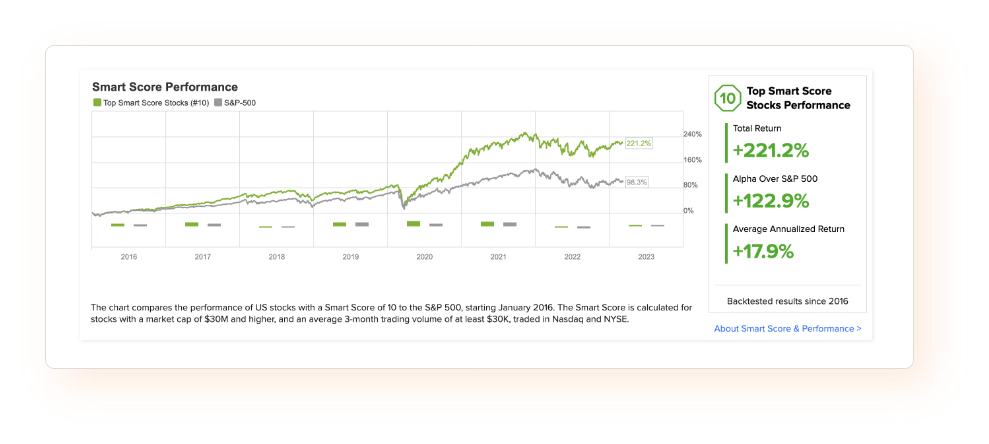

We believe that the path to long-term financial success is best described by the classic fable of the tortoise and the hare, where the moral of the story is “slow and steady wins the race” The Smart Investor service doesn’t promise a path to overnight riches but helps you build a portfolio of stocks with strong long-term upside potential and lower than average volatility. What that means for the Smart Investor is that we are using data and stock selection methods that give an edge to the investor. That edge may not be apparent in every single stock every single month, but these proven methods will show their benefit over time (as demonstrated by the long-term outperformance of our Smart Score algorithm over the market).

We believe that the path to long-term financial success is best described by the classic fable of the tortoise and the hare, where the moral of the story is “slow and steady wins the race”. The Smart Investor service doesn’t promise a path to overnight riches but helps you build a portfolio of stocks with strong long-term upside potential and lower than average volatility.

What that means for the Smart Investor is that we are using data and stock selection methods that give an edge to the investor. That edge may not be apparent in every single stock every single month, but these proven methods will show their benefit over time (as demonstrated by the long-term outperformance of our Smart Score algorithm over the market).