TipRanks Smart Dividend Newsletter – Edition #21

Hello and welcome to the 21st edition of TipRanks’ Smart Dividend – a weekly Newsletter providing you with investment ideas for safe-bet quality stocks that are outstanding dividend payers, compared to their peers.

Today’s dividend stock recommendation is the world’s largest IT distributor, helping a myriad of its global customers to seamlessly integrate cutting-edge technologies from leading global vendors. The company we are recommending has a clear shareholder-compensation strategy and undertakes distributing half of its free cash to its investors.

But first, let us present a brief investment thesis, supporting our recommendation.

Investment Thesis: Distributed Systems

Every business, regardless of its size or industry, relies on a robust technological infrastructure to thrive in today’s competitive landscape. Companies that help other businesses to employ and integrate comprehensive IT solutions provide intangible services that will always be in demand.

Within this realm, companies that stand out share common strengths. Their ability to secure and expand market share, robust scale of operations, deep technological expertise, and the ability to stay on top of the latest IT breakthroughs, form the foundation of their success.

Strategic partnerships and a global presence further underscore the significance of these companies. Collaborations with key industry players and an extensive network of suppliers and customers solidify their position as indispensable players in their sector.

With low barriers to entry, the IT distribution and integration services industry is teeming with competition, depressing margins. However, even in this sphere, there are firms whose ability to generate cash supports their commitment to enhance shareholder value through dividends and buybacks. When backed by robust financial health, combined with their market presence and expertise, this strong alignment with shareholder interests presents a very compelling income investment case.

Quality Dividend Stock: This Week’s Top Pick

TD SYNNEX Corporation (SNX) is a leading global distributor and solutions aggregator for the Information technology (IT) ecosystem. The company offers systems design and integration solutions, logistics services, cloud services, online services, financing services, and marketing services. Further, it provides public cloud solutions in productivity and collaboration, IaaS, Infrastructure as a Service, Platform as a Service, Software as a Service, security, mobility, IoT, and other hybrid solutions. SNX also distributes peripherals, IT systems, storage solutions, networking, security equipment, personal computing devices, printers, mobile phones and accessories, data center servers, software, system components, consumer electronics, and communications and complementary products. TD SYNNEX’s edge-to-cloud portfolio is anchored in some of the highest-growth technology segments including cloud, cybersecurity, big data/analytics, AI, IoT, mobility, and “everything as a service.”

TD SYNNEX is a Fortune 500 company, commanding a market capitalization of $8.8 billion and a workforce of 23,500 employees. It has an annual revenue of $63.3 billion and serves more than 150,000 customers in 100+ countries, providing them with unified IT products, services, and solutions from 1,500+ technology vendors. The company’s corporate headquarters are in Clearwater, Florida, and Fremont, California.

TD SYNNEX has distribution agreements with all prominent technology providers. It incorporates Microsoft’s (MSFT) products, such as Azure suite of solutions, into its product portfolio. Last year, SNX strengthened its collaboration with Alphabet (GOOGL) by expanding its cloud solution portfolio with Google Cloud to 60 additional global markets in Latin America and Europe. The company has been chosen to be the exclusive North American distributor for the new suite of business products announced by Meta Platforms (META), including a line of innovations tailored to the commercial market. SNX also partners with SAS AB (SASDQ) as its primary global distributor of AI and analytics software. The company’s list of Original Equipment Manufacturer (OEM) suppliers includes Apple (AAPL), HP Inc (HPQ), and many other prominent tech leaders.

The company was founded in 1980 as “Synnex Corporation,” a technology hardware and related logistics services distributor. In September 2021, Synnex merged with its main competitor, Tech Data Corporation, a multinational distribution company specializing in IT products and services headquartered in Clearwater, Florida. The two merged companies created TD SYNNEX, the largest IT distributor in the world.

Synnex acquired all outstanding shares of Tech Data in a cash transaction. The merger aimed to expand the company’s market share and technological offerings while optimizing cost structure. After a challenging post-merger period, the move has begun to pay off. IT distribution is a very fragmented and competitive sphere with thin margins; economies of scale play a significant role in the success of players in this market. In addition to its scale, SNX’s large vendor base and global footprint are expected to continue supporting its market share growth.

