Senior Values

In the intricate fabric of the Healthcare sector, the health insurance industry emerges as a pivotal yet often unheralded segment. This sector, functioning beyond the limelight, serves as a critical pillar in the healthcare system, facilitating access to necessary medical services and insurance coverage.

Within this sector, the sub-industry that includes the providers of government health plans, particularly Medicare and Medicaid, holds a quietly significant position. This industry, often operating in a nuanced and regulatory-intensive environment, plays a fundamental role in delivering essential health services to diverse populations. Its role, while less conspicuous, is characterized by steady development and resilience that speaks to its vital function in public health management.

Central to the narrative of this sub-industry is its ability to navigate the complex interplay of government policies and patient needs. The integration of policy-driven initiatives and patient-centric approaches, though not overtly highlighted, has been instrumental in shaping accessible and affordable healthcare solutions. This gradual yet impactful transformation has been pivotal in enhancing healthcare delivery to the most vulnerable and elderly populations.

Importantly, the health insurance industry in general, and the health plan providers in particular, stand to benefit significantly from demographic shifts, such as population aging. As the proportion of elderly individuals increases, there is a corresponding rise in the demand for health insurance services, ensuring a robust and growing market for providers in this space.

With a focus on regulatory compliance and community engagement, the health plan providers are set for continued growth within the Healthcare sector. Before we delve into the story of a key player in this field, let’s first set the stage with a short overview of the economy and markets and the Smart Investor calendar.

Economy and Markets: Looking Forward

There are several important reports scheduled to be published in the next few days.

-

On Thursday, the U.S. Bureau of Economic Analysis will release the third estimate of Q3 2023 GDP Growth Annualized. This report will provide a final reading of the U.S. economy’s health in the previous quarter, incorporating fresh data received after the first and second estimates’ release. The third reading is expected to be unchanged from the second, which showed a 5.2% annualized rate of economic expansion.

-

On Friday, we will receive November’s Core Personal Consumption Expenditures (Core PCE) data. This report, published by the U.S. Bureau of Economic Analysis, reflects the average amount of money consumers spend monthly, excluding seasonally volatile products such as food and energy. FOMC policymakers use the annual Core PCE Price Index as their primary gauge of inflation. Analysts expect the Core PCE to mimic the disinflation trend seen in the CPI report, slowing to 3.4% from October’s annual rate of 3.5%.

-

Also on Friday, the University of Michigan will publish December’s Michigan Consumer Sentiment Index. This report portrays the results of a monthly survey of consumer confidence levels and consumers’ views of long-term inflation in the United States. The level of confidence affects consumer spending, which contributes about 70% of the U.S. GDP. The index is expected to remain unchanged from November’s level of 69.4.

As for the stock calendar, the Q3 2023 earnings season for Smart Investor Portfolio companies has ended, with no earnings reports coming out this week.

The ex-dividend date for General Electric (GE) is December 27th.

Today, we are adding the stock of one of the largest health insurance service providers in the United States, featuring stellar finances, modest valuations, and great growth prospects.

To make room for this valuable addition, we are letting go of the Materials giant, whose sales and cash have been in decline, pressuring stock performance, while its outlook deteriorated.

New Addition: Humana (HUM)

Humana Inc. is one of the leading health insurance service providers in the United States.

The company, through its Retail division, provides Medicare benefits and state-based Medicaid contracts, which are marketed on a retail basis to individuals. The Group and Specialty business offers employer group commercial fully-insured medical products and specialty health insurance benefits. Humana also offers pharmacy solutions, provider services, home-based services, and clinical programs to the company’s health plan members as well as to third parties through the Healthcare Services segment.

The company was founded in 1961 as a nursing home management firm under the name “Extendicare Inc.”; by 1968, it became the largest nursing home company in the United States. Over the years, the company expanded its services and became a major player in the healthcare industry. In 1972, after divesting the nursing home business, Extendicare moved into the hospital business. It changed its name to “Humana” in 1974 to reflect the changing perception of medical aid from indifferent treatment to human care.

