TipRanks Smart Dividend Newsletter – Edition #23

Hello and welcome to the 23rd edition of TipRanks’ Smart Dividend – a weekly Newsletter providing you with investment ideas for safe-bet quality stocks that are outstanding dividend payers, compared to their peers.

Today’s dividend stock recommendation is one of the world’s largest defense contractors, serving various security needs of the U.S., U.K., and other governments. The company we are recommending features stellar finances and great profitability metrics, while its shareholder-compensation strategy makes it appealing to income investors.

But first, let us present a brief investment thesis, supporting our recommendation.

Investment Thesis: The Most Dangerous Times in Decades

JPMorgan’s (JPM) latest earnings report on October 13 included a message from Jamie Dimon, Chairman and CEO, which contained a phrase we don’t often hear from bank managers: “This may be the most dangerous time the world has seen in decades.” As the Russia-Ukraine war is raging on, U.S.-China relations are deteriorating, and Israel’s war against Hamas terrorists is threatening to spark a larger conflict, there is an increasingly large number of uncertainties in the global geopolitical theater, as well as in the world’s economy and capital markets. The only certainty in the stock markets in particular can be attributed to defense firms, whose fate is directly related to the global threat level.

In this context, Jamie Dimon’s somber assessment underscores the pivotal role of the defense industry amidst global instability. The ongoing tensions and conflicts not only heighten security concerns but also bring to the forefront the strategic importance of defense companies. As nations grapple with these emerging challenges, the demand for advanced defense capabilities is likely to escalate, thus spotlighting the sector as a potentially robust investment avenue.

Defense companies, unlike many other sectors, tend to thrive in periods of geopolitical turmoil. They are often seen as beacons of stability in the stock market, given their typically strong backlogs, government contracts, and pivotal role in national security. Moreover, these firms are at the forefront of technological innovations in areas like cybersecurity, unmanned systems, and artificial intelligence, which are critical for modern warfare and security strategies. This technological edge not only serves the purposes of defense but also has applications in civilian sectors, potentially broadening revenue streams and offering a hedge against market volatility.

Furthermore, the defense sector’s alignment with governmental policies and budgets offers a unique buffer against economic downturns. With governments committed to maintaining national security, defense budgets are often resilient, even in times of fiscal tightening. This characteristic provides a degree of predictability and stability to investors, making defense stocks a potentially safer harbor during economic uncertainty.

Quality Dividend Stock: This Week’s Top Pick

BAE Systems PLC (GB:BA or BAESF) is a British multinational defense, aerospace, and security company that delivers a full range of products and services for air, land, and naval forces, as well as advanced electronics, security, information technology solutions, and customer support services. BAE Systems also offers associated services, including training solutions, maintenance and modernization programs to support ships and equipment in service worldwide, and the management of supporting infrastructure.

BAE operates through the following segments: Electronic Systems, Cyber and Intelligence, Platforms and Services (U.S.), Air, Maritime, and Headquarters. The Electronic Systems segment is responsible for the U.S. and U.K.-based electronics activities, including electronic warfare systems, electro-optical sensors, military and commercial digital engine and flight controls, precision guidance and seeker solutions, next-generation military communications systems and data links, persistent surveillance capabilities, and hybrid electric drive systems. The Cyber and Intelligence segment, which includes the U.S.-based Intelligence and Security business, and its U.K.-headquartered Applied Intelligence business, covers the group’s cyber security, secure government, and commercial and financial security activities. The Platforms and Services (U.S.) segment manufactures combat vehicles, weapons, and munitions, and delivers services and sustainment activities, including ship repair and the management of government-owned munitions facilities. The Air segment deals with U.K.-based air activities for European and International markets, U.S. programs, and its businesses in Saudi Arabia and Australia. The Maritime segment focuses on the group’s U.K.-based maritime and land activities. The Headquarters segment includes the group’s head office in London, and U.K.-based shared services activities.

BAE Systems was formed in 1999 when British Aerospace – an aircraft, munitions, and naval systems manufacturer – acquired and merged with Marconi Electronic Systems, the defense electronics and naval shipbuilding subsidiary of the General Electric Company plc (GEC), in a $9.5 billion deal.

The merging companies have a rich heritage of defense and aircraft building, together spanning hundreds of years of experience. British Aerospace was formed in 1977 by the nationalization and merger of the British Aircraft Corporation (BAC), the Hawker Siddeley Group, and Scottish Aviation. Both BAC and Hawker Siddeley were themselves the result of previous mergers and acquisitions. Marconi Electronic Systems’ heritage dates back to Guglielmo Marconi’s Wireless Telegraph & Signal Company, founded in 1897. The company was a part of English Electric when the latter was acquired by GEC in 1968.

