Powering On

We live in an increasingly technological world, with implications in every aspect of our lives. The semiconductor industry is a key player in this field, a cornerstone on which many of technological advancements are based.

This industry’s role extends beyond just powering consumer gadgets: it fuels innovations across a myriad of sectors, ranging from medical devices to industrial production to aerospace and defense. Semiconductors are also increasingly crucial in all types of vehicles, not just electric ones. From enhancing safety features to improving fuel efficiency, chips are at the heart of automotive innovation.

As we witness a shift towards more sophisticated technology, from the expansion of electric vehicles to the rise of smart homes, the semiconductor market continues to adapt and grow. Despite its susceptibility to market cycles and supply chain challenges, the sector’s overall direction points towards sustained growth. It has become indispensable in numerous industries, particularly in the industrial and automotive sectors.

The crucial role played by chips in everything around us serves as a strong investment case for the stocks of semiconductor producers. Investing in this sector offers a unique opportunity to capitalize on a story that’s integral to both industrial prowess and our everyday lives. Our modern economy has come to rely on these tiny, superiorly sophisticated pieces of silicon.

We will present one of the leading companies in this industry, but first, let’s delve into a short update on the economy and markets, and the Smart Investor calendar.

Economy and Markets: Looking Forward

Several important reports, whose readings affect stock markets directly, are scheduled to be published in the next few days.

-

Later today, S&P Global will publish the preliminary readings of January’s S&P Global Manufacturing PMI and Services PMI. The Manufacturing PMI captures business conditions in the manufacturing sector, which contributes a significant part of total GDP. The manufacturing PMI is an important indicator of business conditions and the overall economic condition in the U.S. Services PMI captures business conditions in the services sector and is a crucial indicator as the services sector is responsible for over 70% of total U.S. GDP. PMI indices are leading economic indicators used by economists and analysts to gain timely insights into changing economic conditions, as the direction and rate of change in the PMIs usually precede changes in the overall economy.

-

On Thursday, the U.S. Bureau of Economic Analysis will release the advance estimate of Q4 2023 GDP Growth Annualized. This report will provide an initial assessment of a change in GDP in the previous quarter. GDP is a comprehensive measure of U.S. economic activity, and changes in this data point tend to reflect the nation’s overall economic health. After the third quarter’s growth of 4.9%, in the final period of last year, the economy is expected to have grown by 2%.

-

On Friday, the U.S. Bureau of Economic Analysis will publish December’s Core Personal Consumption Expenditures (Core PCE). This report reflects the average amount of money consumers spend monthly, excluding seasonally volatile products such as food and energy. FOMC policymakers use the annual Core PCE Price Index as their primary gauge of inflation. Analysts expect the Core PCE to mimic the trend seen in December’s CPI report, showing a slight uptick on a monthly and annual basis.

As for the stock calendar, the Q4 2023 earnings season for Smart Investor Portfolio companies is in full swing, with the quarterly results of STMicroelectronics (STM), Applied Industrial Technologies (AIT), Super Micro Computer (SMCI), and Electronic Arts (EA) to be published in the next few days.

There are no ex-dividend dates for Smart Investor Portfolio companies coming up in the next week.

Today,we are adding the stock of a global leader in the automotive and industrial semiconductor sphere, featuring stellar finances and robust earnings growth outlook, as well as strong alignment with shareholder interests.

To make room for this valuable addition, we are letting go of one of the leading health insurance service providers in the United States, whose stock has come under severe pressure due to unexpected earnings weakness and flagging outlook.

New Addition: ON Semiconductor (ON)

ON Semiconductor Corp., aka onsemi, engages in the design, manufacturing, and marketing of a portfolio of semiconductors, semiconductor components, and sensors. The company, headquartered in Scottsdale, Arizona, is the world’s largest supplier of image sensors to the automotive market, and the second-largest provider of power semiconductors.

