The Ion Surge

The heart of modern technology is encapsulated in a tiny chip: the semiconductor, which powers everything from our daily-use smartphones to high-end supercomputers.

Building chips is a knowledge- and technology-intensive process, which includes several critical stages. One of these bedrock processes is ion implantation, a crucial step in creating essential components like transistors and diodes. As the demand for sophisticated semiconductors, primarily in burgeoning sectors like electric vehicle electronics and artificial intelligence memory chips, surges, this market segment is poised for substantial growth.

To be able to succeed in this demanding market, its players need technical capabilities, but also high operational efficiency, robust management, and astute financial health.

Today, we are adding one such business to our Smart Investor holdings. This company manages to strike a balance between cutting-edge innovation, a high growth trajectory, and fiscal responsibility. But first, let us delve into a short update on the economy and markets, and the Smart Investor calendar.

Economy and Markets: Looking Forward

There are several important reports scheduled to be published in the next few days:

- Later today, we will receive the Federal Reserve’s interest rate decision following the policymakers’ meeting. The Fed’s policy rate is widely expected to stay unchanged this time. Market participants will focus on the central bank’s economic projections, as these could shed some light on the Fed’s further moves.

- On Thursday, we will receive the final reading of Q2 2023 GDP Growth Annualized. After an initial estimate that came in below expectations and a subsequent upward revision in the second reading, this final reading will confirm the actual growth rate of the U.S. economy for the second quarter. This data not only provides insight into past economic growth but also offers clues about near-term trends. The Federal Reserve will certainly factor in this data when formulating its interest rate policy.

- On Friday, we will get the report on August’s Core Personal Consumption Expenditures. Published by the Bureau of Economic Analysis, this report details consumer spending during the specified period. The Core PCE Index is the Federal Reserve’s principal gauge for inflation and serves as the benchmark for its inflation-targeting strategies. Consequently, it ranks among the most pivotal reports influencing the Fed’s policy decisions.

- Also on Friday, we will receive some insight into the consumer sentiment via September’s Michigan Consumer Sentiment Index. This report includes consumers’ confidence in the health of the economy and their outlook for longer-term economic conditions. The higher the level of trust consumers have in the strength of the economy, the higher their spending, which is an important part of overall GDP (Gross Domestic Product) growth.

- On Monday, we will receive the report on September’s ISM Manufacturing PMI. The report, released by the Institute for Supply Management, shows business conditions in the U.S. manufacturing sector. It is a significant indicator of the overall economic conditions. PMIs are considered to be one of the most reliable leading indicators for assessing the state of the U.S. economy, helping analysts and economists to correctly anticipate changing economic trends.

As for the stock calendar, the Q2 2023 earnings season for Smart Investor Portfolio companies is almost finished, but there are still incoming reports from firms whose fiscal year is shaped differently. Companies whose earnings are scheduled to be published this week are Jabil (JBL) and Accenture (ACN).

The ex-dividend date for Air Products and Chemicals (APD) is on September 29th.

Today, we are adding a stock of a market leader in one of the crucial stages of the semiconductor fabrication process. The company we are adding has been growing earnings at an awe-inspiring pace, and its long-term prospects are outstanding, despite the volatility of its industry.

To make room for this valuable addition, we are letting go of the stock of one of the largest oil producers in the U.S., whose stock is expected to continue to be weighed down by its lack of earnings growth.

New Addition: Axcelis Technologies (ACLS)

Axcelis Technologies, Inc. designs, manufactures and services ion implantation equipment used in the fabrication of semiconductor chips. The company offers high current, high energy, and medium-current ion implanters for various applications in distinct market segments worldwide.

Axcelis was founded in 1978 under the name “Nova Associates” with the goal of producing the world’s first high current production implantation system. It was acquired by Eaton Corporation and acted as its Semiconductor Equipment Division until it was spun off as an independent company, Axcelis Technologies, in 2000. In July of the same year, the company’s shares were listed on NASDAQ.

Ion implantation is one of the principal steps in the process of the fabrication of transistors, diodes, resistors and capacitors, among other components on semiconductor chips. Thus, ion implanters are crucial to producers of all kinds of chips, from processors (CPUs) to memory (DRAM) chips, to storage (NAND) chips.

According to research, the global ion implantation market is expected to expand from its current size of about $3 billion in 2022 at a CAGR of 10%-15% in the next five years, driven by the rising and sustained demand for semiconductors. The ion implantation market is more fragmented than could be expected of a high entry-cost market, with a few large-size firms like Applied Materials (AMAT), Sumitomo Heavy Industries (SOHVF), and several mid-size players competing for various niches. However, over 90% of the total ion implanter market share is concentrated within two companies, Applied Materials with around 60% and Axcelis with over 30%. Moreover, thanks to ACLS’ sole concentration on ion implanters and the widest product portfolio among competitors in the sphere, the company is poised to continue its rapid growth, winning over more market share from AMAT.

