Essential Helpers

In the complex tapestry of modern industry, the industrial distribution sector plays a quietly essential role. This sector, though out of the limelight, is a backbone of various industries, driving efficiency and innovation in a subtle yet impactful manner. Its value, measured in billions, is underscored by steady growth and an understated resilience, reflective of its fundamental role in the modern industrial ecosystem.

At the core of the sector’s significance is its adaptability, based on a deep understanding of complex industrial needs. The seamless integration of advanced technologies such as automation, robotics, and smart systems has revolutionized the way industrial products are built, distributed, and utilized, increasing technological prowess across industries and the economy as a whole.

This industry thrives on the universal need for efficient and reliable industrial solutions, a demand that remains consistent across economic cycles. In times of economic growth, it supports expanding industrial activities; in downturns, its role in maintenance and repair becomes crucial, offering a semblance of stability amidst uncertainty.

Marked by a blend of technological innovation and industrial practicality, this sector is poised for sustained growth. We will present a leading company in the industrial distribution sector, but first, let’s delve into a short update on the economy and markets, and the Smart Investor calendar.

Economy and Markets: Looking Forward

There are several important reports scheduled to be published in the next few days.

-

On Friday, the U.S. Bureau of Labor Statistics will release November’s Nonfarm Payrolls and Unemployment reports, which present the number of new jobs created during the previous month, and the percentage of people who were actively seeking employment in the previous month. These reports are considered two of the most important economic indicators, as policymakers follow the shift in the number of jobs, since it is strongly associated with the health of the economy as a whole. One of the mandates of the Federal Reserve is full employment, and it takes labor market changes into account when determining its policy decisions, which influence the capital markets.

-

Also on Friday, the University of Michigan will publish the preliminary December’s Michigan Consumer Sentiment Index. This report, published by the University of Michigan, portrays the results of a monthly survey of consumer confidence levels in the United States. The level of confidence affects consumer spending, which contributes about 70% of the U.S. GDP.

As for the stock calendar, the Q3 2023 earnings season for Smart Investor Portfolio companies is winding down, with only Broadcom (AVGO) scheduled to report this week.

The ex-dividend date for STMicroelectronics (STM) is December 11th.

Today, we are adding the stock of one the largest industrial distributors in North America, featuring stellar finances and profitability, which is projected to continue thriving in the years to come.

To make room for this valuable addition, we are letting go of a healthy and robust industrial company, whose stock is expected to continue being pressured by a weakness in its main revenue unit.

New Addition: Applied Industrial Technologies (AIT)

Applied Industrial Technologies, Inc. is one of North America’s largest distributors and service providers of industrial motion and control technologies.

The company distributes various value-added industrial products, including engineered fluid power components; bearings; specialty flow control solutions; power transmission products; fluid power; automation solutions, including machine vision, robotics, motion control, and smart technologies; and miscellaneous industrial supplies. In addition, Applied provides engineering, design, and systems integration for industrial and fluid power applications, as well as customized mechanical, fabricated rubber, fluid power, and flow control shop services. Applied also offers storeroom services and inventory management solutions that provide added value to its customers.

AIT provides for optimizing the performance and cost of its customers’ major capital equipment and production infrastructure through technical expertise, service capabilities, and comprehensive after-market repair and support. Although it does not generally manufacture the products it sells, Applied assembles and repairs various products and systems.

Applied supports the Maintenance Repair Operations (MRO) and Original Equipment Manufacturing (OEM) operations of businesses in virtually every industry segment, including agriculture and food processing, cement, chemicals and petrochemicals, fabricated metals, forest products, industrial machinery and equipment, life sciences, mining, oil and gas, primary metals, technology, transportation, and utilities, as well as government entities.

The company’s distribution structure is built on two platforms, service center-based distribution and fluid power businesses. AIT’s service centers are located in all the U.S. states, as well as in Canada and Mexico. The service center-based distribution business accounts for a substantial majority of Applied’s field operations and sales dollars. The company’s specialized fluid power segment primarily markets products and services directly to customers, as well as through the service center network. In addition to distributing fluid power components, the segment assembles fluid power systems, performs equipment repairs, and offers technical advice to customers.

The company was established in 1923 as “The Ohio Ball Bearing Company,” renamed “Bearings, Inc.” in 1953, and was first publicly traded on NYSE that same year. In 1997, the company changed its name to “Applied Industrial Technologies” to reflect its diversified offerings and has been traded on the NYSE since that date under the symbol AIT.

From the 1950s through the early 1990s, Applied targeted U.S. expansion with small and mid-sized acquisitions. In the mid-1990s, the company significantly increased the pace and scope of buyouts, expanding its capabilities and geographical reach. Following the successful integration of acquired entities, Applied showcases their brands, along with its own legacy brands. These include Bearings, Dixie Bearings, King Bearing, Mainline, Invetech, and others.