In the 1980s, Humana entered the health insurance business. After one of its hospitals lost a contract with a local health maintenance company, Humana started its own health insurance plan. The health-plan line of business took off immediately, growing by accelerating rates. It was so successful that at the beginning of the 1990s, Humana’s management decided to spin the hospitals out to allow Humana to focus solely on insurance. By 1993, Humana’s hospital business had become the largest hospital operator in the U.S.; it was then spun off as Galen Health Care Inc., a separate public company. Since then, Humana has concentrated on providing group health insurance and Medicare plans as well as health and supplemental insurance plans to individuals.

During the years, Humana has grown through the internal deployment of investment resources to business growth and innovation, as well as through acquisitions of a total of 22 companies. Its most notable acquisition in recent years has been the completion of the takeover of Kindred at Home, the largest home health organization in the nation. Humana acquired 40% of Kindred in 2018 and bought the remaining 60% in 2021; the total transaction of about $10.5 billion was the largest in the company’s acquisition history. Another notable acquisition by Humana was the purchase of One Homecare Solutions, a provider of a variety of home-based health services, in 2021.

Today, Humana is ranked #42 in the Fortune 500 list of the largest U.S. companies by revenue, and #5 in the list of the largest U.S. health insurance providers by 2022 revenue. According to the American Medical Association’s (AMA) latest report, Humana ranks as #2 in the Medicare Advantage market, with 18% market share; that, compared to UnitedHealth Group’s (UNH) 28% (UnitedHealth is also a Smart Portfolio company). The health insurance company commands a market capitalization of $56.6 billion and has reported a 2022 revenue of $92.9 billion. It has a workforce of over 67,000 employees, serving tens of millions of customers in the U.S.

Humana is, and expected to be in the future, one of the largest beneficiaries of the population aging megatrend, because of its wide market share in the Medicare Advantage market. As the demographic mix shifts toward larger-share advanced age health-plan consumers, the market size of eligible Medicare enrollees increases. Medicare enrollment has been on a continued path upward for the past two decades, thanks both to demographics and the Medicare Modernization Act of 2003. In 2023, 51% of eligible Medicare beneficiaries are enrolled in Medicare Advantage plans, with enrollment growing by about 8% annually in the last few years. As this trend continues, the Congressional Budget Office (CBO) projects that the share of Medicare beneficiaries enrolled in Medicare Advantage plans will rise to at least 62% by 2033. Humana and UnitedHealth benefit the most from the rise of enrollment percentages, as they together control almost half of the nation’s Medicare Advantage market, while in about a third of counties, they account for at least 75% of Medicare Advantage enrollment. In addition, within its focus on the aging population, Humana has been expanding its home health care and preventive care offers, which are forecast to be a significant growth driver in the years to come.

Throughout its history, Humana itself has been a takeover target several times, with none of the potential deals succeeding for various reasons. For example, in 1998, Humana and UnitedHealth Group planned to merge, but the move failed when UnitedHealth Group posted large quarterly losses. In 2015, Aetna, which was since acquired by CVS Health (CVS), announced that it would acquire Humana, but the merger was blocked by a federal judge. The latest attempt at a merger came in October this year when one of the company’s main competitors Cigna (CI) attempted to negotiate an acquisition of Humana, but the deal fell through after failing to agree on price. As of December 2023, there are speculations that Walmart (WMT), which has been exploring ways to expand its healthcare footprint, is interested in acquiring Humana.

Humana has attracted numerous potential acquirers because of the strength of its business and its continuous expansion. The company’s specialization in the Medicare Advantage plans is a major growth catalyst, as this segment of healthcare displays accelerating rates of growth. In addition, Humana’s diversified offerings, which include dental, vision, and life insurance, as well as home-care services, add to the company’s strengths.

Another factor of Humana’s attractiveness is the company’s stellar financial health. While its debt-to-equity ratio is a medium 70%, HUM’s cash is almost triple its total debt. The company’s debt is more than well-covered by operating cash flow, while the interest payments are covered by EBIT many times over. Humana’s strong liquidity position is underscored by its current ratio of 1.4 and quick ratio of 1.2.

