Weekly Newsletter

A weekly email with an inside scoop on high-quality Dividend stocks.

Stock Research

See the reasons behind every stock recommendation, based on TipRanks’ data.

Leverage the potential of dividends to outperform the market and generate a consistent stream of passive income throughout your life.

By subscribing to TipRanks’ Smart Dividend Newsletter, you can reach your financial objectives.

The Best of TipRanks Technology and Data. Simplified.

A weekly email with an inside scoop on high-quality Dividend stocks.

See the reasons behind every stock recommendation, based on TipRanks’ data.

TipRanks Smart Dividends Newsletter is sent weekly – every Monday at 8 AM EST.

As an investor, you know the importance of having reliable information and insights when making decisions. That’s why every newsletter provides you with the following:

The purpose of the newsletter is to simplify income investing and help investors achieve their financial goals by leveraging TipRanks’ extensive knowledge.

By analyzing the data on tens of thousands of stocks and filtering for quality and dividend consistency, we provide a BUY recommendation in each weekly Newsletter.

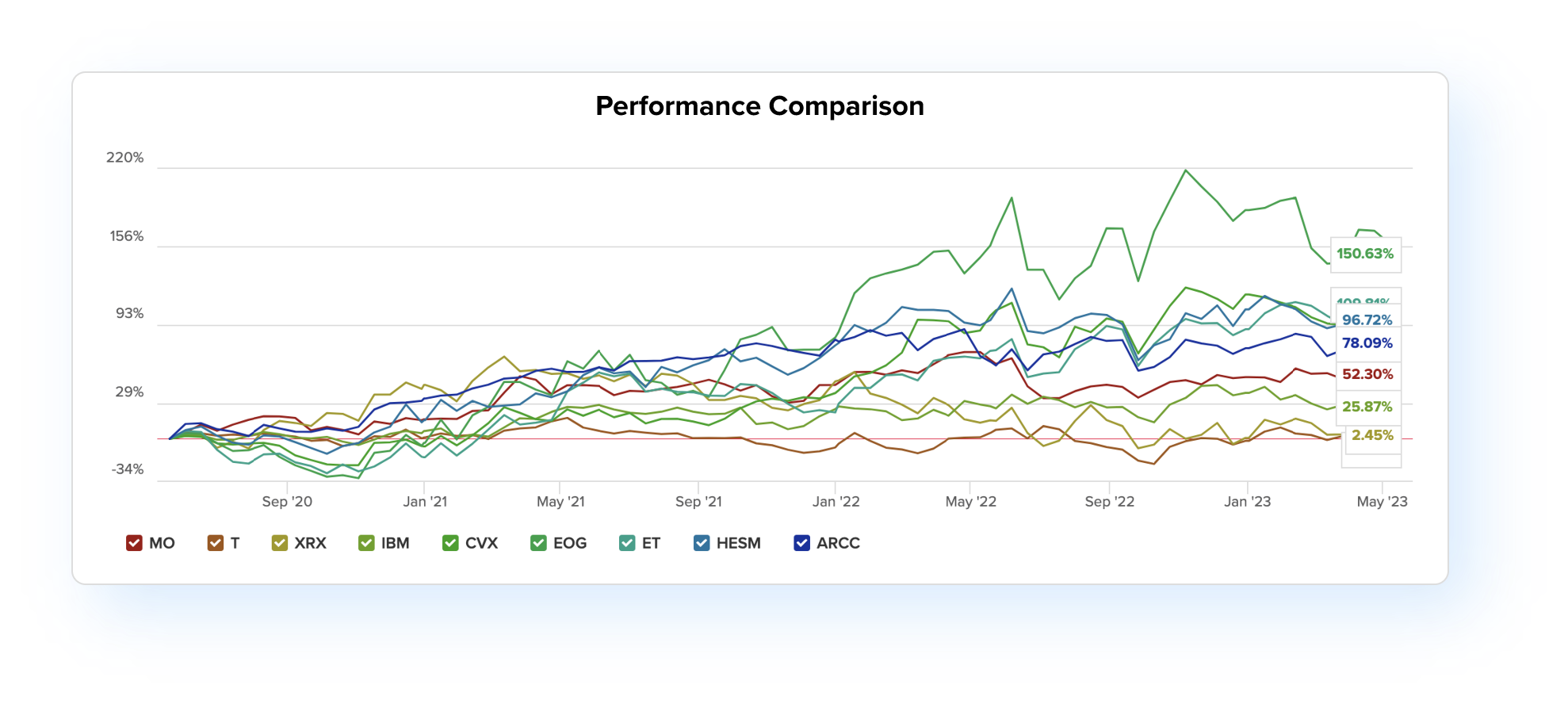

With the help of the Smart Dividend Newsletter, you can enjoy a steady income stream, less volatility than the broad market, and a total return that is superior to the S&P 500.

Our team handpicks stocks for a long-term, market-beating income portfolio based on our research and access to TipRanks’ vast data reserves, leaving you to sit back and enjoy the benefits of these top-quality stocks.

Sign up for Smart Dividend Newsletter today!

Dividend stocks can fit into any portfolio. For those seeking income, dividend stocks can provide a steady stream of cash, which can be used for personal needs or reinvested for compounding returns. For growth investors, dividend stocks can increase your portfolio’s diversification and decrease its volatility.

Buying established companies with a history of good dividends adds stability to a portfolio, helps cushion declines in the actual stock prices, and presents an opportunity for stock price appreciation, coupled with a steady stream of income from dividends.

Dividends are an important part of the total return for investors, as they have contributed an average of 32% of the S&P 500’s returns since 1926. Moreover, over the long-term investment period, dividend-paying companies in the S&P 500 index have outperformed the non-payers of dividends and the overall broad market on a risk-adjusted basis.

So, if your strategy is focused on stocks for the medium- to long-term investment period, you need to have Smart Dividend stocks in your portfolio.

TipRanks’ Smart Dividend Newsletter is a weekly subscription e-mail. Every week, we will recommend a dividend-paying stock, which in our view can become a staple in your investment portfolio. We will outline the factors that led us to choose the stock, and update you on any economic, financial and market developments affecting your portfolio.

We consistently strive to find you the best of all worlds: robust companies with stable growth prospects, sound management, and expected stock outperformance, providing steady and growing dividend income.

Our analysis starts with the Smart Score, which is a proprietary quantitative stock scoring system created by TipRanks (https://www.tipranks.com/glossary/s/smart-score). We then run the best stocks through TipRanks’ unique dividend selection machine (https://www.tipranks.com/compare-stocks/dividend-stocks).

The recommended stocks will be chosen according to a strict set of criteria, including macro & sector outlook, past performance versus peers, a high but sustainable dividend yield, a healthy payout ratio, a history of stable and growing dividends, and, of course, various metrics of the companies’ financial health as well as their competitive position and business outlook. We also factor the stocks’ relative valuation into our analysis, as competitively priced stocks often have more room for upside, increasing the total return in the long haul.