TipRanks Smart Dividend Newsletter – Edition #38

Hello and welcome to the 38th edition of TipRanks’ Smart Dividend – a weekly Newsletter providing you with investment ideas for safe-bet quality stocks that are outstanding dividend payers, compared to their peers.

Investment Thesis: Communicating Income

The telecommunications sector presents a unique blend of stability and growth opportunities for investors, serving at the nexus of both global connectivity and constant technological advancements and innovation.

Within this industry, companies that offer robust dividend yields stand out, appealing to those seeking steady income alongside the potential for capital appreciation. Firms that have consistently raised dividends reflect financial health and a commitment to shareholder returns, making them particularly attractive.

Let us present one such company, which we view as a compelling income investment idea.

This Week’s Quality Income Stock Idea

Verizon Communications, Inc. (VZ) is an American multinational telecommunications conglomerate. VZ provides communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide. Verizon is the largest U.S. wireless carrier.

1

Company Overview

Headquartered in New York City, Verizon is one of the largest global providers of communications services. With a market capitalization of $167 billion and annual revenues of $134 billion, VZ ranks #26 in the Fortune 500 list of largest U.S. companies. Tellingly, the company serves 99% of Fortune 500 members.

The company was formed in 1984 as “Bell Atlantic” following the breakup of the Bell System into seven regional operating companies. It changed its name to “Verizon” in 2000, after acquiring GTE and subsequently expanding the reach of its services to most of the U.S. In 2015, Verizon expanded into online media and content through its acquisition of AOL, and, later, Yahoo! Inc.

Verizon began trading on the New York Stock Exchange (NYSE) under the symbol “VZ” in 2000. Verizon is also listed on the NASDAQ Global Select Market under the same ticker. Verizon’s stock has been a component of the blue-chip Dow Jones Industrial Average since 2004.

1

Business Prospects

Verizon provides wireless and wireline communications services and products, as well as fixed wireless broadband, fiber optics internet network, and other communications and network solutions and services. The company’s primary source of revenue is the wireless business, including wireless services, internet plans, television subscriptions, and phone services, which are responsible for 70% of total revenue and nearly all of its operating income.

VZ has been investing in building its network strength for over 15 years, which now places it in a strong competitive position as its wireless network provides the broadest coverage in the industry. This position is further strengthened by the company’s excellent reputation with customers, as it has won most of J.D. Power’s network quality awards for almost three decades. As a result of its robust market position and wide economic moat, Verizon has been able to consistently generate significant free cash flows, which it uses to invest in the business, reduce leverage, and pay dividends.

1

Dividend Analysis

Verizon Communications has been paying dividends since its formation in 1984. Its payouts have been raised for 19 consecutive years, the longest in the U.S. telecom sector. VZ’s current dividend yield stands at 6.8%, well above the sector’s average of 2.5% and higher than its competitors’ payouts.

In the past decade, the dividend has grown by an average annual rate of 2.3% and is expected to maintain similar or higher growth rates in the years to come. The safety of the dividend is supported by a moderate payout ratio of 56%, leaving the company with ample room to increase dividends while investing in business expansion and paying down debt. In addition, the company has generated ample free cash flows throughout the years. Thus, Verizon’s current cash payout ratio is 59%, a very moderate level for a high-dividend payer.

Verizon is a classic dividend stock, with the payouts comprising most or all capital gains over different time horizons. While that isn’t expected to change materially, stock price appreciation may begin to add more to the total shareholder gains in the coming years. That is due to substantial strategic investments in 5G, fiber optics, and other technological advancements, as well as several profitable collaborations, helping the company leverage its wide reach and extensive network capabilities for diverse applications and audiences. These developments are projected to better position Verizon for future growth.

1

Total Return Outlook

On January 23, the company reported its fourth-quarter and full-year results for 2023. Investors were not bothered by the decline in revenue and earnings, with the stock jumping post-release, as the decline was caused by one-off non-cash charges. Other than this development, VZ’s numbers look positive. Meanwhile, the company continued to post significant cash flows, which left it with almost $8 billion worth of cash after paying dividends. This stockpile of cash should be even higher going forward, as the company expects lower capital spending in 2024. The ability to produce ample cash supports the company’s aim to reduce debt, which helps to save money on interest, which it then funnels towards investing back in the business and raising dividends.

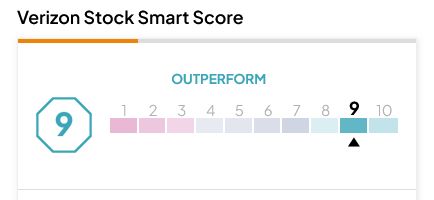

Verizon’s strong fundamentals and robust prospects are reflected in its TipRanks Smart Score rating of 9/10 (“Outperform”) for its stock, as well as by top Wall Street analysts’ average projected upside of 13.7% for the next 12 months:

Despite the recent increase in the stock, it continues to trade at very attractive valuations. VZ is undervalued compared to the Communication Services sector, its industry, and its peer average. In addition, it trades about 65% below its fair value, based on future estimated cash flows. These factors position Verizon firmly within the value stock universe.

1

Investing Takeaway

To conclude, Verizon Communications is a very large, stable, low-risk business with an enormous customer base and strong competitive position. The company has invested in venues that should help it grow its revenues and earnings, further supporting its already powerful cash-generation capabilities. With strong fundamentals and an improving outlook, Verizon’s highly reliable, high-yield dividend is expected to grow for years to come. All in all, VZ is a high-income stock trading at a more-than-reasonable price. Therefore, we view VZ as well-suited to be a part of long-term income portfolios.

Disclaimer

The information contained in this article represents the views and opinions of the writer only, and not the views or opinions of TipRanks or its affiliates and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment, and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices, or performance.