TipRanks Smart Dividend Newsletter – Edition #17

Hello and welcome to the 17th edition of TipRanks’ Smart Dividend – a weekly Newsletter providing you with investment ideas for safe-bet quality stocks that are outstanding dividend payers, compared to their peers.

Today’s dividend stock recommendation is for the world’s largest smartphone chipmaker, whose stellar finances, wide innovation, and deep know-how support its long-term position as a market leader, as well as its outlook for continued growth in shareholder compensation.

But first, let us present a brief investment thesis, supporting our recommendation.

Investment Thesis: Chipping In

In the complex arena of technology investment, chipmakers emerge as the cornerstone of modern innovation. Their critical role in powering today’s technology makes them prime candidates for strategic investment. While some may be apprehensive due to the industry’s cyclical nature, it’s essential to see beyond the short-term cycles.

Advanced chipmakers have diversified their revenue streams, delving into transformative tech domains such as Artificial Intelligence (AI) and automotive technologies, supporting consistent long-term revenue growth. In the vast sea of competitors, only the most substantial entities with robust financials can consistently fuel such ambitions, giving them a competitive edge.

Delving deeper into the financial landscape of such firms reveals the allure of dividend and income investment. It’s not just about the immediate returns or market speculation; it’s about the long-term, consistent income that can be garnered from a company with a proven track record in its domain.

While many in the tech and semiconductor sector shy away from dividends, these industry leaders not only sustain dividend payouts but also consistently elevate them, rewarding patient investors for years on end. Large-scale entities in this sector have weathered storms, adapted to changes, and consistently delivered value to their shareholders.

The industry’s giants have demonstrated their commitment to shareholders through consistent dividend increases, presenting a compelling case for investors seeking steady growth and income.

Quality Dividend Stock: This Week’s Top Pick

Qualcomm, Inc. (QCOM) is an American multinational corporation that develops and sells semiconductors and wireless communication technologies and products. QCOM’s products and services are used in mobile devices and other wireless products (including network equipment, broadband gateway equipment, consumer electronic devices, and other connected devices) as well as in automotive and the Internet of Things (IoT). Qualcomm is one of the largest global semiconductor companies and the world’s largest smartphone chipmaker.

The company was founded in July 1985 and is headquartered in San Diego, CA. It commands a market capitalization of $125.7 billion and a workforce of 51,000 across 170 offices in more than 30 countries. QCOM belongs to the IT sector (Industry: Semiconductors and Semiconductor Equipment).

The company operates through three segments: Qualcomm CDMA Technologies (QCT) semiconductor business, Qualcomm Technology Licensing (QTL), and Qualcomm Strategic Initiatives (QSI). Qualcomm also provides development and other services and related products to the United States government agencies and their contractors.

The QSI segment is the company’s investment arm, funding early-stage companies in various industries, including 5G, artificial intelligence, automotive, consumer, enterprise, cloud, IoT, and extended reality, and investing in various financial instruments.

The QCT segment develops and supplies integrated circuits and system software for use in wireless voice and data communications, networking, application processing, multimedia, and global positioning system products. This is the unit that designs and develops the Snapdragon processors – the SoCs (“system-on-a-chip”, a complete processing system in a single package) found in the majority of the Android smartphones in the world, such as Samsung, Xiaomi, OnePlus, and other handsets. QCOM commands a very large market share of the global Android smartphone AP (Application Processor)/SoC market, ranging from 30% in the low- and mid-low price segment to 55% in the premium/flagship segment, and 65% in the medium-price segment. The company’s largest competitors in different price segments are MediaTek (MDTKF) in the low, mid-low, and mid-high segment and Samsung (SSU) in the premium/flagship category.

QCOM’s Snapdragon chip business is fabless, meaning it designs and markets the chips, outsourcing the manufacturing to foundries like Taiwan Semiconductor (TSM), Samsung Foundry, and GlobalFoundries (GFS). However, most of the company’s wireless connectivity chips (radio frequency or RF modules) are produced in-house, including wafer fabrication, assembly, packaging, and testing. The RF chip segment accounts for about 10% of Qualcomm’s revenues.