Humana’s debt is highly rated by the global credit rating agencies, underscoring the company’s ability to manage its liabilities easily: it carries a rating of “BBB+“ at Fitch, “BBB+” at Standard & Poor’s, and “Baa3” at Moody’s, representing the second-highest notch within the rating scale.

Particularly, Fitch applauded Humana’s “strong capitalization and leverage position,” as well as its business profile, which, according to the rating agency, “reflects a favorable competitive position, primarily in the Medicare Advantage market, large operating scale, and favorable diversification and business risk profile.” In addition, the agency hailed HUM’s “profitable growth in commercial membership that reduces its reliance on Medicare Advantage membership to generate revenues and EBITDA.” Although this growth would require a few years to have a meaningful impact on the bottom lines, it’s a welcome addition, as commercial health insurance provides higher EBITDA margins versus government plans.

As for capital efficiency, Humana features industry-beating metrics. While the Return on Equity (ROE) of 18.4% may seem mediocre, it is higher than that of 75% of its industry peers. Meanwhile, HUM’s Return on Assets (ROA) of 6.2% and Return on Invested Capital (ROIC) of 15% position the company in the top 20% of its industry.

Humana also showcases robust profitability, considering that health plan provision is a low-margin business. The company’s EBITDA margin of 5.1% and net margin of 2.95% are much higher than the industry averages. Modest margins don’t stop the company from generating vast amounts of cash. In the first nine months of 2023, Humana generated operating cash flows of $11.1 billion, an increase of 15% from the comparable period last year. In addition, HUM’s ability to convert its earnings into free cash flow is outstanding: in 2022, the FCF conversion rate was 115% of EBIT; the company ended the year with free cash flows of $4.6 billion, while TTM FCF for end-Q3 stood at $5.7 billion.

On November 1, 2023, Humana reported its Q3 2023 financial results, which featured revenue and EPS that exceeded analysts’ expectations. Q3’s revenue beat continued to be driven by individual Medicare Advantage, which significantly outpaced the industry growth rate, and state-based contracts membership growth, as well as by higher per-member individual Medicare Advantage premiums. In the quarter, revenues rose 15% year-over-year, while three-quarter revenues increased by 13.5% versus the comparable period of 2023.

The company has exceeded EPS expectations in every quarter since EPS estimates have been provided by analysts. Adjusted earnings-per-share rose by 6% in the quarter and by 9.3% in the three quarters of 2023 from the same periods last year. The company’s management has confirmed its commitment to its 2025 adjusted annual EPS target of $37, versus 2022’s adjusted EPS of $25.24.

Despite Humana’s strong financial performance, its stock has underperformed the market, declining by 8.8% in the past 12 months. A large part of the recent underperformance can be attributed to the proposed, and now failed, merger with Cigna, which was unfavorably viewed by the company’s investors, fearing a lower price tag than the company’s intrinsic worth, as well as the regulatory scrutiny. In the past three years, Humana’s shares rose by 18%.

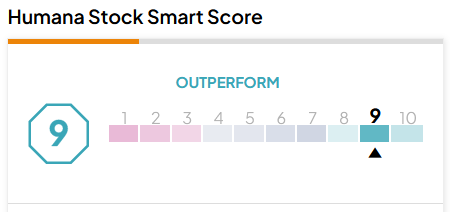

Despite the recent underperformance, analysts are optimistic regarding Humana’s stock performance in the near future, based on strong fundamentals and a robust business outlook. TipRanks-scored top Wall Street analysts see an additional upside of 26.5% for the stock in the next 12 months. HUM carries a TipRanks Smart Score rating of 9/10 (“Outperform”) with a “Strong Buy” recommendation:

The analysts’ positive outlook on the stock is supported by HUM’s modest valuations. Its TTM P/E of 19.1 and a Forward P/E of 17.3 represent a ~30% discount to the Healthcare sector’s averages. HUM trades at the middle of the price range for its industry peers, and, given its robust earnings and cash flows, its current price is much lower than its fair value. Humana appears to be ~40% undervalued according to its discounted cash flow forecast, positioning the company as a significant value investment opportunity.