After the merger, BAE Systems continued its predecessors’ acquisition strategy. In 2020, it purchased United Technologies’ (which afterwards merged with Raytheon) military GPS businesses and Raytheon’s (RTX) military airborne radios business. In August 2023, BAE made its largest acquisition so far, purchasing the aerospace division of Ball Corp. (BALL) for $5.6 billion in cash.

Today, BAE is the largest defense contractor in Europe and the seventh-largest in the world based on 2022 annual revenues. It has a market capitalization of $40 billion and a workforce of more than 96,000 in 40 countries.

BAE Systems maintains leading positions in major defense and security markets around the world – in the U.S., U.K., the Kingdom of Saudi Arabia, and Australia – as well as established positions in several other international markets. Its largest operations are in the United Kingdom, where it is the dominant defense contractor and the main supplier to the British Ministry of Defense, and in the United States, where its U.S. BAE Systems Inc. subsidiary is one of the six largest suppliers to the U.S. Department of Defense. In addition, BAE Systems Australia is one of the largest defense contractors in the country. The company also has a leading position in Saudi Arabia. Moreover, last year, BAE established a new subsidiary, BAE Systems Japan, to maintain and expand its cooperation with the Japanese Ministry of Defense. The company also has a subsidiary in Sweden.

BAE allocates significant resources to research and development (R&D), investing heavily in innovation. The company’s R&D expenses are partially compensated for by the U.K. government. Within its innovation strategy, BAE collaborates with various academic institutions and industry leaders. The company continues to be at the forefront of technological advancement in the defense areas, pursuing defense and security applications of cutting-edge technologies, including Virtual and Augmented reality, Intelligent Autonomous systems, Cyber Security, Artificial Intelligence (AI), and more. BAE is also cooperating with Microsoft (MSFT), Intel (INTC), and other technology leaders to advance the development of chips, electronics, software, and cloud solutions for defense systems and equipment.

BAE participates in several defense programs in the U.S. and U.K., playing a crucial role in bolstering national security in diverse areas, and supplying military aircraft, naval vessels, armored vehicles, submarines, and cybersecurity solutions. In 2022, the U.S. Department of Defense awarded BAE Systems contracts worth $5 billion. In 2023, the cooperation expanded with the addition of a $190 million contract modification to supply additional Bradley A4 vehicles, a $257 million contract to procure additional amphibious combat vehicles, and numerous additional contracts in several areas.

In the U.K., the company is the only nuclear submarine manufacturer and thus produces a key element of the United Kingdom’s nuclear weapons capability. The company provides the lion’s share of the military equipment that the U.K. and other governments supply to Ukraine as it wages a defensive war against the Russian invasion. BAE has set up a local entity in Ukraine to help ramp up the country’s weapons supply.

Despite being a U.K.-headquartered company, BAE Systems’ largest market is the United States, which is responsible for 44% of its global sales. 20% is derived from the U.K., 13% from Europe, 11% from Saudi Arabia, 4% from Australia, and 8% from the rest of the world. Since BAE is a defense contractor to governments, it enjoys exceptionally high long-term sales visibility, underpinned by its long-term contract backlog.

Since Russia invaded Ukraine, leading defense companies have seen a sharp increase in demand for their products. In 2022, global military expenditures have reached their record high, with much of the increase attributed to Europe’s steepest rise in defense spending in the post-Cold War era. At the same time, the increasingly cold relationship between the West and China added to the defense spending expansion, particularly in the cyber defense area. Now, with the war between Israel and Hamas terrorists in the Gaza Strip threatening to spark a larger conflict in the Middle East, the U.S. and allied governments in the region, such as Saudi Arabia, are ramping up their military spending even more. From 2021 to 2020, the global defense market has expanded by 8%; in 2023 it is expected to show similar or higher growth figures, supporting continued growth in demand for BAE System’s products and solutions.

BAE’s financial health is more than stellar. It has a mid-low debt-to-equity ratio of 47%, which has been reduced in the past three years despite the cash acquisitions by the company. BAE’s debt is well-covered by operating cash flow, while interest payments are covered by EBIT many times over. The company’s debt is highly rated by the global credit rating agencies: “BBB+” at S&P Ratings and Fitch Investors Service, and “Baa2” at Moody’s.

