TipRanks Smart Dividend Newsletter – Edition #27

Hello and welcome to the 27th edition of TipRanks’ Smart Dividend – a weekly Newsletter providing you with investment ideas for safe-bet quality stocks that are outstanding dividend payers, compared to their peers.

Today’s dividend stock recommendation is a global leader in the consumer cybersecurity space, which pays an exceptionally high dividend compared to its industry.

Investment Thesis: Valuable Security

Thepast decade, with its rapid digitalization of all human activities, spurred a strong acceleration of cyber threats; now everyone and everything – from your bank to your doctor’s office, to your IoT devices, to your EV car – can become a target. However, we are not left alone in this battle: a myriad of companies are striving to protect us from digital threats.

The global cost of cybercrime was estimated at $8.5 trillion last year; industry professionals expect these costs to triple by 2027. Given the worrisome expansion in the scope and reach of cyberattacks, it should come as no surprise that the cybersecurity market, protecting us from these threats, is also rapidly expanding, and projected to grow by a CAGR of 14%-16% through 2030.

Within the vast space of global cybersecurity, one segment has been long overlooked by investors, the financial press, and the general public: the consumer, or retail, cyberdefense market. However, in recent years, this niche has been quickly rising to prominence, riding the recent trends of online presence, remote work, the Internet of Things, and more. Thus, the potential addressable market of consumer security software is estimated at $20 billion.

With this enormous potential, no wonder that this ever-evolving market is now gaining the recognition it deserves. As we navigate through an era where digital threats are becoming more sophisticated and pervasive, the importance of consumer cybersecurity cannot be overstated. As for investors, this cybersecurity market segment is ripe with opportunities combining growth, value, and income.

Quality Dividend Stock: This Week’s Top Pick

Gen Digital Inc. (GEN) is a leading global cybersecurity software and service company. Its solutions portfolio offers protection across three cybersecurity categories: security, identity protection, and online privacy.

Gen Digital is a pure-play cybersecurity company, commanding a market capitalization of $13.6 billion, annual revenue of $3.4 billion, and a workforce of ~3,500 in its offices in the U.S., Europe, and India, serving 500 million users in more than 150 countries. GEN is a Fortune 500 company and a member of the S&P 500 (SPX) stock-market index. As a pioneer in many of the cybersecurity fields and a leading innovator, Gen Digital has an impressive IP portfolio with over 1,000 patents.

GEN was established in 1982 as “Symantec Corporation” with an aim to develop advanced natural language and database systems. During the next decade, Symantec developed several products that quickly gained popularity, such as a combined file management and word processing program, a natural language query system, an annotation utility, and others. The company underwent an IPO in 1989 and began trading on NASDAQ under the ticker “SYMC.”

In 1990, Symantec announced an acquisition of Peter Norton Computing, a developer of various utilities for DOS (an operating system that was widely used before the “Windows” system). While Symantec had already begun the development of a DOS-based antivirus program one year before the merger with Norton, the acquisition paved the way for the company to become a cybersecurity powerhouse. The company’s suite of Norton virus and privacy protection solutions for private customers and small businesses is one of the most popular cyber safety offerings in the world.

In the years that followed, Symantec underwent numerous management changes, acquisitions, and divestments, as well as company reorganizations. The most important acquisitions of these years were that of a data center software and storage provider Veritas in 2005, and of identity theft protection company LifeLock in 2016.

The largest divestitures were a demerger and a sale of Veritas in 2015 to Carlyle Group (CG) to focus on security software; and a deal with Broadcom. In 2019, Broadcom (AVGO) bought Symantec’s enterprise security business, while its consumer business remained a public entity under the new name, “Norton LifeLock.”

In 2022, the company acquired and merged with Avast, a global leader in digital security and privacy products that was based in the Czech Republic and traded on the London stock exchange, for over $8 billion. The merging companies announced the formation of a new entity under the name “Gen Digital.” The details of the deal were closed in 2021, when the market had a strong run-up, with a significant drop that depressed valuations in 2022. Thus, looking in a rear-view mirror, the timing of the purchase was far from perfect; however, the acquisition cemented GEN’s position as a dominant player in consumer cybersecurity.

