Let’s Stay Interconnected

In an age where interconnectivity reigns supreme, companies that stand at the forefront of creating, designing, and manufacturing vital components of our electronic, digital, and telecommunications infrastructures increasingly gain the attention of savvy investors.

The global interconnectivity industry, encompassing the manufacturers of electronic and fiber optic connectors, cable, and interconnect systems, is on a trajectory of robust growth. This is largely driven by the escalating demand for high-speed connectivity and data transmission in sectors such as telecommunications, computing, automotive, and aerospace. As industries increasingly adopt technologies such as 5G, IoT, and artificial intelligence, the requirements for sophisticated, reliable, and high-performance connectivity solutions become even more imperative. Hence, the future outlook for the interconnectivity industry remains promising, suggesting a potential surge in the market value of leading players.

However, when choosing stocks from the industry, investors are strongly advised to pick companies with a diverse product portfolio and geographic footprint. Diversification across products ensures a wider market reach, mitigating the risk associated with over-reliance on a single product or sector. This breadth of offerings allows the company to adapt and thrive even amidst shifting market dynamics and technological advancements. At the same time, geographic diversification provides a buffer against regional economic downturns or disruptions, thereby promoting business stability and continuity. It also opens the company to a broader consumer base, ensuring a steady revenue stream from different markets.

Another strongly important factor to take into account is the companies’ financial health, which signifies their ability to generate value for their shareholders. Companies with robust financials are typically better equipped to weather economic downturns, invest in future growth, and provide consistent returns. Hence, looking at financial indicators such as profitability, revenue growth, and return on investment can provide a measure of the company’s resilience and potential for sustained growth, making it a more reliable investment choice.

Basically, investing in providers of electronic and fiber optic connectors equates with investing in the very infrastructure of our increasingly interconnected world. As we advance further into the era of electrification and digitalization, strong and resilient companies in the industry stand poised to benefit, making them a worthy consideration for those looking to invest in the technology that powers our future.

Economy and Markets: Looking Forward

There are several very important reports scheduled to be published in the next few days:

- On Thursday, we’ll see published July’s Consumer Price Index (CPI) and Core CPI.

- On Friday, we’ll get a glimpse of the next month’s inflation outlook, provided by July’s Producer Price Index (PPI).

- On Tuesday, we’ll see the data on July’s Retail Sales.

As for the stock calendar, the Q2 2023 earnings season for Smart Investor Portfolio companies is almost over, with only Keysight Technologies (KEYS) scheduled to report next week.

The ex-dividend date for Jabil, Inc. (JBL) is August 14th.

Today, we’re letting go of stock from a company which has been strongly underperforming its peers on the back of its balance sheet and liquidity weakness. In its place, we’re adding an industry leader with stellar financial metrics, high efficiency, great profitability, and an insatiable appetite for expansion.

New Deletion: BJ’s Wholesale Club Holdings (BJ)

BJ’s Wholesale Club Holdings, Inc. operates warehouse clubs in the eastern half of the United States. The company sells a wide range of consumer goods, including media devices, home furnishings, computers and tablets, kitchen appliances, and groceries. Sales of groceries account for almost 70% of the total sales.

BJ’s Wholesale Club Holdings, Inc. was founded in 1984. It is a mid-cap company belonging to the Consumer Staples sector (Industry: Retail).

BJ’s financials don’t demonstrate a picture of robust health, as it has a large debt and low liquidity. Although the company has reduced its debt, its debt-to-equity ratio of 75% is considered high. While the debt is well-covered by operating cash flow and the interest payments – by EBIT, there is a significant red flag attached to the data: BJ’s short-term assets do not cover either its short- or long-term liabilities. The company’s liabilities outweigh the sum of its cash and short-term receivables by over $5 billion, a significant deficit for a company with a market capitalization of just $8.7 billion. This balance-sheet weakness is strongly weighing on the company’s growth outlook, as the high financing costs reduce its ability to reinvest into the business. Besides, BJ’s lenders may require that the company strengthen its balance sheet, which would result in additional stock offerings, i.e., shareholder dilution.

BJ’s liquidity ratios have never been great, to tell the truth, such as its current ratio of 0.7, its quick ratio of 0.1, or its cash ratio of zero. Besides, its liquidity has been worsening in the recent three quarters, with a pronounced decline in operating and free cash flows.

The company’s profitability is good, with operating and net profit margins in line with, or a little higher than, the averages for the Retail industry. While its earnings growth hasn’t shown stability, it has been strong on the whole, given that the company belongs to a highly competitive, low-margin industry. However, BJ’s flagging financial health is weighing on its prospects; the company’s revenue and earnings growth is expected to slow significantly in the next three years.