The company has made 50 acquisitions since 2000, and 33 acquisitions since 2012, representing over $1B in annual sales. AIT’s most notable recent acquisitions include the buyouts of Gibson Engineering and R.R. Floody Company, both providers of automation products and services, in 2021; Automation, Inc., a provider of automation products, services, and engineered solutions, in 2022; Advanced Motion Systems Inc., a machine vision, robotics, and motion control technologies provider, and Bearing Distributors, Inc. and Cangro Industries, Inc., providers of bearings, power transmission, industrial motion, and related service and repair capabilities, in 2023.

Today, Applied Industrial Technologies commands a market capitalization of over $6.5 billion and has reported annual revenues of $4.43 billion in fiscal year 2023 (ended June 30, 2023). It has a workforce of ~6,500 employees in the U.S. and internationally. AIT is headquartered in Cleveland, Ohio.

The company has an extensive supplier list, which includes well-known names such as Timken Company (TKR), Eaton (ETN), Parker Hannifin (PH), ITT (ITT), Ingersoll Rand (IR), Mitsubishi Electric (MIELY), Flowserve (FLS), and many more.

In addition to its high level of supplier diversification, AIT’s customer list is also diversified across various names and industries. The largest customer industry is Industrial Machinery, responsible for 15% of the company’s sales; the Metals and Food & Beverages industries provide 10% each, Forest Products industry is responsible for 9% of sales; the Chemical & Petrochemical and Cement & Aggregate industries provide for 6% each; and Transportation and Oil & Gas industries are responsible for 4% sales each. The additional 36% of sales revenues are derived from all other industries each representing 4% or less of sales, including Utilities, Rubber & Plastics, Construction, Technology, Agriculture, Automotive, and Life Sciences industries.

AIT’s customers are primarily North American companies, with the U.S. responsible for 87% of revenues and Canada for 7%; the company also has customers in Australia, New Zealand, and Singapore. Although Applied also sells to OEMs, the majority of its customers use its products to maintain and repair their machinery and equipment.

The company holds leading market positions in most of its areas of expertise; 80% of its sales are generated from segments where it holds #1 or #2 market positions. Its business operates through two segments: Service Center-based Distribution, responsible for 67% of total sales, and Engineered Solutions, responsible for 33% of total sales. The former segment is based on a legacy service center distribution network across North America, Australia, & New Zealand; it is focused on MRO motion & power control solutions for critical break-fix applications and includes inventory management solutions. The Engineered Solutions segment, specializing in distributing, engineering, designing, and integrating hydraulic, pneumatic, & flow control technologies, as well as advanced automation solutions including robotics, machine vision, industrial networking, and digital offerings, has a much higher margin and is faster growing than the legacy segment. The company plans to increase the latter segment’s share in total revenues to ~45% within five years.

AIT’s financial health is more than stellar. It has a net debt-to-equity ratio of just 17%; the company has been aggressively paying down its debt since 2018, despite its numerous acquisitions. The company’s strong liquidity position is underscored by its current ratio of 3.5 and quick ratio of 2.3. In contrast to most industrial companies, AIT is a cash-generating machine whose FCF has grown at a CAGR of 23% in the past five years; in FY 2023, its free cash flow surged 87% from the previous year.

As for capital efficiency, AIT features industry-beating metrics. Its Return on Equity (ROE) of 26.4%, Return on Assets (ROA) of 13.8%, and Return on Invested Capital (ROIC) of 17.9% are considered high and position the company in the top 10% of its industry. The company’s robust profitability is reflected in its gross margin of 29.4%, operating margin of 11%, and net profit margin of 8.2%, which are much higher than the averages among the Industrial Distributors.

On October 26, Applied reported its fiscal Q1 2024 results for the quarter ended September 30. The company’s revenue and earnings surpassed analysts’ estimates. In fact, AIT has beaten EPS estimates in all quarters for which these estimates were available, without a single miss.

Applied Industrial Technologies has grown its revenues by a CAGR of 12.3% in the past three years, while EPS surged at a CAGR of 40%. In FY 2023, revenue rose by 16% year-over-year, while EPS rose by 34.4%.

In FQ1, earnings-per-share registered an 11th consecutive quarter of double-digit growth, with most of the latest quarters featuring growth in medium or high double-digits. In the quarter, net sales rose 3.4% year-on-year, net income increased by 21.3%, EBITDA expanded by 12.3%, net income rose by 22%, and EPS rose by 23%.

As a result of a successful first quarter, the company’s management raised its full-year fiscal 2024 guidance for net sales, EBITDA margins, and earnings. Particularly, the EPS outlook was increased by 5%. The management said that “the guidance incorporates current economic uncertainty and assumptions of easing end-market demand near term, as well as ongoing inflationary and supply chain headwinds.” It may be assumed that, if not for these near-term obstacles, the guidance may be lifted even more.

Given the company’s stellar finances, robust delivery, and optimistic growth outlook, it is no wonder that AIT’s stock has strongly outperformed its industry, as well as the general market. In the last three years, the stock surged 112%, versus Industrial Select Sector SPDR Fund’s (XLI) 22% and the S&P 500’s (SPX) 25% increase in the same period. In the past 12 months, AIT has gained over 28%, twice the performance of the broad market and four times the increase of the industrial sector’s ETF.