As opposed to the well-known names in the cybersecurity field, like enterprise cybersecurity firms Palo Alto Networks (PANW) and Crowdstrike Holdings (CRWD), GEN focuses on consumer cybersecurity, a market offering large growth opportunities.

The consumer, or retail, cyber defense market is fast gaining prominence, as the rising digitalization of everyday lives, coupled with the rapid penetration of advancements such as the Internet of Things (IoT), artificial intelligence (AI), and cloud computing, present accelerating security challenges. Global security spending in the consumer security software segment is expected to reach $9.3 billion this year; the potential addressable market is estimated at $20 billion. The alarming growth of cyber threats and the pressing necessity of defense against them is underscored by the fact that during July, August, and September of this year, Gen Digital’s software blocked over 1 billion cyberattacks per month, a record high.

GEN offers the following cybersecurity brands, many of which are household names: Norton, Avast, LifeLock, Avira, AVG, ReputationDefender, and CCleaner. Within these product suites, the company offers security and performance products that provide real-time protection against malware, viruses, adware, and other online threats, as well as solutions for protecting against identity and account theft, securing personal information, and detecting fraud. In addition, GEN provides VPN solutions, privacy monitoring assistance software, online reputation management solutions, system optimization tools, and more.

The company derives about 65% of its revenues from consumer security solutions, comprising Norton Security, Avast Security, Norton Secure VPN, and Avira Security products. About 35% of GEN’s revenues originate from identity and information protection solutions, including Norton 360, LifeLock, and other privacy offerings. Approximately 65% of revenues were from the Americas, 25% from Europe, and 10% – from Asia-Pacific and Japan.

The acquisition of Avast significantly bolstered its market position and revenue streams. It also continues to unlock value in terms of cost synergies, with $280 million of savings in operating costs achieved within 12 months after the merger.

However, the merger also significantly increased its debt burden, as GEN has raised about $7.5 billion of additional debt to make the purchase. Since the acquisition was finalized, the company has been working to reduce its debt load. While its debt-to-equity ratio is a very high 360%, it’s already been halved from its peak in end-2022.

GEN’s ability to grow its EBIT at a fast pace and generate significant free cash flows is one of the main redeeming factors that support its commitment to further decreasing its liabilities. Due to the elevated leverage, Gen Digital’s debt ratings fall in the mid-scale of the top part of the ratings scope: “BB” at S&P Ratings, “BB+” at Fitch, and “Ba2” at Moody’s. Particularly, Fitch said in early 2023 that it believes the company will successfully reduce debt as it did in the years prior to Avast’s purchase, utilizing its FCF for debt paydown and prepayments.

Gen Digital’s capital efficiency ratios are robust and compare favorably to the industry averages. While its exceptionally high Return on Equity (ROE) of 69% is less informative because it’s skewed by high debt levels, its Return on Assets (ROA) of 12.6% and Return on Invested Capital (ROIC) of 23% are ranked among the top 10% of the Software sector. Meanwhile, GEN’s robust profitability is reflected in its margins: its gross margin of 87%, operating margin of 58%, net profit margin of 37.5%, and FCF margin of 26% are among the highest in its industry.

In the past three years, the company has been growing revenues at a CAGR of 15%, and earnings-per-share at a CAGR of 19%. On November 7th, GEN reported its fiscal Q2 2024 (ended September 29, 2023), the first quarter in which EPS was in line with estimates after many quarters in which the company exceeded estimates on this metric.

Despite a slight investor disappointment with the bottom-line result, GEN closed another 17th straight quarter of growth, with revenues surging 27% year-over-year, operating income jumping by 41%, and diluted EPS rising by 9%. These stellar results came on the back of significant growth in bookings, with the number of direct customers rising by over 380,000 quarter-on-quarter, sharply increased retention rates, and average revenue per user (ARPU). Even with the robust results, the company’s management confirmed its prior conservative guidance for FY 2024, with revenue and EPS ranges matching consensus estimates.