ACLS is headquartered in Beverly, MA, with principal locations in other US locations, as well as in Germany, Italy, Japan, Korea, Taiwan, China, and Malaysia. It has a market capitalization of $5.2 billion and a workforce of 1,500 employees. In 2022, Axcelis was included in the Fortune Fasted Growing Companies list.

The company derives 68% of its revenues from the U.S., 26% from Asia Pacific (its fastest-growing market), and the rest from Europe. ACLS’ customers include all of the 20 largest semiconductor manufacturers in the world, including Samsung Electronics (SMSN), Intel (INTC), Taiwan Semiconductor (TSM), Texas Instruments (TXN), Advanced Micro Devices (AMD), Nvidia (NVDA), and ASML Holdings (ASML), among others. Since no individual customer accounts for greater than 10% of revenue, Axcelis’ concentration risks are limited.

As a prominent player in the semiconductor industry, Axcelis is well-positioned to benefit from the increasing demand for high-end semiconductors, specifically in the two fastest-growing end-markets: electric vehicle (EVs) electronics and artificial intelligence (AI) memory chips. Axcelis has a very high exposure to the silicon-carbide semiconductor (SiC) market, which is expected to grow at a CAGR of 30%-35% in the next several years due to the necessity of SiCs in EV production. ACLS holds a market share of approximately 75% in the SiC ion implantation equipment niche. In addition, with artificial intelligence technology rapidly gaining traction, the demand for AI chips is expected to benefit those providing equipment for their production, such as Axcelis.

Axcelis’ financial health is no less than perfect. It has zero debt; its quick ratio of 2.6 and a current ratio of 3.8 points at a very high liquidity position. ACLS’s outstanding operational efficiency and solid execution are underscored by its industry-beating operating margin of 23%. Axcelis’ stellar profitability is reflected in its gross margin of 43% and net profit margin of 20%, which are much higher than the average in its industry.

The company’s outstanding financial performance is exhibited through its Return on Equity (ROE) of 30.3% and a Return on Assets (ROA) of 20.2%, much higher than the sector’s averages. The company features an industry-beating Return on Invested Capital (ROIC) of 38%.

Moreover, Axcelis’ revenues rose at a CAGR of 35% in the past three years, while EPS grew at a CAGR of 82% over the same period. While three-year EPS growth was strongly driven up by post-pandemic rebound in semiconductor industry, the company has continuously displayed strong earnings results over the years. ACLS has registered double- or triple-digit year-on-year EPS growth in all quarterly reports since 2020 (apart from two post-lockdown quarters with over 1,500% growth).

Axcelis has surpassed analysts’ revenue and earnings projections in all quarterly reports without exception. In Q2 2023, its revenues rose 24% year-over-year, while net income surged by 39% and EPS – by 41%. On the back of these outstanding results, the company has lifted its full-year 2023 outlook for revenue, which is now expected to increase by 20% from 2022. It must be said that Axcelis’ revenues display a high degree of visibility, since the company is now taking orders for the year 2025, as the 2024 capacity is already sold out. According to the company’s management, the lion share of revenue growth is expected to continue to be attributed to SiC power device market, driven by the global shift to electric vehicles; however, the company is registering solid growth in the AI sphere, with expanding demand from memory chip producers.

Axcelis’ exceptional earnings growth and well-founded optimism regarding its outlook have been reflected in the stock’s outperformance. ACLS’s stock has brough its investors an outsized gain of 626% in the past three years; in the past 12 months, the stock has risen by 174%. These gains include a 22% drop from ACLS’s all-time high in July, as the company’s shares were recently weighed down by the weakness in semiconductor stocks, a decline in general market sentiment, and some profit taking.

As a result of the recent weakness, Axcelis’ stock valuations have come down, presenting a buying opportunity. The stock is now trading at a TTM P/E of 25.4, in line with the IT sector average, and a Forward P/E of 22.4, representing about an 11% discount to the sector. The company is trading in line with the average for its peers in the industry, and below its historical price-to-earnings and its fair value.

While Axcelis doesn’t pay dividends, it rewards its shareholders through share repurchases, made on an opportunistic basis. From 2019 through the second quarter of this year, the company has returned over $157 million of cash to shareholders via stock repurchases, with ~$25 million spent on buybacks in the first half of 2023 alone. In September this year, Axcelis’ Board of Directors authorized additional funding of $200 million for its share repurchase program to be funded from available working capital.

