TipRanks Smart Dividend Newsletter – Edition #15

Hello and welcome to the 15th edition of TipRanks’ Smart Dividend – a weekly Newsletter providing you with investment ideas for safe-bet quality stocks that are outstanding dividend payers, compared to their peers.

Today’s dividend stock recommendation is for a leading innovator that enables the smooth performance of semiconductors used in electronics in every aspect of our lives. The company we are recommending has been raising its dividends for 13 years, while its solid execution and strong earnings growth record support the expected continuation of increasing shareholder compensation.

But first, let us present a brief investment thesis, supporting our recommendation.

Investment Thesis: Yield Management

In an era defined by relentless technological innovation, the semiconductor industry stands out as the backbone of digital transformation. Within this complex ecosystem, companies specializing in Process Diagnostics and Control (PDC) equipment and yield management solutions hold a pivotal role. PDC specialists act as gatekeepers of efficiency and quality in semiconductor fabrication. They offer sophisticated metrology and inspection systems that allow semiconductor manufacturers to identify and rectify process anomalies and defects at the earliest stages. By improving yields—the percentage of functional chips out of the total produced—these companies make a direct impact on the profitability and competitiveness of semiconductor manufacturers. As chip complexity increases and quality demands tighten, the capabilities provided by PDC and yield management will only grow in importance, making these companies an essential part of the semiconductor value chain and a compelling investment case.

Large and established companies in the PDC and yield management sub-industry offer unique advantages that make them compelling opportunities for income-oriented investment. These giants benefit from economies of scale, robust supply chain management, and long-standing relationships with major semiconductor manufacturers. Their substantial R&D budgets enable them to stay ahead of the technological curve, continually innovating to meet the ever-evolving needs of the industry.

Moreover, their significant cash flows and stable revenue streams often translate into consistent dividends and share buyback programs, offering an attractive mix of capital growth and income. In an industry that’s projected to continue its upward trajectory, large, established players in PDC and yield management are well-positioned to capture increased market share while offering the income stability that many investors seek.

Quality Dividend Stock: This Week’s Top Pick

KLA Corporation (KLAC) is a leading designer and manufacturer of process diagnostics and control (PDC) equipment and yield management solutions required for the fabrication of semiconductors and related nano-electronics. The company offers a portfolio of inspection and metrology products and related services, software and other offerings, and also supports research and development (R&D) and the manufacture of integrated circuits (ICs), wafers and reticles.

In simple words, KLA’s primary specialization is the design, production and marketing of equipment for detection, control and improvement of semiconductor production processes. KLA’s tools enable the inspection, control and qualification of all stages and phases of the chip-making process, from research and development to final volume manufacturing. The company’s products support all phases of wafer, reticle, integrated circuits, and packaging production. KLA also offers technologically advanced, yield-enhancing and process-enabling solutions to address various manufacturing stages of printed circuit boards, flat panel displays, specialty semiconductor devices, and other electronic components.

The company was established in 1997 under the name of KLA-Tencor, through the merger of KLA Instruments (founded in 1975) and Tencor Instruments (founded in 1976), two companies in the semiconductor equipment and yield management systems industry. After numerous strategic acquisitions, which helped shape the company in its current form, the company changed its name to KLA Corporation in 2019. Today, KLA is a Fortune 500 company, with a market cap of $69.3 billion, a presence in 18 geographical regions, a workforce of 15,200, and annual revenues of $10.5 billion.

The company’s shares are traded on NASDAQ; KLA is a component of the S&P 500 (SPX) and Nasdaq 100 (NDX) indexes. It belongs to the IT sector (Industry: Semiconductors & Semiconductor Equipment). It caters to all chipmakers of different kinds, including Nvidia (NVDA), AMD (AMD), and others. Its largest customers include Taiwan Semiconductor (TSM), Intel (INTC), and Samsung Electronics (SMSN).

As a “pick and shovel” supplier to the chipmaking industry, KLA depends on the semiconductor market’s trends. While semiconductor & equipment producers have encountered a number of short-term headwinds, the longer term direction is clearly upwards. The increasing demand for electronics in all aspects of society, from daily use to advanced science applications, supports a positive outlook; as the industry continues its fast development, semiconductor process control and enabling solutions are becoming more critical.

KLA maintains a leading position in almost all market segments where it is working, thanks to its high level of spending on research and development, which has resulted in technological leadership. But it is the company’s main line of business – semiconductor process control, responsible for over 85% of the company’s product sales revenues – that stands out in this respect: KLA commands a 57% market share in this niche.

Products bring in 80% of KLA’s total revenues, with services (consulting, technical assistance, installation, maintenance, etc.) adding 20%. The services segment is supported by a significant installed base that drives accelerating recurring revenues; this segment adds to the expanding profit margins which, in turn, support the company’s innovation drive.

Geographically, the company’s sales are diversified around the globe; however, this diversification – namely, about a quarter of total sales income derived from China – is one of the few KLA’s weaker points. However, the ongoing efforts in the U.S. and Europe to promote localization of semiconductor supply chains should offset headwinds from Chinese economic weakening and the restrictions on chip trade put in place by Western governments.

As a part of the advanced-tech universe, KLA benefits from the ongoing technological developments as its tools are used to support all cutting-edge tech, such as artificial intelligence (AI), electric vehicles (EVs), autonomous vehicles, and the Internet of Things (IoT). To maintain and expand its market presence, the company continues to invest heavily in R&D (in 2022, 15% of revenues were channeled into research), as well as to actively pursue strategic acquisitions. In recent years, KLA Corp. has acquired 12 companies, with the most recent takeovers being ECI Technology in 2022, Anchor Semiconductor in 2021, and SPTS and Orbotech in 2019.