Particularly, Fitch mentioned BAE’s strong business profile, “robust end-market demand,” and “strong position in many key defense markets,” as well as “prudent cost management, efficient project execution and strong positions on key programs with strong growth dynamics” among the main factors for a rating upgrade in November last year.

BAE Systems’ capital efficiency ratios may seem mediocre at first glance; however, they compare favorably to the industry averages. Thus, the Return on Equity (ROE) of 18.7 and its Return on Assets (ROA) of 7.0 are much higher than the Aerospace & Defense industry averages.

In the past five years, the company has been growing revenues at a CAGR of 6.5%, and earnings at a CAGR of 22.4%. In August, the company reported its H1 financial results (as a U.K.-based company, it reports on a semi-annual basis). In H1 2023, EPS and revenues exceeded analyst expectations by a wide margin. In fact, BAE beat analysts’ EPS projections in each report since these projections became available. In the first half of 2023, EPS rose by 22% year-on-year, while revenue grew by 13%, and operating income increased by 24%. As a result of a successful first half, BAE’s management lifted the company’s full-year 2023 guidance for sales, EBIT, free cash flow, and EPS growth.

The company’s financial strength supports its capital allocation strategy, which includes a structured dividend policy and flexible payout of excess capital via share buybacks. BAE Systems has been paying regular dividends since its formation in 1999, increasing the total annual payouts for at least a decade. The dividends are paid semi-annually, with the first payout (in June each year) larger than the second one (in November each year). In the past five years, the payouts grew at a CAGR of 5.1%. With its low payout ratio of 30% and an expected continued earnings growth, analysts project a much higher dividend growth in the next three years. The latest dividend increase was in June 2023, when the payout rose by 11%. Currently, BAE’s dividend yield of 2.7% is already much higher than the Industrial sector’s average of 1.6%.

The following dividend information is given for the U.S.-listed ADR under the ticker BAESF:

In addition to dividends, BAE Systems returns capital to its shareholders through buybacks within the framework of its share repurchase programs. On June 1st, 2023, the company commenced the third tranche of its current $1.8 billion share buyback program, bringing the total value of buybacks within this framework to $1.2 billion. The management also approved a further share buyback program of up to $1.8 billion. This further program is expected to roll on after completion of the current buyback program and will be completed within three years of its commencement.

BAE Systems PLC is listed on the London Stock Exchange under the ticker GB:BA, where the company is a member of the FTSE-100 stock index of the largest U.K. companies. In addition, its ADRs traded in the U.S. OTC markets under the ticker BAESF. The following stock information is given for the U.S.-traded ADR.

In the past three years, BAE’s stock has risen by 162%, strongly outperforming the iShares U.S. Aerospace & Defense ETF (ITA), which rose by 42% in the same period. In the past 12 months, BAESF surged by 45%, while ITA has barely made it into the black.

Despite the strong performance in the past years, BAESF trades at modest valuations: its TTM P/E of 16.5 and Forward P/E of 17.7 represent an 8% and a 6% discount to the U.S. industrial sector’s averages, respectively. While foreign stocks normally trade at a discount to their U.S. counterparts, in the case of BAE System this discount is quite unjustified and may soon turn into a premium.

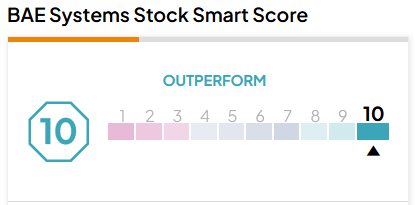

The company’s stock is trading near its all-time high, which makes it vulnerable to some correction on profit-taking in the near term. However, given the company’s strong finances and robust earnings outlook, underpinned by rising defense demand (which is not expected to decline), TipRanks-scored top Wall Street analysts see an average upside of 11% for BAESF. BAE System carries a TipRanks Smart Score rating of “Perfect 10” with a “Strong Buy” recommendation:

To conclude, we believe that one of the world’s largest defense contractors, with its stellar finances and strong earnings growth, is well-positioned to continue benefitting from increased global security concerns. BAE Systems is expected to build on its strengths and extend its commitment to compensate its shareholders through dividends and buybacks. Thus, we view the company as an attractive choice for dividend investors.

Disclaimer

The information contained in this article represents the views and opinions of the writer only, and not the views or opinions of TipRanks or its affiliates and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment, and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices, or performance.