Despite the large cash transaction to TD’s shareholders, SNX’s solvency and liquidity remain stellar. Its net debt-to-equity ratio of 34% is considered medium-low; the debt is well-covered by operating cash flow, while interest payments are well-covered by EBIT. TD SYNNEX’s short-term assets exceed both its short- and long-term liabilities. The company’s debt is highly rated by the global credit rating agencies: “BBB-” at S&P Ratings and Fitch.

In fiscal Q3 2023 (ended August 31), the company missed on revenues, which came at the mid-point of the company’s forecasted range but surpassed analysts’ EPS expectations by a wide margin. Notably, TD SYNNEX beat EPS estimates in all quarters when these estimates were available, with a single exception in FQ2 2023.

The company is still in the midst of the difficult process of absorbing another large entity. Besides, the ongoing weakness in PC ecosystem products demand in Europe and the U.S. weighed on top lines, albeit it was partly offset by an increase in demand for advanced solutions and high-growth technologies, fueled by cloud and data center-related technologies. These solutions and technologies are currently responsible for about a quarter of the company’s sales; their part in the portfolio mix is projected to expand further. While market difficulties in Europe are expected to continue to be a setback in the next quarters, the company’s excellent cost-cutting abilities and its push into high-growth advanced technologies will cushion its bottom-line results.

During the past decade, SNX’s revenue grew by a CAGR of 19%, while earnings-per-share increased by a CAGR of 8.4%. In FQ3, despite the revenue decline, TD SYNNEX succeeded in expanding its gross, operating, and net profit margins versus FQ3 2022. Notably, in FQ3, the company increased its cash and cash equivalents by 47% from the previous quarter; in the first three quarters of FY 2023, the company generated free cash flow (FCF) of $1.09 billion. SNX’s ability to generate cash is especially commendable given its thin margin, highly competitive industry, and this year’s difficult macro environment.

The company’s capital allocation strategy pencils in returning about 50% of the FCF to shareholders through dividends and buybacks. SNX has been paying dividends since 2014, consistently raising them for the last three years. The company’s dividend yield of 1.48% is much higher than the IT sector’s average of 1.0%, while its very low payout ratio (12.1%) indicates that the company has sufficient resources to continue raising dividends while retaining enough capital to invest in business growth. TD SYNNEX targets a 2% dividend yield in the medium term.

In addition to dividends, TD SYNNEX returns capital to its shareholders through buybacks on an opportunistic basis. In January this year, the company announced that its Board of Directors has approved a stock repurchase program of up to $1 billion of its common stock over a period of up to three years, replacing the previous three-year program. In fiscal Q3, SNX repurchased its stocks for the amount of $103 million, bringing the total amount of buybacks in the first three quarters of FY 2023 to $280 billion.

TD SYNNEX’s stock suffered a large pullback at the beginning of the year on the back of unfavorable macro and market developments. Despite that, the stock has risen 11% in the past year, beating most of its peers, while underperforming the S&P 500’s (SPX) gain of 17.7%. In the past three years, SNX outperformed the broad market, gaining 26%, while the SPX rose 25%. SNX trades at modest valuations: its TTM P/E of 13.6 and Forward P/E of 14.7 represent about a 25% discount to its sector’s averages.

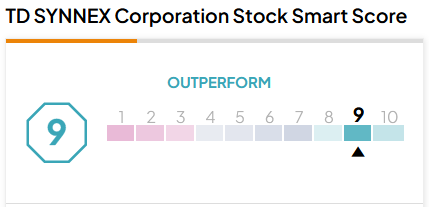

While SNX cannot be included in a high-growth stock list, it does have a robust capital gain potential, as TipRanks’-scored top Wall Street analysts see an average upside of 25.9% for the stock in the next 12 months. SNX has a TipRanks’ Smart Score rating of 9 out of 10 (“Outperform”) with a “Strong Buy” recommendation:

To conclude, we believe that TD SYNNEX Corporation, with its exceptional cash generation abilities, robust profitability, strong market presence, and commitment to compensate its shareholders through dividends and buybacks, makes it an attractive choice for dividend investors.

Disclaimer

The information contained in this article represents the views and opinions of the writer only, and not the views or opinions of TipRanks or its affiliates and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment, and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices, or performance.