let’s delve into a short update on the macro and market developments, which will also help you evaluate the stock we will present next.

Macro & Markets: Bull Market or Not, Dividends Protect from Uncertainty

The U.S. Federal Reserve has paused its rate increases for the first time in 15 months. However, investors were shaken by the hawkish language that accompanied the decision. Jerome Powell said that high and sticky inflation is still a concern, and most members of the Committee see further increases this year as appropriate. Indeed, the updated “dot-plot” projection (a chart that records each Fed official’s projection for the central bank’s key short-term interest rate) signals two more 25 basis point hikes in 2023. Besides, the Fed’s Chairman explicitly warned the markets that they shouldn’t count on interest rate cuts for another “couple of years.”

Meanwhile, economic signals continue to be mixed, with some pointing at weakness (manufacturing) and some rebounding (consumer spending); at the same time, the labor market continues to display tightness, propping up inflation. “It may make sense for rates to move higher, but at a more moderate pace,” Powell said after the interest rate decision was announced.

The Fed’s hawkish language surprised the stock markets, which have just begun to expand the last months’ rally to stocks outside of Big Tech. However, the S&P 500 (SPX) rose for the fifth straight week; the VIX – an SPX-options index, representing the short-term volatility projection, also known as “the fear index” – is still at its lowest levels since before the Covid-19 pandemic. These developments signal that at the moment, stock market participants don’t attribute much weight to the Fed’s rhetoric; this may soon change. Statistically, every time the Federal Reserve paused its hiking efforts for a number of meetings, stock markets rallied; on the other hand, when it resumed rate hikes after a skip, the outcomes for stocks varied significantly.

So, even if the history of the U.S. stock markets is to repeat itself this time – and if the Fed stands behind its “dot plot,” of course – it is still difficult to know what to expect concerning the stock performance. Thankfully, there’s one thing investors can predict and count on: dividends.

Quality Dividend Stock – This Week’s Top Pick

Without further ado, let’s dive straight into our recommendation for a quality dividend stock for this week.

Becton, Dickinson & Company (BDX), also known as BD, is a medical technology company that provides medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, the pharmaceutical industry, and the general public worldwide. With more than 75,000 employees and a presence in virtually every country in the world, BD is one of the largest global medical technology companies; it is included in the Fortune 500 list.

Becton operates through the following segments: BD Medical, responsible for over half of sales, and BD Life Sciences and BD Interventional, each providing around a quarter of revenues. The BD Medical segment focuses on medication delivery solutions, medication management solutions, and pharmaceutical systems. The BD Life Sciences segment focuses on biosciences and integrated diagnostic solutions; while the BD Interventional segment focuses on the development of surgical and other interventional systems and processes.

Becton, Dickinson and Company is a large-cap company, commanding a market cap of $75 billion. It belongs to the Healthcare Sector (Industry: Healthcare Products/Medical Devices). The company holds different market shares in various segments of its activity; for instance, it produces 70% of all needles and syringes sold in the world. Overall, the medical devices market share for the company stood at 19% in Q1 2023, despite stiff competition from giants like Abbot (ABT) or Medtronic (MDT).

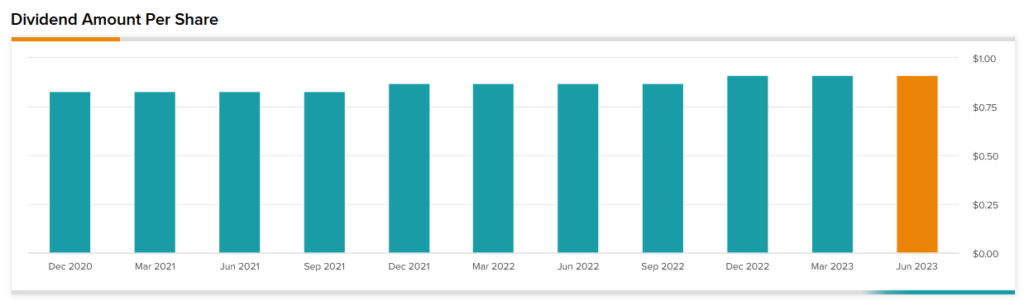

The company was founded in 1897. Since becoming publicly traded in 1962, BD has paid regular quarterly dividends and has also declared periodic dividend increases. With a history of 51 years of dividend growth supported by BD’s leading position in the industry, the company is included in the exclusive list of Dividend Kings (firms with over 50 years of dividend increases).