BJ’s stock experienced a strong rally on the back of high expectations of rising earnings after the end of the pandemic restrictions. However, investors have soured on BJ after it reached its all-time high in September last year. While the Consumer Staples sector as a whole has been underperforming this year, with investors’ attention turning to faster-growing sectors, BJ did much worse. The Consumer Staples sector stocks, as represented by the Consumer Staples Select Sector SPDR Fund (XLP), have risen 2% year-to-date, while BJ has lost 4%. This year’s performance comes in stark contrast to the past, as in the last three years, BJ gained 65%, while XLP rose by 23%. While the company is now trading at about a 20% discount to the sector, we don’t think it turns the stock into a value position, as it may well continue to underperform. Taking all this into account, we don’t see a compelling reason to continue holding the stock.

BJ’s removal from the portfolio will make room for the company we are adding this week, APH.

New Addition: Amphenol Corp. (APH)

Amphenol Corp. designs, manufactures, and markets electrical, electronic, and fiber optic connectors. The company is one of the world’s largest providers of high-technology interconnect, sensor, and antenna solutions, operating in the U.S. and international markets.

Amphenol’s products enable connectivity across virtually every end-market, including automotive, broadband communications, commercial aerospace, industrial, information technology and data communications, military, mobile devices, and mobile networks.

Amphenol operates through seven global divisions: Communications Solutions, providing rugged, miniature, high-performance interconnect solutions for drones, warehouse robots, and robotic arms; Mobile Consumer Products, providing a broad range of components with presence on more than 50% of the world’s mobile devices; Global Interconnect Systems, which designs and manufactures electro-mechanical cable assemblies and Value-Add Interconnect Solutions for Information Technology and Data Communications, Mobile Networks, Industrial, Heavy Equipment, Rail and Military/Aerospace markets around the world; Sensors, offering a diverse sensor portfolio of standard and customized products for eight different industries (automotive & EV, medical, etc.); Industrial Products Group, providing interconnect systems for harsh environment applications, used in the Energy, Mining, Rail, and other industries; and Military & Aerospace, offering interconnect solutions for aircraft, avionics, unmanned systems, and other uses. Each division is basically a standalone business, working under the corporate umbrella of Amphenol. This decentralized corporate structure allows for faster decision-making and implementation, providing for faster organic growth and higher resilience.

Amphenol Corporation was founded in 1932 in Chicago, Illinois. The company’s first invention was a molded radio socket that used connecting devices made out of phenolic material instead of the more brittle ceramic materials used at the time. The company grew rapidly as it explored and invested in new technologies. It expanded significantly during World War II, when Amphenol became the primary manufacturer of connectors used in military hardware, including airplanes and radios. Through the years, Amphenol underwent several mergers and acquisitions, changing names and owners, but continued to grow and expand its geographical presence and product offerings. In 1991, the company completed an IPO on NYSE under the ticker APH. In 1997, the private equity firm Kohlberg Kravis Roberts (KKR) acquired a majority interest in Amphenol; with financial support from KKR, Amphenol began a strategic acquisition program that contributed to the significant growth of the company. During the early 2000s, KKR gradually reduced its ownership of Amphenol, finally exiting in 2004.

Today, Amphenol is a global corporation with operating entities in more than 60 locations around the world. APH is headquartered in Wallingford, Connecticut, USA. With 91,000 employees around the globe and a market capitalization of $50 billion, Amphenol is a large-cap Fortune 500 company. The company sells its products globally; in 2022, the U.S. was responsible for 33% of its revenues, China – for 26%, and the rest of the world – for 41%. It belongs to the Information Technology sector (Industry: Electronics).

Amphenol has continued its strategy of supplementing organic growth with acquisitions. It has acquired about 50 companies over the years, displaying a strong track record of effectively integrating acquisitions into its core business model, driving expansion in its top and bottom lines. Some of the more significant acquisitions completed in recent years include the purchase of MTS Systems and Halo Technology in 2021; Integrated Cable Assembly Holdings and NPI Solutions in 2022; and CMR Group, EBY Electro, and Radio Frequency Systems, Inc. in 2023. These strategic acquisitions allow the company to further integrate its product lines and strengthen its business portfolio, allowing for greater diversification of its revenue streams. Amphenol’s broad market exposure mitigates market, economic, and geography-specific risks while increasing the company’s potential to profit from different technological trends, such as 5G, automation, vehicle electrification, etc.

Despite its large size, robust profitability, and global reach, Amphenol often flies under investors’ and analysts’ radar. It is not a consumer-facing company, but a producer for producers, hence its relative anonymity. While investors’ attention is mostly drawn to the newest, cutting-edge software solutions, they are worthless without the appropriate hardware – which has to have a way to pass along energy and data. Thus, the importance of hardware connectivity applications is in that they are the bits and pieces that allow circuits to interconnect. These connectors are found in almost everything around us, from smartphones and personal computers to airplanes, wireless networks, missile systems, data centers, and more. The global connector market size was valued at $83 billion in 2022 and is projected to reach $178 billion by 2032, growing at a CAGR of 8% in the next five years on the back of the increasing demand for high-speed data transmission across computers, mobile, IoT, and other uses. Amphenol is ranked #2 globally among the largest connector market players after TE Connectivity (TEL). APH accounts for 12% of the total world connector market share (by sales) versus TEL’s 15%.