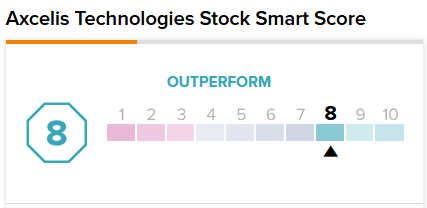

TipRanks-scored top analysts foresee an average upside of 35.7% for the stock in the next 12 months. Axcelis carries an 8/10 “Outperform” Smart Score rating on TipRanks with a “Strong Buy” recommendation:

To conclude, we view Axcelis as a winning combination of quality and growth. Its stellar finances, outstanding earnings growth, revenue visibility, solid execution on strategy, and bright outlook, make it a valuable addition to the Smart Investor portfolio.

New Deletion: Occidental Petroleum (OXY)

Occidental Petroleum is one of the largest oil and gas producers in the United States. It operates through the following segments: Oil and Gas, Chemical, and Midstream and Marketing. The Oil and Gas segment explores for, develops and produces oil and condensate, natural gas liquids and natural gas. The Chemical segment manufactures and markets basic chemicals and vinyl. The Midstream and Marketing segment purchases, markets, gathers, processes, transports and stores oil, condensate, natural gas liquids, natural gas, carbon dioxide, and power.

OXY is a Fortune 500 company with a market capitalization of $56 billion and a workforce exceeding 11,600 employees. It is also one of Warren Buffet’s favorite stocks: his Berkshire Hathaway (BRK.B) holds a 25% stake in Occidental. While we hold Buffett’s investment acumen in high esteem, we recognize that the strategies of Smart Investor don’t always align with those of the legendary investor. Buffett often mentions that his “favorite holding period is forever.” However, we contend that for most individual investors, “long term” is typically perceived as no longer than five, and at most ten, years. Keeping this perspective, our analysis places greater emphasis on the stock’s projected performance over the next 12 months compared to the Oracle of Omaha’s approach.

OXY’s recent financial performance was underwhelming. The company has missed analysts’ EPS estimates in the last four quarters. In Q1 and Q2 of 2023, earnings-per-share registered double-digit declines versus the same periods of last year. In Q2 2023, EPS tumbled by almost 80% year-on-year, despite the strong increase in crude oil prices in the second half of the quarter.

Despite its elevated debt ratios, Occidental is a financially healthy company overall, displaying robust capital efficiency metrics and healthy margins. However, its lack of earnings growth has led to its stock underperformance, which would be even worse if not for Buffett’s support (Berkshire has performed several additional purchases of the stock every time it has dipped in the past years).

In the past three years OXY’s stock surged by 516%, strongly outperforming the general market as well as the Energy Select Sector SPDR Fund’s (XLE), which rose 197%. However, the stock has displayed significant weakness since the end of 2022, when its earnings performance began to deteriorate. In the past 12 months, OXY’s stock has risen by 9%, versus XLE’s gain of 30%.

In the longer term, OXY’s earnings growth should improve on the back of its recent actions to diversify its revenue streams, such as a ten-year agreement with Amazon (AMZN) to partner in carbon removal from atmosphere. However, in the next one to two years, Occidental’s revenues and EPS are expected to continue declining, which will weigh on the stock performance. Therefore, we find it prudent to sell the stock at this point.

Charter Members of the 30% Winners Club

*The 30% Winners Club includes stocks from the Smart Investor Portfolio that have risen at least 30% since their purchase dates.

Alas, the exclusive club’s ranks have significantly shrunk following the brutal week for stock market indexes, and specifically for technology stocks. After ORCL, AVGO, and CDW fell back below the 30% threshold, the Winners Club now includes only two stocks, GE and TECK (they have also registered wide losses, but are still well above the threshold thanks to their previous strong gains).

The stocks that have fallen from grace are now the closest contenders for a comeback: AVGO with 29.4% gain from purchase, ORCL with 28.7%, and CDW with 26.7%. Will they be able to close these narrow gaps, or will someone else outrun them to the finish line?

What’s Next?

Our next commentary will come out on Wednesday, October 4th, before the market opens.

Until then – we wish you a world of investment success!

Access the full Smart Investor Archive, including all historical stock picks and original newsletters.

Portfolio Changes

|

Disclaimer

The information contained in this article represents the views and opinions of the writer only, and not the views or opinions of TipRanks or its affiliates and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices, or performance.