TipRanks Smart Dividend Newsletter – Edition #18

Hello and welcome to the 18th edition of TipRanks’ Smart Dividend – a weekly Newsletter providing you with investment ideas for safe-bet quality stocks that are outstanding dividend payers, compared to their peers.

Today’s dividend stock recommendation is one of the world’s largest snack brands, offering the most recognizable and loved brands in the world. Its strong market share and successful delivery make it one of the most compelling investments in the consumer staples sector.

But first, let us present a brief investment thesis, supporting our recommendation.

Investment Thesis: Sweet Life

In an ever-changing world we live in, there remains a steadfast reliance on the fundamentals of daily life – the products we consume. The companies operating in the realm of consumer staples have positioned themselves at the heart of our daily routines, providing us with essential goods that are as timeless as they are vital.

To thrive, a business must do more than merely meet demand; it must anticipate it. The industry leaders, one of which we discuss in this article, have mastered the art of staying ahead of the curve. They not only provide products that meet the needs of today’s consumers but also forecast the trajectory of these markets.

In addition to their ability to navigate changing consumer preferences, it’s worth noting that companies within the consumer staples sector have a history of stability and financial strength. This often translates into reliable dividend payments, a hallmark of the sector. Investors are drawn to consumer staples not only for the essentials they provide but also for the dependable income stream they offer through consistent dividend distributions. These dividends underscore the enduring appeal of consumer staples as a defensive and income-oriented investment choice.

Quality Dividend Stock: This Week’s Top Pick

Mondelez International, Inc. (MDLZ) is an American multinational confectionery, food, beverage and snack food company based in Chicago, IL. It is best known for its iconic global brands such as Oreo, Cadbury, Milka, Toblerone, Sour Patch Kids, Trident, and many more.

Mondelez is ranked in the Fortune 500 and a Fortune Global 500 lists of the largest companies in the U.S. and in the world. With a market capitalization of $97.5 billion, global net revenues of $31.5 billion, and a workforce of 91,000 in more than 80 countries, MDLZ is one of the largest snack companies in the world. It belongs to the Consumer Staples sector (Industry: Food Products).

Mondelez International originated from the splitting of Kraft Foods Inc., which was founded in 1923, into two separate entities. In 2012, Kraft Foods spun off its North American grocery business to a new entity called Kraft Foods Group, Inc., which merged with Heinz in 2015, forming Kraft Heinz Company (KHC). Kraft Foods Inc.’s snack food business was renamed Mondelez International and was refocused as an international snack and confection company.

The newly-formed Mondelez continued its legal predecessor’s growth strategy, expanding its business through acquisitions and partnerships. In the past five years, the company has made nine acquisitions, the latest of them being the purchase of Chipita, a major European supplier of packaged cakes and pastries, finalized in 2023. Earlier, in 2022, Mondelez finalized the buyout of Clif Bar, which helped widen the company’s presence in the fast-growing snack bar market. Last year, MDLZ also purchased Ricolino, Mexico’s leading confectionery company; the buyout is expected to double the size of its Mexico business.

Mondelez has positioned itself as a global leader in the snack industry, with about 35% market share in the global confectionary market. The company holds a #1 position in the global biscuits (cookies and crackers) market, #2 in chocolate, and #3 in the fast-growing markets for pastries and snack bars. In different geographies and sub-markets, the company holds even larger market shares: it is the market leader in biscuits & energy bars in the U.S., in chocolate in the U.K. and India, in biscuits in China, and in biscuits, cakes & pastries in the EU.

Mondelez’s business is highly diversified in terms of product types, brands, and geographies. Its largest and fastest-growing market is the global Emerging Markets. The developing countries are responsible for 39% of total revenues, which have shown growth of 11% year over year in 2022. Within this segment, Latin America is the most promising, with over 14% growth in revenues in 2022. The second-largest market is Europe, responsible for over 35% of total net revenue and year-on-year growth of 4.5%; North America accounts for the rest of the revenue pile, growing by 5.5% year over year.