Becton’s dividend yield of 1.4% may not sound high, but it is twice the average for the U.S. Healthcare Products industry (0.68%). The company’s medium-low payout ratio of 32% (versus the industry’s average of 46%) leaves the company with most of its earnings to invest in business expansion, M&A, and R&D.

In contrast to other industries in the Healthcare sector, Becton’s industry is quite stable and predictable in terms of demand and projected revenues; much of the demand is generated by hospitals and clinics, supporting recurring revenue model and lower operating costs. However, it is mostly a low-growth industry; Becton counters that by engaging in serial acquisitions, which allow it to boost its business scope and geographical reach, as well as grow revenues and reduce costs. In the last five years, BD has completed 17 acquisitions of different companies and continues to seek inorganic growth opportunities.

Despite its 120-year history, BD remains the leader in innovation in the industry. The company invests heavily in research and development. In fiscal year 2022 (ending in September 2022), Becton launched 25 new products; 10 new developments have been launched in the first half of fiscal 2023 alone. By FY 2025, the company plans to launch over 100 new products, with the potential to generate $30-50 million of additional annual revenue per product. In addition, BD constantly works to incorporate cutting-edge technological advancements into its products. For instance, in January this year, BD released a robotic system to automate lab specimen processing, and in May 2023 the company announced that it received FDA clearance for its new application that uses artificial intelligence (AI) to interpret bacterial growth and release negative specimens with minimal human interaction.

Becton, Dickinson and Company’s fiscal Q2 2023 (calendar Q1) results surpassed analysts’ estimates, as two of the company’s segments reported strong revenue growth. While sales in the life sciences segment, which sells diagnostic devices, fell year-on-year due to a slump in demand for Covid-19 tests, a surge in demand for drug delivery devices and surgical equipment outweighed these negative effects. On the bottom line, BD beat analysts’ estimates on EPS, as it has done in each quarter since these estimates became available (and at least since Q2 2019). After its strong results in fiscal Q2, the company raised its full-year FY 2023 revenue and adjusted EPS guidance. In the past five years, Becton’s average annual revenue growth has been 5%, and earnings have risen by almost 25% per annum. The company’s Return on Equity (ROE) of 6.6% is similar to that of the U.S. Healthcare Products industry; BD’s net profit margin of 8.3% is higher than the average for the industry (7%).

Becton is a financially healthy company. Although the company funds its multiple acquisitions with debts, in addition to its own cash, it has succeeded in cutting its debt-to-equity ratio from over 100% five years ago to 70%. BD’s interest payments on debt are well covered by EBIT. The company’s EBITDA margin of 25.6% is more than twice the average for the industry, 10.4%.

Becton, Dickinson and Company is expected to continue its great performance. Analysts expect average annual EPS growth of 17.5% in the next three years, with continued revenue growth of around 5% a year. Becton is not a growth company; its primary appeal is its stability and low volatility. On the other hand, along with the higher-cost cutting-edge technologically advanced products, the company supplies absolutely necessary medical tools and implements, which, given the aging population, will see a continued rise in demand.

Morgan Stanley (MS) has recently included Becton in a list of companies with the strongest pricing power in their industries, which can continue to uphold adequate profitability on the back of their ability to maintain or raise prices despite falling inflation. According to MS strategists, BD enjoys strong pricing power thanks to its low production costs and high market share. Besides, a significant part of BD’s revenues stems from lower-priced products such as syringes, helping revenue stability, which is the basis for continued business expansion. In addition, Morgan Stanley recommends Becton’s stock as a non-cyclical choice for investors searching for stability in the current volatile markets.

The company’s stock has risen by 1% year-to-date and by 9.4% in the past 12 months; in the last three years, it gained 15%. Considering the medium-to-low stock gains, BD’s valuations may seem extreme, with GAAP TTM P/E of 47.5 and Forward P/E of 35.9 – however, they are lower than average P/Es for the industry. The U.S. Medical Equipment industry’s average TTM P/E currently stands at 78, as BD’s extremely expensive peers (such as Boston Scientific and Intuitive Surgical) pull up the average.

Becton is rated 10/10 (“Outperform”) by TipRanks’ Smart Score system with a “Moderate Buy” recommendation, and an average upside forecast of 9.1% for the next 12 months.

With over 120 years of operations and a 51-year history of dividend increases, BD is a great long-term income investment, with continued increases in dividend payments as good as certain. In addition, it is one of the most stable predictable low-volatility healthcare stocks in the U.S. markets. We believe that Becton, Dickinson and Company has a place in all income investment portfolios.