TipRanks Smart Dividend Newsletter – Edition #5

Hello and welcome to the fifth edition of TipRanks’ Smart Dividend – a weekly Newsletter providing you with investment ideas for safe-bet quality stocks that are outstanding dividend payers, compared to their peers.

Today’s quality dividend stock recommendation is the world’s fourth largest industrial conglomerate, which, in its 138 years of existence, has churned out a myriad of inventions and developed multitudinous products, many of which are still in use today. Besides its enormous importance for industrial development, the company we are recommending is a value-creating machine for its shareholders and a generous dividend payer.

But first, let’s delve into a short update on the macro and market developments.

Macro & Markets: Is This Time Different?

Federal Reserve Chair Jerome Powell, in his testimony before Congress, said that the Fed would likely need to raise the interest rate two more times before the end of the year. This past week, there were rate hikes by the Bank of England and the Swiss National Bank; the ECB and the Bank of Canada lifted their rates earlier this month. There is a growing concern that central banks around the world will be forced to continue raising rates to curb stubborn inflation, pushing economies into sharp downturns. Weak economic data from the Eurozone and China, as well as a sharper decline in U.S. manufacturing activity, upheld the view of the weakening global economy, renewing worries over a possible U.S. hard landing.

The recession theme has returned to the headlines after it was buried under the happy chatter about the AI-fueled rally, which has pulled the stocks out of their bear market lows. Despite its strength, this has been one of the most unloved rallies on record. One of the main reasons for analysts and strategists to declare it unsustainable has been the narrowness of the gains, concentrated in a small number of stocks connected in some way with the AI theme.

According to investing textbooks, in the current late stage of the economic cycle, we were supposed to see gains in Real Estate, Utilities, Energy, and Consumer Staples. Instead, the market’s reality is disconnected from the economic one this time, with the performance displaying exactly opposite numbers from those expected. Now that the possibility of an economic downturn has reentered the market participants’ expectations with a vengeance, we may observe a re-convergence of the market behavior with the economic data. On the other hand, things might be really different this time – who knows, maybe new market textbooks will be written based on these peculiar last few years. Whatever the future holds, it’s great to have an anchor, providing some stability and certainty: dividends.

Quality Dividend Stock – This Week’s Top Pick

Without further ado, let’s dive straight into our recommendation for a quality dividend stock for this week.

Honeywell International Inc. (HON) is an American multinational corporation, which operates as a diversified technology and manufacturing company worldwide. Honeywell is the world’s fourth-largest conglomerate.

Honeywell operates through four business groups: Honeywell Aerospace (Aero), Honeywell Building Technologies (HBT), Safety and Productivity Solutions (SPS), and Performance Materials and Technologies (PMT). Its Aerospace segment develops sustainable fuels, avionics and spacecraft control systems, integrated safety and security systems, connectivity solutions, and much more. The company’s Building Technologies section provides software for building ecosystems, including management, cloud, cybersecurity, sustainability, safety, and integrated operations. HON’s Performance Materials and Technologies division offers automation control, instrumentation, and software and related services, as well as high-quality and high-performance chemicals and materials. The company’s Safety and Productivity Solutions segment provides personal protection equipment, gas detection technology, cloud-based notification and emergency messaging, and many more products and services.

Honeywell is a large-cap company with a market cap of $133.2 billion and a global workforce of approximately 110,000 employees. It is on the Fortune 100 list of the 100 largest companies in the U.S., ranked by revenue. HON belongs to the Industrial Sector (Industry: Diversified Industrials/Industrial Conglomerates).

Throughout its history, Honeywell International’s engineers have filed numerous inventions, many of which are widely used today, either in their original form or in some iteration. These include autopilot, unleaded gasoline, biodegradable detergents, barcode, etc. Although the company has been in existence for almost one and a half centuries, it is still at the forefront of innovation.

Founded in 1885, Honeywell went through many changes: mergers, acquisitions, spin-offs, and consolidations. The company has existed in its current form since 1999, as a product of the merger of Honeywell Inc. and AlliedSignal. Honeywell International Inc. was a component of the DJIA from 1999 to 2008, but its corporate predecessors traded on the Dow since 1925. In 2020, Honeywell rejoined the Dow Jones Industrial Average index, and the following year moved its stock listing from the New York Stock Exchange to the Nasdaq.

The industrial and software giant has been paying dividends since 1972; it has registered steady annual increases in its cash payouts to shareholders since 2011. Honeywell pays a dividend yield of 2.06%, versus the industry average of 0.7% and the Industrial sector’s average of 1.5%. In the past 10 years, HON grew its dividend per share by a CAGR of 9.1%. The company’s medium-low payout ratio of 45.5% is sustainable and leaves the company with ample net earnings to invest in its organic and inorganic business growth.

Besides dividends, HON rewards its investors with generous buybacks. In end-April, the company’s Board of Directors authorized a new buyback program, which includes a repurchase of up to $10.0B of the company’s common stock.

