TipRanks Smart Dividend Newsletter – Edition #36

Hello and welcome to the 36th edition of TipRanks’ Smart Dividend – a weekly Newsletter providing you with investment ideas for safe-bet quality stocks that are outstanding dividend payers, compared to their peers.

Investment Thesis: Utilizing Stability

Investors typically purchase utility stocks for their perceived safety and dividend payouts. The latter is the industry’s hallmark, as these low-growth companies tend to offer high shareholder compensation in the form of cash payouts.

As for safety, not all stocks in the Utilities sector are created equal, with some of them on shaky financial standing which could lead to dividend cuts, while others might be strongly punished by the markets, leading to investor losses.

However, there are companies in this sector that have demonstrated stable annual earnings increases that support their long-term track records of dividend-increases. For some, their positive business prospects reinforce the expectations that they will raise their dividends for years to come. Some of these companies are strongly undervalued after a difficult year during in 2023, which could lead to double-digit annual returns over the next several years.

Let us present one such company, which we view as a compelling income investment idea.

This Week’s Quality Income Stock Idea

Edison International (EIX), through its subsidiaries, is a generator and distributor of electric power, as well as a provider of energy services and technologies including renewable energy.

Edison International is the parent company of Southern California Edison (SCE), one of the nation’s largest electric utilities, and of Edison Energy (EE), a global energy advisory company and a portfolio of businesses that provide commercial and industrial customers with energy management and procurement services and distributed solar generation. Edison Energy companies are independent of Southern California Edison.

SCE, headquartered in Rosemead, California, serves approximately 15 million people in a 50,000-square-mile area of Central, Coastal, and Southern California. SCE has provided electric service in the region for 136 years. Notably, utility generation is heavily regulated, with each state having its own regulations. Thus, in California, regulation creates a separation between sales and profits, meaning that SCE doesn’t make more money when sales increase; changes in sales only affect the timing of cash collection. Instead, the California Public Utilities Commission allows SCE to earn a fixed return on its capital investments in energy infrastructure, a mechanism that aims to encourage utilities like SCE to continue investing in the electrical system infrastructure to keep it reliable. While this arrangement puts a lid on revenues from selling utilities, it also protects earnings from changes in electricity sales and makes revenues highly predictable and stable.

Edison Energy, based in Irvine, California, is an unregulated energy service provider, focusing on helping large users of energy reduce their energy costs, improve the environmental performance of their operations, ensure energy resiliency, and manage exposure to energy price risk. EE advises its clients on conventional energy supply solutions, renewable energy projects, including fleet transition to electric, and comprehensive energy optimization strategies. California’s extensive climate goals of energy transition to renewables and clean sources support EE’s business, as they require grid changes and extensions, vehicle and building electrification, and pipeline adjustments, among other developments.

Officially incorporated in 1909, Edison International traces its roots to several predecessor companies dating back to 1986. The company’s stock has been trading on the New York Stock Exchange (NYSE) under the ticker “EIX” since 1980. Today, with a market cap of almost $26 billion and annual revenues of $17.2 billion (2022), Edison International ranks #241 on the Fortune 500 list of the largest U.S. companies by revenue.

EIX has been consistently paying dividends without interruption since 1960, constantly increasing them annually over the past 20 years. The latest such increase was announced in December 2023, when the management raised the payout by 5.8%. In the past five years, the company’s dividend-per-share has grown by 4.8% annually; it has doubled over the past decade. Since 2004, the dividend has grown at a CAGR of 7.1%. Based on this track record and the company’s dividend policy, analysts expect EIX to continue raising its cash payouts by 4%-5% annually for years to come.

Currently, Edison’s dividend yield stands at 4.43%, much higher than the Utilities sector’s average of 3%, and higher than its industry and its peer average.

While the company’s dividend payout ratio is medium-high at 65% (based on adjusted earnings), this is an average level for a utility company as firms in this sector tend to share a larger part of their income with shareholders than the average for the broader market. This is partly to compensate for the industry’s typical low rates of earnings growth and minimal stock movements.

The company’s dividend reliability is supported by its ability to maintain stable annual EPS (earnings-per-share) growth, despite short-term volatility inflicted by seasonal cost increases and natural occurrences such as wildfires. Edison’s management has recently confirmed its commitment to delivering 5% to 7% core EPS growth through 2028.

As for its financial health, EIX has a high level of debt, which is normal for companies in the industry that must constantly invest in capacity upgrades and disaster prevention. Thus, Edison’s subsidiary SCE has increased its Capex to mitigate and prevent wildfire damage and to support the state’s greenhouse gas reduction targets. While there is regulatory support for these issues, along with a state-created insurance fund, an increase in costs is unavoidable. However, the leading credit rating agencies don’t see EIX’s high debt load as overly problematic, which is reflected in the company’s relatively high credit ratings: “BBB” at S&P Ratings and Fitch, and “Baa2” at Moody’s. According to Fitch Ratings, Edison compares favorably to its comparable peers due to larger scale, lower parent-company debt, and a reduced risk of wildfire damage due to ongoing protection and strengthening efforts.

The Utilities sector stocks have been under pressure over the past year, as investors favored high-growth stocks over defensive plays. While EIX outperformed its sector, as represented by Utilities Select Sector SPDR Fund (XLU) in the past 12 months, it still registered a decline of 1% (XLU dropped by 11%). In the past three years, EIX rose by 16%, while XLU lost 1.5%. The sector’s (and Edison’s) stock performance this year will be mostly dependent on the economic situation, as defensive low-growth stocks tend to gain some luster during economically weaker periods due to the propensity of investors to rush to safety. However, longer-term prospects are compelling, as a gradual global shift to an electricity-driven economy is expected to strongly benefit utility companies.

Following EIX’s stock outperforming its sector, the company is valued higher than the average for the Utilities sector. However, compared to its peers, Edison International is attractively valued, with its P/E ratios at the mid-range of the peer valuation scale. In addition, based on future cash flow projections, EIX is strongly undervalued, trading at about 70% below fair value.

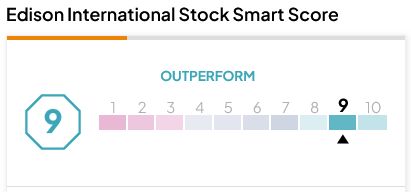

TipRanks-scored top Wall Street analysts see an average upside of 16.7% for the stock over the next 12 months. Hedge funds and individual investors clearly believe that this will be the case, as both these groups have strongly upped their EIX holdings in recent months. Edison International carries a TipRanks Smart Score rating of 9/10 (“Outperform”) with a “Moderate Buy” recommendation:

To conclude, Edison International is a stable, reliable, shareholder-responsive company, with revenues fairly resistant to economic shocks. EIX stock is highly undervalued, making it a value proposition. At the same time, Edison can provide its shareholders with both portfolio stabilization and a sizable capital cushion from its high and consistently rising dividends, presenting an attractive long-term opportunity for dividend investors.

Disclaimer

The information contained in this article represents the views and opinions of the writer only, and not the views or opinions of TipRanks or its affiliates and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment, and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices, or performance.