The Innovative Gene

In the vast landscape of investment opportunities, the biotechnology sector stands out as a fertile ground for investors seeking substantial growth. The high-risk, high-reward nature of the industry is reflected in the incredible advancements it has fostered, reshaping the future of medicine while creating lucrative investment channels. The crux of the investment case for biotechnology stocks lies in their profound potential to deliver breakthrough therapies that address unmet medical needs. These game-changing innovations often translate into substantial financial returns, fostering a unique investment proposition.

As we have seen during the Covid-19 pandemic, biotechnology and innovative pharmaceutical companies are immensely important for global well-being; this importance carries significant financial rewards, as it should. In addition, as increasing longevity drives global population aging, the demand for medical treatments and therapies that can improve well-being is rising fast. Besides, as global prosperity rises, so does the investment in research and development of medicines and procedures intended at treatment of serious diseases, including less-common ones.

While investment in many biotechnology companies may be too risky for some investors, this risk can be mitigated by choosing stocks of companies with robust profitability and capital efficiency metrics, which command significant market share. An additional factor to consider when looking for stable, long-term investment opportunities in the industry, is the expiration dates on patents held by biotechnology companies, as patent cliffs often lead to significant declines in revenue. Equally important is the breadth and the diversity of these companies’ pipelines of new products under research and development.

Investing in biotechnology, and specifically in resilient and innovative companies in the industry, offers an ideal blend of future growth prospects with near- and long-term financial reward, driven by cutting-edge science and strategic market diversification. As we look to the future, biotechnology stands out as a sector with immense potential for growth, making it an attractive arena for discerning investors.

Economy and Markets: Looking Forward

There are several very important reports scheduled to be published in the next few days:

- On Thursday, we’ll see published July’s S&P Global Services PMI and ISM Services PMI.

- On Friday, there will be an avalanche of labor market reports, including July’s Nonfarm Payrolls, Unemployment Rate, Average Hourly Earnings, and Average Weekly Hours.

- On Monday, we’ll see the data on June’s Consumer Credit Change.

As for the stock calendar, the Q2 2023 earnings season for Smart Investor Portfolio companies is powering ahead with earnings reports coming in today from Occidental Petroleum (OXY), CDW (CDW), Perion Network (PERI), Alamo Group (ALG), and Albemarle (ALB). In the next few days, we’ll receive earnings reports from Wesco International (WCC), Infineon Technologies AG (DE:IFX), Air Products and Chemicals (APD), and Cigna (CI).

The ex-dividend date for Lamb Weston Holdings (LW) is August 3rd.

Today, we’re letting go of a stock from a profitable company, whose growth has slowed while its debts have sharply risen, and solvency has worsened. In its place, we’re adding an innovation leader from the biotechnology space, whose stellar fundamentals and brisk growth support a bright long-term outlook.

New Deletion: Bruker Corporation (BRKR)

Bruker Corporation engages in the development, manufacture, and distribution of scientific instruments, and analytical and diagnostic solutions that enable customers to explore life and materials at microscopic, molecular, and cellular levels. The company offers DNA test strips, genotype molecular diagnostics kits, testing kits for the diagnosis of COVID-19 infection, and life science tools, as well as research, analytical, and process analysis instruments and solutions. It also provides a range of analytical and bioanalytical detection systems and related products, as well as several additional medical devices and instruments.

With a market capitalization of $10.3 billion, Bruker is a large-cap company, bordering on mid-cap. It belongs to the Healthcare sector (Industry: Medical Devices).

Bruker Corporation could tick the box for good financial health, if it didn’t have a large and rising debt burden, coupled with declining liquidity. In the past five years, its debt-to-equity ratio has increased from 28% to 101%. BRKR’s debt is well-covered by operating cash flow and its interest payments are well-covered by EBIT. However, Bruker’s interest coverage ratio has been steadily worsening in the past three years. The company’s low and declining cash ratio underscores weakening liquidity. In addition, while Bruker is a profitable company with respectable margins, its earnings growth has been slowing in the past several quarters, and its cash has been in decline.

Another weak point for Bruker is that majority of its revenues are originated abroad, which makes it more exposed to currency fluctuations, as well as to different economic cycle stages in various markets, affecting the demand for its products and impacting the stability of its earnings.