On some level, owning Honeywell shares resembles investing in an ETF, because of the company’s wide business diversification. Honeywell is the U.S.’s last industrial conglomerate, spanning numerous sectors, industries, and technologies. The conglomerate structure helps the company maintain its rock-solid business, as its different business segments ride various stages of the economic cycle. For example, when the Aerospace segment suffered during Covid-19, Honeywell’s other segments partially compensated for the slump. HON’s business is quite diversified across the segments: Aero represents 33% of the total sales and PMT comes second at 30%, while SPS and HBT contribute 20% and 17%, respectively.

Honeywell’s Aero business is one of the most stable in terms of revenues, of course barring events like Covid-19. The company is one of the U.S. government’s top contractors; its products can be found on board every NASA space mission; it ships power units, generators, and high-performance engines for airplanes, helicopters, and military vehicles. Moreover, HON has contracts with all global aircraft builders and carriers.

One of the drivers of Honeywell’s success is its innovative approach. For example, in the past few years, the company has grown its own software and Internet of Things (IoT) business, further blurring the line between being an industrial and an IT company. Moreover, it has continued investing in breakthrough technologies, including sustainable tech solutions, aerial systems, and even quantum computing. Last year, Quantinuum, the quantum computing company spun out from Honeywell, made a breakthrough in the technology that should help accelerate commercial adoption of quantum computers; as HON continues to hold a majority stake in the new company, it will profit from the results. Honeywell is known for a number of its spinoffs, as its internal investments into various technological innovations often grow to be independent successful businesses.

Another factor fueling Honeywell’s success story is its continuous growth and expansion, without abandoning its core business. The company has completed more than 120 investments and acquisitions over the years, which have helped it to diversify its products, geographical locations, and industries. Honeywell’s acquisitions have consisted largely of businesses aligned with the company’s existing technologies. The acquired companies are integrated into one of Honeywell’s four business groups but retain their original name, serving as the company’s subsidiaries.

Honeywell is a financially sound and very profitable company. Although the company’s net debt-to-equity ratio of 67% is considered medium-high, HON’s debt is well covered by operating cash flow, and interest payments on its debt are well covered by EBIT. As for Honeywell’s profitability, it scores an A across different metrics. Return on Equity (ROE) of 29.6% is high and better than average for the sector, and so is its Return on Assets (ROA). HON’s net profit margin of 14.5% is more than twice that of the Industrial sector; its EBITDA margin of 23.3% is almost twice that of the sector. The company also generates ample cash, protecting it in any downturn (and supporting its dividends and buybacks).

In its financial results report for Q1 2023, Honeywell beat analysts’ estimates, as it did in at least 16 past quarters. That, despite the current economic conditions weighing on the industrial sector due to high inflation, rising interest rates, and macroeconomic uncertainty. In Q1, the company’s EPS rose over 8% year-on-year, after two quarters of double-digit growth. The company also raised its full 2023-year guidance. The company is expected to continue its steady growth, increasing EPS by 11% annually in the next three years and reaching an ROE of over 40% in three years.

In the past decade, Honeywell’s stock is up by 179%, while the S&P 500 (SPX) has gained 177%. In shorter periods, being a non-IT stock, HON has lagged behind the S&P 500, but not as much as one would expect: in the past five years, HON has risen 41%, while SPX has risen by 59%. In the last three years, the stock has brought its investors almost as much as the large-cap index: 38% (vs. the index’s 40%).

In the past 12 months, Honeywell’s stock outperformed the S&P 500, rising 12.2% versus the index’s 11.5%. However, HON has been declining from end-2022, weighed down by the economic uncertainty and unfavorable short-term prospects for industrial companies. The year-to-date decline of 6.6% has decreased the company’s valuation, a boon for long-term investors looking for quality at fair prices.

Although Honeywell, with its TTM P/E of 26, still isn’t cheap compared to the sector’s average of 19, it would be unreasonable to expect this value-churning giant cash machine to trade lower than the wide industrial sector, which includes many companies with hair-thin profit margins. Besides, analysts agree that at the current P/Es, Honeywell is undervalued vs. its own fair value; its buyback and dividend policy allows for much higher share prices.

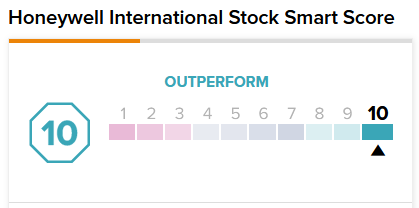

Honeywell is rated 10/10 (“Outperform”) by TipRanks’ Smart Score system with a “Strong Buy” recommendation, and an average upside forecast of 15.6% for the next 12 months.

Honeywell enjoys revenue diversity and is well-positioned to experience sustained tailwinds. Despite current economic challenges, long-term investors will find Honeywell an attractive investment opportunity. With its more than a decade-long record of consecutive dividend increases, backed by a rock-solid business model, a healthy balance sheet, and the size to withstand any downturn, further dividend growth is as good as guaranteed. We believe that safety, stability, and a positive long-term outlook make a compelling case for holding HON in all income investment portfolios.