Notably, Humana is a dividend-paying company; its cash payouts have been continuously raised each year since 2011. Although the company’s current dividend yield is a low 0.75%, its stellar cash generation history, a more than modest payout ratio of 12.4%, and a 12-year history of uninterrupted annual payout increases suggest that HUM will continue raising its dividends in the years to come.

However, the shareholder rewards don’t end with dividends, as Humana also performs buybacks within its share repurchase authorization. Humana’s management authorized a stock repurchase program of $3 billion in February 2023, in addition to the previous program which at that time had $1 billion of remaining capacity. As of the end of the third quarter, the remaining buyback capacity was $1.9 billion, following share repurchases worth $1 billion in the first nine months of 2023.

To conclude, Humana has a wide economic moat, stellar finances, outstanding cash generation abilities, and robust earnings growth prospects. These metrics, coupled with the company’s modest valuation, optimistic share-price outlook, and strong alignment with shareholder interests, make the company’s stock a winning combination of value, quality, and income compounded, and as such, a valuable long-term addition to the Smart Investor portfolio.

New Deletion: Air Products and Chemicals (APD)

Air Products and Chemicals, Inc. is a diversified American-based multinational corporation that supplies gases, equipment, chemicals, and related services in the Americas, Asia, Europe, the Middle East, India, and other countries.

Although Air Products remains well-capitalized, its balance sheet has weakened over the past several quarters, with the net debt-to-equity ratio rising to a medium-high 54%. At the same time, its cash position has worsened in the past few quarters, with free cash flow registering significant declines.

On November 7th, APD reported its fiscal year 2023 and fiscal Q4 2023 (ended October 30, 2023) financial results. While EPS exceeded analysts’ estimates in FQ4, revenues disappointed. The company’s revenue fell by 10% year-on-year, led down by lower energy pass-through expenses and falling income from Asia on the back of the slow recovery in the electronics demand and the ongoing economic weakness in China.

These obstacles are expected to continue depressing the company’s margins well into the first half of calendar 2024, which led several Wall Street analysts to downgrade APD’s stock-price targets and recommendations, with some of them stating doubts about the company’s ability to reach its fiscal 2024 guidance targets, and even about the strength of its fundamentals going forward.

In FY 2023, the company registered a negative FCF due to increased capital investment and decelerating revenues; despite that, and despite its rising net debt, it continues to pay high dividends. If revenues and cash flows don’t turn the corner, APD may have to cut the dividend, or at least discontinue its increases, which would pose an additional headwind for the company’s stock.

APD’s stock performance has been uninspiring, with a decline of 13% in the past 12 months, compared to iShares U.S. Basic Materials ETF’s (IYM) increase of 12% in the same period. Despite the underperformance, the company’s stock is expensive compared to its sector, with its TTM P/E of 26.3 representing almost a 50% premium over the Materials sector’s average.

Air Products and Chemicals’ history stretches back to 1940; during these long years, it saw many periods of high growth, as well as times when its financial and stock performance languished. Thus, APD may well come out of the current slump within several quarters, especially when the global economy strengthens, supporting revenues. However, for now, we believe it is prudent to sell the stock.

Charter Members of the 30% Winners Club

*The 30% Winners Club includes stocks from the Smart Investor Portfolio that have risen at least 30% since their purchase dates.

The markets had another winning week, and the Winners Club ranks have expanded. Ladies and gentlemen, please welcome Wesco International (WCC), which succeeded in clearing the threshold, rising over 31% since its purchase. In addition, Oracle (ORCL), which had been a member until last week’s stumble, has rejoined the Club.

Thus, the club’s members now include six stocks: GE, AVGO, ANET, CDW, WCC, and ORCL.

The next in line to enter our exclusive club is now Stellantis (STLA), which has seen its stock soar in the past two months on the back of its great financial performance. It will be interesting to see whether this robust performer enters the Winners Club, or whether someone else will outrun it to the finish line.

What’s Next?

Our next commentary will come out on Wednesday, December 27th, before the market opens.

Until then – we wish you a world of investment success!

Access the full Smart Investor Archive, including all historical stock picks and original newsletters.

Portfolio Changes

|

Disclaimer

The information contained in this article represents the views and opinions of the writer only, and not the views or opinions of TipRanks or its affiliates and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices, or performance.