Amphenol checks all the boxes on financial health, capital efficiency, and profitability metrics. Despite financing numerous acquisitions, the company has succeeded in significantly reducing its debt in the past five years; currently, its net debt-to-equity ratio stands at a healthy 37%. APH’s debt is well-covered by operating cash flow, while interest payments are comfortably covered by EBIT. APH’s short-term assets exceed both its short- and long-term liabilities. The company boasts an outstanding Return on Equity (ROE) of 27.3% and a Return on Assets (ROA) of 13.5%, leaving its industry far behind on these metrics. Amphenol’s operating and net profit margins are also considerably higher than average for its peers, indicating outstanding operational efficiency. The company’s revenues have been growing at an average annual rate of 12% in the past five years, while earnings have increased by 16% annually.

In Q1 2023, the company surpassed analysts’ revenue and EPS estimates, as it did in all quarters in its public-company history, with one single exception in the midst of the pandemic. However, the company’s earnings-per-share declined 4% year-on-year after 11 consecutive quarters of growth, with ten of them registering double-digit growth. The slight drop was anticipated; it was caused by declines in the IT datacom, mobile networks, and mobile devices markets, which were partially offset by growth in the commercial air, military and automotive markets as well as contributions from the company’s acquisition program. According to the management, the latest acquisitions will help lift revenues in the second half of the year, compensating for weakness in the Communications Solutions division’s sales and mitigating the weakness in the Chinese market.

Despite the moderation in sales from the previous year, the operating margin surged from 18.3% to 20.4%, underscoring the company’s high efficiency. In addition, the company’s outstanding cash-generating ability came into light as operating and free cash flow increased versus the prior quarter. Still, the sales decline strengthens the company’s case for its strategic acquisition strategy, as it helps Amphenol to quickly expand to different markets, diversifying its revenue streams to increase its resilience.

For an “under-the-radar” company, Amphenol’s stock has done exceedingly well. In the past 12 months, APH has gained 22%, outperforming the S&P 500 (SPX) index (this comparison is due to the absence of plain-vanilla industry ETFs). In the past three years, the company’s investors have gained over 72% on the stock, compared to SPX’s increase of 43%. It must be said that due to the strong outperformance, APH is on the expensive side now, as its TTM P/E of 28.8 and Forward P/E of 30.3% present an approximate 15% premium over its sector’s averages. However, there are sufficient reasons to anticipate further upside from the stock, as stated above; compared to its long-term potential, the price seems more than fair.

In addition to solid compounding price appreciation returns, Amphenol’s shareholders are compensated by dividends and stock buybacks. The company has been paying dividends since 2009, growing them for the last decade. Although APH’s dividend yield of 1% is low compared to its industry, the company’s financial strength, cash-making prowess, and long track record of dividend payout increase support the outlook for continued dividend growth. Amphenol has also been active in purchasing its shares: in Q2 2023 alone, the company repurchased its stock for the amount of $154 million, after a $167 million in buybacks in the first quarter of the year.

With stellar financial metrics, a bright outlook, and high total investor returns, it’s no wonder that hedge funds and individual investors have been rushing in recent months, increasing their exposure to the stock. After the stronger-than-expected showing in Q2 results, analysts from major institutions such as Robert W. Baird and Goldman Sachs have been upping their 12-month upside predictions and price targets for Amphenol, despite the recent run-up in the stock’s price. While given Amphenol’s high valuation metrics, the stock price may even stagnate in the near term, we believe that in the long term, its stock – as well as its business – will outperform as it did many times in the company’s history, including the recent years.

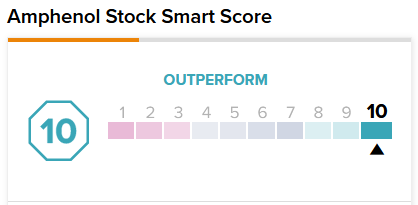

Amphenol carries a “Perfect 10” Smart Score rating on TipRanks with a “Moderate Buy” recommendation:

To conclude, we believe that Amphenol is poised for continued robust profitability, driven by organic growth as well as expansion by strategic acquisitions. The company’s generous shareholder compensation trend is expected to strengthen, supported by the company’s ability to generate free cash flow. Amphenol’s winning company structure, diversification efforts, and prudent management, it is poised to extend its success into the long term. Thus, we are convinced that Amphenol is a valuable addition to the Smart Investor portfolio.

What’s Next?

Our next commentary will come out on Wednesday, August 16, before the market opens.

Until then – we wish you a world of investment success!

Access the full Smart Investor Archive, including all historical stock picks and original newsletters.

Disclaimer

The information contained in this article represents the views and opinions of the writer only, and not the views or opinions of TipRanks or its affiliates and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices, or performance.