Of course, extensive R&D efforts, as well as acquisitions, do not come without a cost. This is apparent in KLA’s high net debt-to-equity ratio of 91%. However, the company’s giant market capitalization and stellar execution, coupled with strong financial metrics, make the debt load look less worrisome. In addition, the company’s costs of serving its debt are quite low thanks to its high credit rating (“A-“ at Fitch and S&P Global Ratings), reflecting its very low risk. Besides, KLA’s short-term assets exceed both its short- and long-term liabilities; its debt is well-covered by operating cash flow, while EBIT covers interest repayments many times over. In addition, the company has been working to reduce its debt: despite a large acquisition, in fiscal 2022 (ending June 2023) net debt fell by 31% year-on-year.

Apart from the debt ratio, KLA’s metrics border on perfection. While its Return on Equity (ROE) is less meaningful as it is skewed by debt, its Return on Assets (ROA) of 25% (versus the industry’s average of 9%) and return on invested capital (ROIC) of 34% signal an exceptional level of profitability. The company’s operating margin of 38% and net profit margin of 32% leave its peers well behind. Its free cash flow margin of 37.5% reflects an enviable ability to turn revenues into free cash, further decreasing any risk posed by debt. In addition, the company’s continued strength in free cash flow generation supports its dividend and stock buyback policies.

KLA’s business model is focused on driving consistent FCF performance and the company is committed to returning capital to shareholders via dividend and stock repurchase programs, which it sees as fundamental to augmenting total shareholder returns. KLA Corp. has a proven track record of returning cash to shareholders.

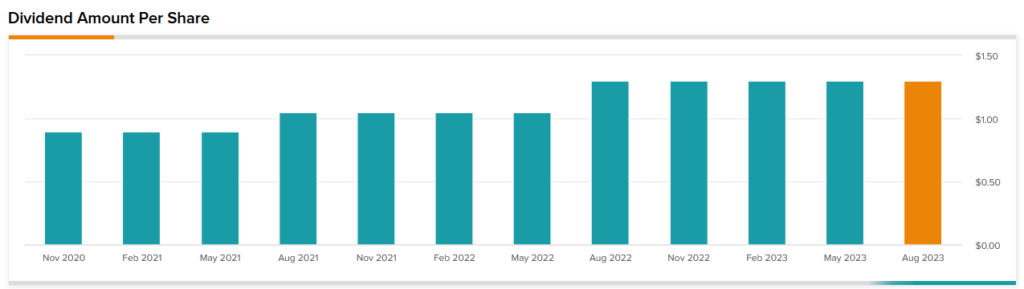

The company’s current dividend yield stands at 1.05%, marginally higher than average for the IT sector. KLA has been increasing dividend payouts for the last 13 years; the latest increase was in August 2022 when the payout rose by 24%. From 2006 to 2022, the company’s cash dividends rose by a CAGR of 15%. According to the management, dividend payments are an integral piece of KLA’s disciplined approach to capital management. Despite the growth in payouts, the company’s payout ratio is a more than modest 20.5%, which means that it retains a sufficient amount of its earnings to reinvest in its business, and the flexibility to further dividend growth.

In addition to dividends, KLA views share repurchases as an important part of its policy of returning value to its shareholders. The company targets total capital returns (dividends + buybacks) of 70% or more of the free cash flow generated by the company over the long term. In fiscal 2023 (ending June 30), the company repurchased shares for the amount of $3 billion, with about $2 billion still available for further share repurchases under the business’ share repurchase program.

Despite its formidable market capitalization and market share, the company has been displaying enviable growth rates. Thus, in the past five years, KLA’s revenues grew by an average annual rate of 21%, while its EPS surged by 32% a year in the same period. In fiscal Q4 2023, the company has posted revenue and EPS results that exceeded analysts’ estimates by a wide margin – as it has done in every quarter, without a single miss, since these estimates became available. In addition, KLA published an upbeat outlook for the current quarter and for FY 2024, underscoring its ability to grow its profits in any economic environment.

Obviously, better-than-expected results coupled with an optimistic outlook (which is based on proven execution capabilities) have drawn investor interest to the stock, causing it to surge. KLAC has risen 53% in the past 12 months, beating even the iShares Semiconductor ETF (SOXX) despite the ETF’s large exposure to the high-flying NVDA. In the past three years, KLA’s stock has gained 162% versus SOXX’s 70%.

Despite the increase in the stock, KLAC is still attractively priced, given its strong fundamentals, EPS growth, and shareholder compensation practices. It is now trading at TTM P/E of 20.1 and Forward P/E of 23.9, representing 17% and 11% discounts, respectively, to the IT sector averages. KLA has a TipRanks’ Smart Score rating 9/10 (“Outperform”), with a “Moderate Buy” recommendation:

To conclude, KLA Corporation is a highly efficient business with exceptional cash-generating abilities. While the company, together with the broad semiconductor industry, is facing some headwinds in the near-term, it is one of the best-positioned companies in its sphere to overcome these difficulties. With its profitability, stability, skilled management, and policies aimed at returning capital to shareholders, we view KLA as a valuable addition to any portfolio and a compelling income investment stock.

Disclaimer

The information contained in this article represents the views and opinions of the writer only, and not the views or opinions of TipRanks or its affiliates and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices, or performance.