All in all, Bruker is a valuable business that is growing in line with the Healthcare sector averages. However, the company’s stock reflects much higher growth expectations than the company can deliver. On the TTM P/E metric, the company is about 15% more expensive than its industry’s average; BRKR is also trading way above its fair value. The stock continues to be overvalued even after it has fallen by 15% from its peak in April 2023. This decline has led to its strong underperformance year-to-date versus its industry, as represented by iShares US Medical Devices ETF (IHI), as BRKR is up only 2.5% compared to the fund’s 10%. Bruker’s recent underperformance comes in stark contrast to the stock’s history, as in the past three years it has risen three times as much as the fund.

The high valuation, coupled with the underperformance, have led hedge funds as well as individual investors to sell the stock. In addition, insiders from the company have also disclosed some selling in recent months. These factors, combined with some fundamental red flags, weighed on Bruker’s Smart Score at TipRanks, which has tumbled to 3/10 (“Underperform”). Taking all this into account, we don’t see a compelling reason to continue holding the stock.

Bruker’s removal from the portfolio will make room for the company we are adding this week, VRTX.

New Addition: Vertex Pharmaceuticals (VRTX)

Vertex Pharmaceuticals, Inc. is a global biotechnology company engaged in the development and commercializing therapies for the treatment of cystic fibrosis, infectious diseases including viral infections such as influenza, bacterial infections, autoimmune diseases such as rheumatoid arthritis, cancer, inflammatory bowel disease, and neurological disorders including pain and multiple sclerosis.

Vertex markets its products to specialty pharmacy and specialty distributors in the United States, as well as retail pharmacies or pharmacy chains, hospitals, and clinics. The company has numerous collaborations with the most innovative companies, including CRISPR Therapeutics (CRSP), Moderna (MRNA), ImmunoGen (IMGN), Kymera Therapeutics (KYMR), Verve Therapeutics (VERV), and others.

Vertex was incorporated in 1989, as stated by its founders, to “transform the way serious diseases are treated.” By 2004, its product pipeline focused on viral infections, inflammatory and autoimmune disorders, and cancer. The company’s first cystic fibrosis drug came out in 2012. Vertex was one of the first biotech firms to use an explicit strategy of rational drug design rather than combinatorial chemistry; the company has made a number of breakthroughs in the treatment of serious diseases, such as incorporating genetic therapies.

Today, Vertex Pharmaceuticals, Inc. is a large-cap Fortune 500 company, commanding a market capitalization of over $90 billion. With $8.93 billion in annual revenue in 2022, it ranks #5 in the global list of the largest biotechnology companies in the world. It has more than 5,000 employees in its U.S. headquarters in Boston, international headquarters is in London, and other locations in the United States, Europe, Canada, Australia and Latin America. Vertex belongs to the Healthcare sector (Industry: Biotechnology).

Vertex has acquired seven companies, with the latest of them being ViaCyte, a preclinical therapeutic company specializing in regenerative medicine therapies for diabetes, which Vertex acquired in July 2022 for $235 million. The company has also expanded its therapy range by acquiring specific products and whole research pipelines. In addition, it joins forces with other companies to pursue its development and production goals. For instance, in June 2023, Vertex has cooperated with Lonza Group (LZAGY) to build a dedicated manufacturing Facility for Type-1 Diabetes cell therapies.

Vertex is focused on discovering, developing and bringing innovative medicines helping fight serious diseases. It is mostly known for its cystic fibrosis (CF), a life-threatening genetic disease. In this niche, Vertex is a monopoly, as currently there are no approved drugs that treat the underlying cause of cystic fibrosis aside from the ones discovered, developed, and sold by Vertex. The company has developed Trikafta, the only FDA-approved drug that has proven effective in combating CF. Since its approval in 2019, Trikafta has been Vertex’s “cash cow.” Trikafta won’t run into a patent cliff until 2037; however, the company doesn’t rest on its laurels, but has a number of next-generation CF drugs in different stages of research development.

The company is a serial innovator: its research and & development outlays represent over 70% of its operating expenses; about 60% of its workforce is dedicated to R&D. The heavy investment is paying off already and is expected to be even more profitable in the years to come. Vertex doesn’t concentrate on one disease treatment but has multiple lines of drugs under its belt. It has used its increased cash flow to fund R&D for treatments for a number of diseases and conditions, such as sickle cell disease, APOL1-mediated kidney disease, Type 1 diabetes, etc.

In sickle cell disease treatment development, Vertex has collaborated with CRISPR Therapeutics to develop Exa-cel, a potential one-time treatment, that is currently awaiting regulatory approval. When released, Exa-cel will become the world’s first CRISPR gene-editing therapy, which should become Vertex’s next product to generate multibillion-dollar sales.