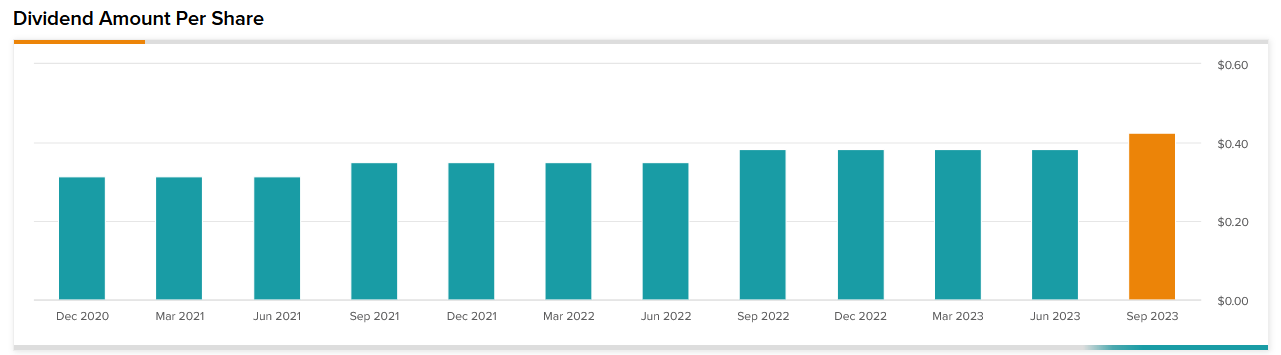

The Consumer Staples sector is known for its prevalence of dividend-paying companies, supporting relatively high dividend yields. Mondelez is not an exception: it has been paying and increasing dividends since its formation in 2012. Its yield of 2.2% is only slightly higher than the average for the sector. However, the company’s capital allocation strategy, in place since 2018, foresees further strong acceleration in dividend payout growth. MDLZ’s dividend-per-share increased at a CAGR of 12% in the past five years and the company plans to continue raising the payout at a pace surpassing its EPS growth. The latest dividend hike was in July, when the payout rose by 13%. Mondelez’s payout ratio is a moderate 49% and is well-covered by earnings and cash flows.

In addition to dividends, MDLZ performs share repurchases, with a new $6 billion, four-year program approved in January 2023. While investment in organic growth and acquisitions remains the company’s biggest capital allocation priority, it performs opportunistic buybacks, depending upon prevailing market conditions and other factors. In the years 2018-2022 the company purchased its shares for the total amount of $9 billion.

The global snack powerhouse is well-positioned to continue strongly increasing its total shareholder return, supported by its strong finances and high profitability. The company’s financial health is robust, notwithstanding the fact that strong expansion comes at the cost of higher debt loads. While MDLZ has reduced its debt in the past years, its net debt-to-equity ratio is still quite high, at 66%. However, the cost of serving that debt is modest, given that credit agencies rate Mondelez “BBB,” reflecting its very low risk.

Moreover, Mondelez’s profitability and capital efficiency metrics compare well with its peers. Its Return on Assets (ROA) of 6.5% is in line with the average for the industry, while its Return on Equity (ROE) of 15% is much higher than the average. The company’s operating margin of 16.5%, net profit margin of 12.2%, and FCF margin of 8.5% are much higher than its sector’s median metrics.

MDLZ has been growing revenues at a CAGR of 5.3% in the past five years, while EPS rose at a CAGR of 8.4%. In the past two years, the company’s revenue and earnings growth significantly accelerated, driven by its vast market share, translating into strong pricing power, as well as by its geographical and business expansion. These factors support Mondelez’s accelerated profitability despite the volatility in input prices (cocoa, sugar, etc.).

In Q2 2023 the company’s EPS and revenues exceeded analyst expectations for a sixth consecutive quarter. Net revenue rose by 16% year-on-year, and EPS increased by 28%. In the first half of 2023, in total, revenues grew by 17.5% year over year, operating income increased by 23%, and EPS surged by a stunning 91.3%. These strong results come on the back of the continued successful application of the company’s long-term strategy, competitive market position, and market-beating brand portfolio.

Following the first half-year results, Mondelez’s management has lifted their outlook for the full-year 2023. Although the rising prices of cocoa and sugar are a significant threat to all food and beverage producers, Mondelez’s is well-positioned to sustain margins through increased efficiency and pricing. In addition, while companies selling consumer staples tend to do well during economic downturns, packaged food suppliers usually do even better. As consumers feel the pinch, foregoing eating out and other expensive choices, snacks see a rise in demand as an affordable “feel-good” substitute.

Taking into account robust finances, sturdy earnings growth, strong market position, and an optimistic outlook, it’s of no surprise that Mondelez’s stock has been outperforming its sector and, at times, the broad market. In the past three years, MDLZ rose 26%, almost on par with the S&P 500’s (SPX) 30%, and versus Consumer Staples Select Sector SPDR Fund’s (XLP) 11%. Furthermore, in the past 12 months, the company’s stock added over 19%, compared to XLP’s zero change and SPX’s 15% increase.

As a result of this outperformance, MDLZ is now trading on the more expensive side of the consumer staples’ range. Its TTM P/E of 23.8 and Forward P/E of 20 represent 14% and 5% premium to the sector’s average. However, these valuations still may be a bargain compared to the company’s financials, growth, and outlook. Apparently, institutional investors view it as such since hedge funds have been increasing their exposure to the stock by hundreds of percent in recent months. MDLZ has also seen a strong rise in individual investors’ interest.

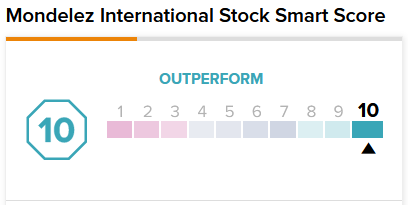

TipRanks’-scored top Wall Street analysts see an average upside of 14.5% for the stock in the next 12 months. MDLZ has a TipRanks’ Smart Score rating of “Perfect 10” with a “Moderate Buy” recommendation:

In conclusion, we believe that Mondelez, which offers some of the most recognizable and loved brands in the world, is well-positioned to thrive in good and bad economic times, safeguarding investment portfolios against economic downturns and inflation. MDLZ’s leading market position and pricing power, as well as its strong finances and earnings growth, support its strategy of raising dividends and increasing total shareholder compensation. That makes it a compelling income investment stock and a valuable addition to any long-term investment portfolio.

Disclaimer

The information contained in this article represents the views and opinions of the writer only, and not the views or opinions of TipRanks or its affiliates and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment, and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices, or performance.