Despite strong outperformance, AIT is still trading at modest valuations. Its TTM P/E of 18.2 and a Forward P/E of 17.8 represent a ~15% discount to the Industrial sector’s averages.

It must be noted that the company’s stock registered its all-time high on December 4th; as a result, it may be under some pressure in the near term due to profit-taking. However, in the next 12 months, TipRanks-scored top Wall Street analysts see an additional upside of 13% for the stock; given its strong fundamentals and performance, it may surprise on the upside.

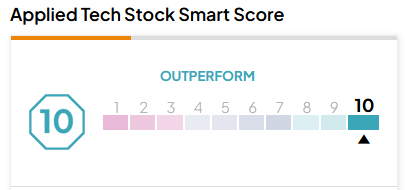

Applied Industrial Technologies carries a TipRanks Smart Score rating of “Perfect 10” with a “Strong Buy” recommendation:

In addition to stock price appreciation, AIT’s shareholders are rewarded through dividend payments, distributed quarterly since 2009. Although the company’s current dividend yield is a low 0.84%, its more than modest payout ratio of 15% and a 14-year history of uninterrupted annual payout increases suggest that Applied will continue raising its dividends in the years to come.

But the shareholder rewards don’t end with dividends, as Applied also performs buybacks on an opportunistic basis. In August 2022, the company authorized a new share repurchase program to buy up to 1.5 million shares of its common stock. While since the program announcement the company has not made any buybacks due to the stock’s surge in price, the management said that “share buybacks remain in scope for FY24 given balance sheet capacity and return profile.”

Given all of the above, we view Applied Industrial Technologies, Inc.’s stock as a winning combination of quality and growth, and as such, a valuable addition to the Smart Investor portfolio.

New Deletion: Terex Corporation (TEX)

Terex Corporation is an American manufacturer of materials processing machinery and aerial work platforms. TEX designs, builds, and supports products used in a variety of industries including construction, maintenance, infrastructure, quarrying, recycling, energy, mining, shipping, transportation, refining, and utilities.

The company operates through two main segments: Aerial Work Platforms (AWP) and Materials Processing (MP). The AWP segment designs, produces, markets, and services aerial work platform equipment, utility equipment, telehandlers, and light towers. The AWP segment is responsible for about 60% of total global sales. The MP segment supplies materials processing and specialty equipment and is responsible for about 40% of total global sales.

Terex is a financially healthy company with low debt ratios, great financial efficiency metrics, robust profit margins, and double-digit EPS growth. However, its stock performance has been underwhelming in recent months, and analysts foresee further pressure in the near term.

On October 26, TEX reported its Q3 2023 results. While the EPS exceeded estimates, the difference was much smaller than in the previous quarters. Diving into the details of the report gives some insight as to why analysts were not pleased with the results, despite the positive headline. Generally, the EPS beat was largely driven by tax benefits, not by higher sales.

Terex’s main revenue source, the AWP division, posted a miss on margin projections, as it “was negatively impacted by supply chain issues resulting in lost production and manufacturing inefficiencies,” according to the management. TEX has been facing a continued erosion in AWP backlog, and a lack of further margin upside is expected to continue weighing on the stock in the near future, as the price tailwinds dissipate on the back of supply chain normalization. Meanwhile, the company is experiencing cost increases stemming from the ramp-up of one of its major facilities.

As a result of the third-quarter segment miss, the management downgraded its AWP operating margin projection for the full year 2023. While the overall full-year 2023 EPS guidance was slightly lifted, the increase fell short of analysts’ expectations. Several analysts downgraded their price targets for TEX stock, noting a forecast for softer AWP orders and projecting that the company’s 2024 production will likely need a downward adjustment.

These developments are coming at a sensitive time for the company, which is undergoing a leadership change process, which isn’t necessarily negative but increases the level of uncertainty for the next quarters. All these factors combined, coupled with heavy selling by some prominent hedge funds, have led to the company’s losing its “Perfect 10” TipRanks Smart Score, which declined to 6/10 (“Neutral”).

Given these facts, we believe that it will be difficult for Terex to resume its previous great stock performance in the near term. Thus, we see it as appropriate to sell the stock.

Charter Members of the 30% Winners Club

*The 30% Winners Club includes stocks from the Smart Investor Portfolio that have risen at least 30% since their purchase dates.

The markets had another winning week, but our exclusive club’s ranks remained unchanged, with most of the action happening below the 30% threshold.

The Winners Club still includes five stocks: GE, AVGO, ORCL, ANET, and CDW.

The runner-up to the Winners ranks is now General Dynamics (GD). However, with a gain of 23.1% since purchase, it has a lot of ground to cover. Will it be able to close the gap, or will someone else outrun it to the finish line?

What’s Next?

Our next commentary will come out on Wednesday, December 13th, before the market opens.

Until then – we wish you a world of investment success!

Access the full Smart Investor Archive, including all historical stock picks and original newsletters.

Portfolio Changes

|

Disclaimer

The information contained in this article represents the views and opinions of the writer only, and not the views or opinions of TipRanks or its affiliates and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices, or performance.