TipRanks Smart Dividend Newsletter – Edition #14

Hello and welcome to the 14th edition of TipRanks’ Smart Dividend – a weekly Newsletter providing you with investment ideas for safe-bet quality stocks that are outstanding dividend payers, compared to their peers.

Today’s dividend stock recommendation is one of the leading biotech companies in the world, which, despite its long history, continues to be a leader in innovation and research. The company we are recommending has been raising its dividends for 12 years, while its solid execution and strong earnings growth record support the expected continuation of increasing shareholder compensation.

But first, let us present a brief investment thesis, supporting our recommendation.

Investment Thesis: The Golden Gene

Investing in biotechnology stocks is akin to backing the scientific pioneers of our time. These companies are at the forefront of innovations in medicine, healthcare, and technology—developing therapies for previously untreatable conditions, groundbreaking vaccines, and life-extending treatments. But the appeal of biotech goes beyond scientific discovery.

Investors are increasingly attracted to established biotech firms that have already proven their mettle, generating stable revenue streams and delivering consistent growth. The sector is notoriously volatile, yet it offers higher growth prospects than many other industries. That’s why adding a dividend-paying biotech stock to your portfolio can be a masterstroke. Not only do you benefit from potential capital appreciation, but you also receive a steady income stream.

When a biotech company has a track record of consistently raising its dividends, it usually signals operational excellence and a sustainable business model. In a volatile market, these are the kind of reliable bets that can help anchor your portfolio.

Quality Dividend Stock: This Week’s Top Pick

Amgen, Inc. (AMGN) is one of the world’s leading biotechnology companies, employing genetics in the discovery and development of biological medicines. The company produces human therapeutics with a primary focus on treatments for serious diseases, mainly in the inflammation, oncology/hematology, bone health, cardiovascular disease, nephrology, and neuroscience areas. A biotechnology innovator and a pioneer in the science of using living cells to make biologic medicines, Amgen helped invent the processes and tools that built the global biotech industry.

Amgen was incorporated in 1980 in California as Applied Molecular Genetics Inc. The company went public with the name “Amgen” in 1983. In the same year, the company released its first treatment, Epogen, that soon became one of the most successful drugs in biotech history. In 1992, Amgen reached a threshold of $1 billion dollars in sales. In 2020, the company’s stock, which is traded on NASDAQ, was included in the Dow Jones Industrial Average (DJIA) index. Today, Amgen is a Fortune 500 company with $27 billion in annual revenues, which commands a market capitalization of $137 billion, employs a staff of approximately 25,000, and has a presence in over 100 countries.

Amgen’s medicines typically address diseases for which there are limited treatment options or provide a viable option to what is otherwise available. The company’s treatments are already used by millions of patients around the world, and Amgen continues to expand its pipeline, developing medicines with breakaway potential. In addition to the development of original treatments, the company also produces biosimilars to existing drugs whose patent protection has expired. Amgen sells its products to healthcare providers, including physicians or their clinics, dialysis centers, hospitals, and pharmacies globally, but primarily in the U.S.

To keep pace with rapidly changing opportunities and challenges, Amgen has adopted a dynamic R&D strategy. Despite its focus on human biology and genetics, the company employs all relevant innovations in its research and development process. The union of technology and biotechnology has been one of the pillars of Amgen’s drug research for many years. AMGN’s researchers use Big Data mining tools to harness and process real-world data to improve their understanding and prediction of diseases, as well as identify new research targets. The company has been investing heavily in the incorporation of artificial intelligence (AI), data science and other technologies to create the next generation of medicines. In the biotech field, Amgen is investing in gene editing, cell therapy, and other advanced technologies.

AMGN has a long list of products, with some of them producing blockbuster sales year after year. Its top four drugs – rheumatoid arthritis treatment Enbrel, postmenopausal osteoporosis drug Prolia, plaque psoriasis medicine Otezla, and fracture-preventing treatment XGEVA – comprise about half of the company’s total sales. The recent earnings report showed that these drugs continue generating cash for the company, with additional treatments gaining ground in terms of revenue. In the past three years, Amgen’s EPS has grown at a CAGR of 35%.

The Q2 2023 revenue and earnings results exceeded estimates by a large margin, as they did in 14 out of the 16 last quarters. Amgen’s EPS returned to year-on-year growth after two quarters of slight declines, driven by a surge in sales volume (and not price increases, as opposed to some competitors), with nine products registering record quarterly sales. The company was able to easily meet demand growth, thanks to its massive manufacturing capacity.

Of course, no one is perfect, and there were some not-so-positive disclosures in the report, such as the slower-than-expected market uptake of Amjevita, the biosimilar to AbbVie’s blockbuster Humira, whose patent expired. Still, the company did very well in the second quarter, which allowed the management to increase profit and revenue guidance for the year.