Even though Qualcomm is the chip market leader in the Android universe, the company’s largest customer is Apple (AAPL), responsible for about 20% of the semiconductor giant’s revenues. At the beginning of September 2023, Apple and QCOM signed a three-year extension of their supplier agreement, after the iPhone maker’s efforts to design chips in-house ran into performance and legal trouble. As a result, QCOM’s modem chips will be installed in iPhones through 2026.

In addition to QCOM’s smartphone chip business, the company’s automotive chip design has been gaining pace significantly in recent years. Qualcomm sells comprehensive (hardware and software) Snapdragon automotive platforms, which handle numerous functions, from infotainment to connectivity to driver assistance and safety. Previously these functions were handled by several different chips; their combination allows them to cut costs, reduce complexity, and increase functionality.

With the acceleration of automation and digitalization of the vehicle industry, modern cars are now running as much on electronics as they do on mechanics. Electronic components are now responsible for about 40% of vehicle production costs, and this component is expected to continue rising. Qualcomm has been investing heavily in the development of its auto-related technologies to be able to capitalize on this global trend and is now beating its competitors in the race, specifically in providing chips suited to mobile artificial intelligence (AI) applications.

Although QCOM’s auto-related business division is still relatively small when compared to the smartphone chip segment, it is the fastest-growing segment, seeing sales increase 40% year-on-year in fiscal 2022, and 20% in the latest reported quarter. Qualcomm partners with several leading automakers, such as General Motors (GM), Volvo (VLVLY), Mercedes-Benz (MBGAF), BMW (BMWYY), Stellantis (STLA), and others, to provide them with automotive platforms. It also develops strategic partnerships and with leaders in the tech industry such as Amazon’s (AMZN) cloud arm AWS to advance innovative technologies in the automotive sector. Qualcomm expects its auto-related revenues to surge sevenfold by 2031.

Qualcomm’s QTL segment grants licenses or provides rights to use portions of its intellectual property portfolio, which include various patent rights useful in the manufacture and sale of wireless products. QCOM’s humongous R&D investment over the years has made it the owner of a vast patent library and cemented the company as the leading authority in the field of wireless phone network operations. All the major smartphone makers in the world acquire licenses to Qualcomm’s technologies, which means that a large chunk of its revenues comes from licensing patented tech.

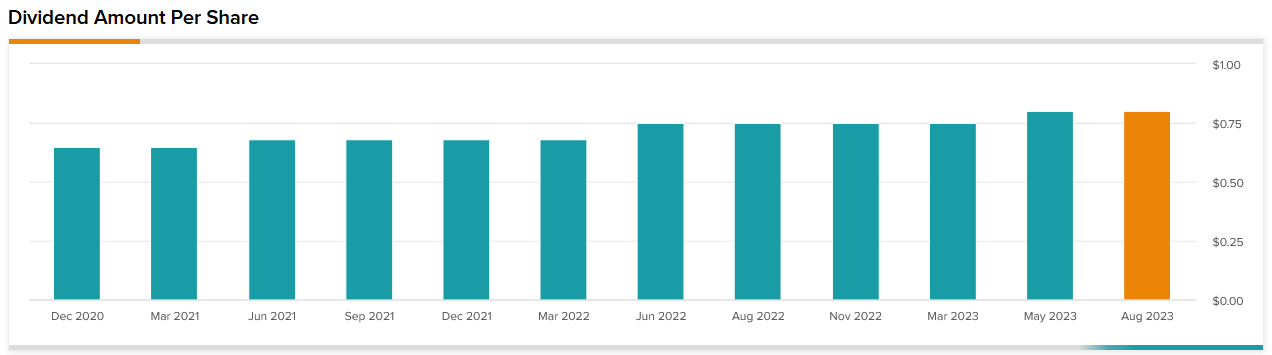

Long-time dividend investors are probably familiar with Qualcomm, since it pays one of the highest dividend yields in the IT sector, currently at 2.81% (versus the sector average of 1%). The company has been paying and steadily increasing dividends since 2003. The latest dividend increase was in May 2023, when the payout rose by 7%. QCOM’s dividend-per-share increased at a CAGR of 10.5% in the past decade and the company plans to continue raising the payout by 8-12% annually. Qualcomm’s payout ratio is a modest 33% and is well-covered by earnings and cash flows.