Vertex is also testing a promising non-opioid pain drug, which can help millions of people with acute or chronic pain. The company is performing a clinical study of a treatment for APOL1-mediated kidney disease; currently, there is no approved drug for the disease. Moreover, Vertex has three programs focused on curing type-1 diabetes, with one of them featuring innovative approach developed in collaboration with CRISPR Therapeutics.

Vertex Pharmaceuticals’ financial health is more than stellar. It has zero debt, and cash and short-term investments of $11.5 billion. The company’s capital efficiency and profitability metrics are outstanding. Its Return on Equity (ROE) of 25.7% Return on Assets (ROA) of 17.2% are much higher than average for its industry. Vertex boasts an operating margin of 44% and a net profit margin of 35.4%, leaving its peers far behind in these metrics and indicating outstanding operational efficiency.

The company’s revenues have been growing at an average annual rate of 26% in the past five years, while earnings have increased by 23% annually. Over the same period, Vertex has grown its earnings-per-share by 30% per annum on average. In Q1 2023, the company surpassed analysts’ EPS estimates, as it did in all quarters in its public-company history, with two single exceptions. Although the bottom line declined due to a one-time milestone payment, sales surged by over 13% year-on-year, supporting the thesis of further strong expansion. The company’s financial results demonstrate profitable growth, driven by the success of its CF blockbuster drug, Trikafta. With the patent cliff on that “cash cow” not in sight and given that the company has multiple new products in development (with one of them expected to receive FDA approval by the end of the year), the company’s fast earnings growth is expected to continue over the long term.

Vertex views itself first and foremost as a research and development company. As such, it prioritizes investing in R&D over paying out dividends. However, the company does return capital to its shareholders through stock buyback programs. Thus, in February 2023, Vertex’s board approved a new $3 billion share repurchase program.

With stellar financial metrics and bright growth outlook, it’s no wonder that Vertex’ stock has displayed a market-beating performance. In the past three years, VRTX rose by 27%, while its industry – as represented by the iShares Biotechnology ETF (IBB) – fell by 6%. Year-to-date, Vertex’ stock surged by 23%, while IBB has lost 1%. This outstanding performance has, of course, lifted VRTX valuation above its peer averages, but not above the averages for the Healthcare sector. Vertex is trading at a TTM P/E of 28.5 and a Forward P/E of 27.3, slightly cheaper than averages for the sector. While the company looks expensive versus its peers, it must be noted that not many of them can compare to Vertex in terms of growth and profitability, and those that come close to its performance are much more expensive (such as, for instance, Eli Lilly, LLY with its P/E of 74.2). Vertex’ stock reached its all-time high on July 20th and has given back some gains since then on profit taking; the recent small decline should provide a more comfortable entry point for investors.

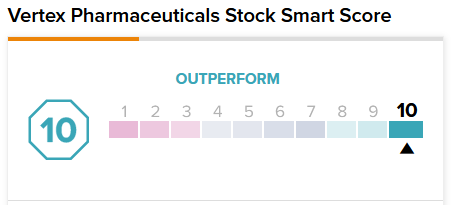

After a two-year long rally, analysts see a smaller upside for the stock in the next 12 month, with the average upside currently at 7.1%. While given the company’s high valuation metrics, the stock price may even stagnate in the near term, we believe that in the long term, the stock will outperform. Hedge funds as well as individual investors are very positive toward the company and have been increasing their holdings in recent months. Vertex Pharmaceuticals carries a “Perfect 10” Smart Score rating on TipRanks with a “Moderate Buy” recommendation:

To conclude, we believe that Vertex is poised for continued robust revenue and earnings growth, supporting outstanding profit margins. The company’s commitment to innovation has driven impressive results, which we expect to see also further down the road, as current treatments produce high margins, while the robust pipeline underlines significant potential. With its prudent management and strong business model, we view Vertex Pharmaceuticals as a compelling long-term investment and a valuable addition to the Smart Investor portfolio.

What’s Next?

Our next commentary will come out on Wednesday, August 9, before the market opens.

Until then – we wish you a world of investment success!

Access the full Smart Investor Archive, including all historical stock picks and original newsletters.

Disclaimer

The information contained in this article represents the views and opinions of the writer only, and not the views or opinions of TipRanks or its affiliates and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices, or performance.