The increased revenue outlook did not include any projected contribution from the potential acquisition of Horizon Therapeutics, with the $28 billion overtake currently challenged by the Federal Trade Commission, but still expected by management to be closed by the year-end. If, contrary to the expectations, this deal falls through, Amgen will pursue its product portfolio expansion goals elsewhere.

Acquisitions, along with the heavy investment in its promising pipeline, have spurred AMGN in the past and are expected to continue supporting its ambitious product growth targets and open up new markets for existing products. Acquisitions, along with the R&D expansion, will also help overcome revenue declines from patent cliffs, which all innovative pharmaceutical companies encounter along the way. Over the years, AMGN has acquired 24 companies; its latest acquisition is ChemoCentryx, a biotechnology company that developed treatments for autoimmune diseases, inflammatory conditions, and cancer, in October of last year.

Of course, extensive R&D efforts, as well as acquisitions, do not come without a cost. Thus, Amgen has a staggeringly high debt-to-equity ratio of around 900%. Amgen’s huge market cap and a BBB+ credit rating (which means that the company can borrow cheaply as it is not considered risky) reflect its ability to easily raise cash if needed. However, there is no solvency issue whatsoever within the company’s balance sheet. Its interest payments are well-covered by its EBIT; besides, its debt ratio (debt/assets) is a solid 0.7. Additionally, the company has ample liquidity, as witnessed by its current ratio of 2.0, let alone the cash and cash equivalents of $35 billion. Furthermore, the company’s ability to turn over 90% of its EBIT into free cash flow is outstanding. As for profitability, Amgen’s operating margin of 38.5% and net profit margin of over 30% leave its peers well behind.

AMGN pays a generous dividend, with the current dividend yield standing at 3.32%, higher than average for the Health sector and for the Biotechnology industry. Moreover, the company has been continuously increasing its dividend payouts for the last 12 years; its latest increase was declared in early August and will take effect next year. In the past decade, the payouts grew at a compound annual growth rate (CAGR) of approximately 17.5%. Despite the high dividend yield and the fast growth, the company’s payout ratio is a modest 54%, which means that it retains a sufficient amount of its earnings to reinvest in its business. Given its track record, Amgen is expected to continue to raise the shareholder payouts.

Amgen has a diversified portfolio of medicines, spanning numerous therapeutic areas and holding a leading market position in their niches. Even more pharmaceuticals are expected to come from its robust pipeline. The company is constantly developing new treatments, with 40 of them currently in various stages of development or trials.

One of the largest positive effects on revenue is expected to be derived from medicines that target obesity. All the effective weight loss drugs currently on the market, and the promising ones expected to hit the market soon, are based on the application of GLP-1, a peptide that suppress appetite and lowers blood sugar. GLP-1 has become to the medical world what AI is to technology, since currently it is the only hope for humanity to successfully fight obesity, which has become a global pandemic. Amgen has its own take on the peptide, advancing development of a first-in-class antibody-based multi-specific molecule, incorporating GLP-1 and the insulin-regulating mechanism. Given its history of successful innovation, it can be safely gauged that Amgen will successfully compete in the field of the anti-obesity battle, shaping up to be one of the fastest-growing and most lucrative markets.

Amgen’s stock has surged after its blockbuster Q2 2023 results but is still up only 7% in the past 12 months, due to a large decline it suffered in the December-March period. Still, it has outperformed the iShares Biotechnology ETF (IBB), in which it is the largest holding. The ETF has risen only 4.5% in the same period.

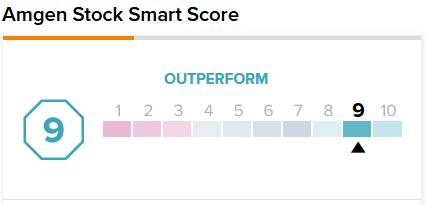

AMGN is very attractively priced, given its strong fundamentals, EPS growth, and large dividend yield. It is now trading at TTM P/E of 17.3 and Forward P/E of 18.0, representing 43% and 33% discounts, respectively, to its sector averages. Amgen has a TipRanks’ Smart Score rating 9/10 (“Outperform”), with a “Moderate Buy” recommendation:

To conclude, Amgen’s economic moat, diversification, and continuous innovation support the company’s growth prospects. We believe that the stock’s current valuation is a terrific opportunity to buy into earnings growth and dividend growth combined, as we see in Amgen a compelling income investment stock.

Disclaimer

The information contained in this article represents the views and opinions of the writer only, and not the views or opinions of TipRanks or its affiliates and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices, or performance.