In addition to dividends, QCOM has a share repurchase program in place. At the time of announcement in 2021, the program stated the total amount of $10 billion allocated to buybacks, with no expiration date. The company performs repurchases on an opportunistic basis, depending upon prevailing market conditions and other factors. In fiscal 2022, QCOM returned approximately 90% of its free cash flow to shareholders, accounting for both buybacks and dividends. In fiscal Q3 2023, the company purchased its shares for the amount of $400 million.

Qualcomm’s dividend growth and buyback strategy outlook are supported by the company’s stellar finances. Its net debt-to-equity ratio of 33% is quite low, with the debt well-covered by operating cash flow, while EBIT covers interest repayments many times over. The company’s costs of serving its debt are low thanks to its high credit rating: Qualcomm is rated “A” at S&P Global Ratings, one the strongest in the industry, reflecting its very low risk.

QCOM’s profitability and capital efficiency metrics are remarkable. Its Return on Assets (ROA) of 18% is outstanding, while its Return on Equity (ROE) of 42% is no less than exceptional. The company’s operating margin of 29.5%, net profit margin of 22.3%, and FCF margin of 18% are much higher than average for its sector.

Qualcomm has been growing revenues at a CAGR of 11.2% in the past five years, while EPS rose at a CAGR of 21.4%. In Q3 of fiscal year 2023 (ending June 30), the company missed analysts’ revenue estimates, but delivered an EPS beat, as it did in every single quarter in the past. Revenues were dragged down by overall weakness in smartphone demand, as well as by pronounced weakness in China, one of the important phone-chip markets. The company expects that the weakness in the smartphone market will continue to impact revenues in the ongoing quarter; the current demand decline is a typical stage in the highly cyclical smartphone market.

Longer term, the company’s highly competitive market position, coupled with its advantages in the incorporation of cutting-edge technologies such as AI into its products, are expected to support revenues. Thus, the company said it maintains a positive long-term outlook for on-device AI inclusion, with a surge in AI-related demand possibly creating an upgrade cycle for handsets, as AI hardware features may soon become a consumer requirement. In addition, QCOM’s accelerating venture into the automotive market provides an additional level of diversification, countering the cyclical smartphone chip sales trend. Besides, Qualcomm’s licensing segment continues to be a highly profitable business, as well as one of the pillars of the company’s statute as an industry leader in chipsets and IP; this segment is expected to help maintain a generous stream of high-margin royalty revenue in the next several years at the least.

After surging to its all-time high in January 2022 and a subsequent decline in profit-taking and last year’s tech stocks’ drop, QCOM’s stock hasn’t fully recovered. In the past 12 months, the stock is down by 11%, depressed by two disappointing quarterly revenue results. We view this underperformance as a great long-term investment opportunity since the stock is now trading at a TTM P/E of 14.8 and Forward P/E of 17.2, representing a 41% and 33% discount to the IT sector, as well as a significant discount to its historical valuation and fair value.

Apparently, institutional investors view the stock price as a bargain, given its merits. Qualcomm’s stock has seen an increased hedge fund interest in recent months, with as many as 18 funds opening large new positions or increasing their holdings by hundreds of percent. Individual investors have also been loading up on the stock in the past weeks.

TipRanks’-scored top Wall Street analysts see an average upside of 20% for the stock in the next 12 months. QCOM has a TipRanks’ Smart Score rating of “Perfect 10” with a “Moderate Buy” recommendation:

In conclusion, we believe that QCOM’s leading market position, coupled with its stellar finances supporting its strategy of raising dividends and increasing total shareholder compensation, make it a compelling income investment stock and a valuable addition to any long-term investment portfolio.

Disclaimer

The information contained in this article represents the views and opinions of the writer only, and not the views or opinions of TipRanks or its affiliates and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices, or performance.