Gen Digital’s stock has largely followed its business results. During the pandemic, the advancement in remote work scopes led to a surge in the company’s profit growth; the stock followed, reaching an all-time high in July 2022. However, like any consumer-facing business, in the past year and a half GEN grappled with the outcomes of rising inflation and interest rates, depressing spending. In fiscal 2023 (ended March 31, 2023), Gen Digital faced the combination of higher interest expenses and softer demand, leading to muted profit growth and weighing on stock performance. Thus, despite the stock’s almost 30% surge following the strong FQ2 results, it’s still down 7.5% for the last 12 months. In the past three years, the stock has brought its investors a gain of 133%.

In the latest two quarters, the customer- and revenue-growth tides have turned again for GEN, despite the ongoing macroeconomic headwinds. A rise in a number of geopolitical conflicts globally, coupled with a surge in high-profile consumer data and privacy breaches, and other negative events, underscored the fact that cyber protection is a necessity for both enterprises and private customers. Longer term, along with the obvious accelerating need for cybersecurity to provide answers to an alarmingly fast increase in cybercrime, GEN is also expected to capitalize on the accelerating digital transformation in both developed and developing economies, with the rising Internet penetration trend spurring fast growth in the latter.

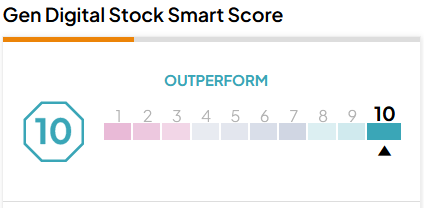

Analysts view GEN’s recent underperformance as a temporary setback, with a roll-back of the losses already underway. TipRanks-scored top Wall Street analysts see an average upside of 27% for the stock in the next 12 months. GEN carries a TipRanks Smart Score rating of “Perfect 10” with a “Strong Buy” recommendation:

Following GEN’s stock underperformance up to November, its shares trade at very modest valuations. Its TTM P/E of 10.8 and a Forward P/E of 9.7 represent 62% and 37% discounts to the IT sector’s averages. When compared to its peers in the industry, Gen Digital comes at the bottom of the price range; it is also currently trading below its fair value. Weighing the company’s customer growth against its low valuations, we believe that its stock presents a value-investment opportunity.

Importantly, the company’s shareholders are generously rewarded through dividends and buybacks. These are an integral part of GEN’s capital allocation strategy, which is centered around a balance of “driving stockholder returns, managing financial risk and preserving the flexibility to pursue strategic options, including acquisitions and mergers,” according to the management, who added, “Historically, this has included a quarterly cash dividend, the repayment of debt and the repurchase of shares of our common stock.”

Gen Digital has been consistently paying dividends since 2013. Its current dividend yield of 2.4% is more than double the average for the technology sector. The company’s commitment to compensating its shareholders, coupled with the low payout ratio of 27% and a more-than-sufficient coverage provided by earnings, permits an optimistic outlook with regard to GEN’s future dividend-per-share growth.

In addition to dividends, GEN performs buybacks on an opportunistic basis. Gen Digital’s stated long-term target is to reduce its diluted share count back to the level before the Avast acquisition when additional shares were issued to help finance the merger. In the FQ1 2024, the company repurchased its shares for the amount of $41 million, after repurchasing $904 million in fiscal 2023. GEN hasn’t made any repurchases in the latest quarter, instead prioritizing faster debt repayments.

In the not-so-distant past, GEN’s results were hampered by economic factors and not product quality issues. As the economic pressures from inflation and interest rates begin to wane, the company is expected to benefit from the increasing need for cybersecurity solutions globally, especially with the trend towards hybrid working models, transition to the cloud, and proliferation of IoT and AI technologies, as well as other catalysts.

In conclusion, we must agree with Bank of America (BAC) analysts who said that Gen Digital’s valuation, compared with its robust business prospects, makes it “an underappreciated value play,” while adding that the company also offers large growth opportunities. With its reasonable valuation and strong dividend yield, this consumer security leader’s stock offers a decent margin of safety for long-term dividend investors, presenting an attractive opportunity in the cybersecurity space.

Disclaimer

The information contained in this article represents the views and opinions of the writer only, and not the views or opinions of TipRanks or its affiliates and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment, and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices, or performance.