While onsemi’s main focus areas are automotive and industrial markets, it also serves customers from the medical sector, aerospace and defense, 5G & cloud, and consumer electronics industries. In the automotive market, the company supplies crucial vehicle electrification, ADAS, powertrain, and safety and security components. In the industrial market, onsemi caters to the energy infrastructure, industrial automation, and smart buildings sub-industries. In the 5G & cloud market, ON provides important components for telecom infrastructure as well as data center power solutions. In the medical space, onsemi’s solutions assist in the ongoing digitalization process, and supply components for the manufacturing of advanced point-of-care technologies and devices. onsemi has been granted a Category 1A Trusted Foundry and Trusted Design accreditation by the U.S. Government, as it provides advanced semiconductor solutions for military and aerospace applications.

ON derives over 50% of its revenue from the automotive market and almost 30% from the industrial market. The total addressable market for both its main segments is expected to grow by a CAGR of ~16% in the next five years. Geographically, the fast-growing Asia Pacific region is responsible for over half of the revenues, with the Americas and Europe each providing about 20%, and the rest is sourced from sales in Japan.

onsemi was incorporated in 1999 following a spin-off of Motorola’s (MSI) Semiconductor Components Group and began publicly trading on NASDAQ in 2000. In the years since its spin-off, the company has achieved leadership positions in several markets and technologies that fuel its growth through both robust internal development and strategic acquisitions, buying out a total of 18 companies and businesses.

Today, ON Semiconductor commands a market capitalization of $32.4 billion, annual revenues (2022) of $8.4 billion, and a workforce of over 31,000 employees worldwide. With a robust infrastructure, the company boasts an extensive network comprising of 19 manufacturing sites in 9 countries, 43 design centers in 19 countries, and 8 solution engineering centers in 5 countries. The company is a member of the Fortune 500 list of the largest U.S. firms by revenue, while its stock is included in the S&P 500 (SPX) and Nasdaq-100 (NDX) indexes.

onsemi’s financial health is stellar: it has very little debt (10% net debt-to-equity ratio), with the debt well-covered by operating cash flow and the interest payments covered by EBIT hundreds of times over. In addition, its short-term assets cover both its short- and long-term liabilities. The company’s robust liquidity position is underscored by its current ratio of 2.4, quick ratio of 1.5, and cash ratio of 1.1. ON’s capital efficiency metrics – Return on Equity, Return on Assets, and Return on Invested Capital – are in the top 5% for the Semiconductors industry.

ON Semiconductor boasts very strong profitability metrics, with its gross (47.5%), operating (32.2%), and net (26.7%) profit margins ranking in the top 10% of its industry. The company aims to expand its gross margin to 53% by 2027 as part of its corporate strategy. In addition, the company has set a target of expanding its operating margin to 40% and FCF margin to 25%-30% (from the current 20%) by the same year.

Another important highlight of onsemi’s strategy is its commitment to shareholders: it has penciled in a return of 50% of its free cash flow through share repurchases by 2027. In February 2023 the company’s management approved a new share repurchase program with authorization to repurchase up to $3 billion of shares of the company’s common stock through December 31, 2025. In Q3 2023, onsemi performed buybacks totaling $100 million.

In the past three years, ON’s revenues have increased at a CAGR of 17%, while its earnings-per-share (EPS) surged by 116%. On October 30, 2023, the company shared its Q3 2023 financial results, far exceeding analysts’ estimates on revenue and earnings. In fact, the company has surpassed EPS estimates in all quarters for which these estimates were available, with a single exception in Q1 2020 (the onset of the pandemic).

Chip stocks – excluding the specific AI-supporting names – have been under pressure for most of 2023 due to the demand weakness, resulting from the “chip glut” which resulted from the post-pandemic rush to restock. The overall semiconductor industry was in a down cycle, with an estimated sales decline of over 9%. Although onsemi’s revenues were less impacted than most of its peers thanks to its wide diversification, they still reflected a sluggish market for EV, IoT, and consumer electronics chips.

However, the chip industry is well-positioned to rebound this year, with a projected 13% increase in sales versus 2023; moreover, analysts expect this year’s chip revenues to surpass 2022’s record. Chip producers such as Samsung and Taiwan Semiconductor (TSM) have said that their sales and orders data confirm demand turnaround. Longer term, the same factors that have propelled the chip industry to its current importance (beyond AI) not only remain intact but continue to strengthen. This applies to ON even more than to its peers, as its focus on auto chips and sensors allows it to capitalize on the transformation of the automotive market toward electric vehicles (EVs). In addition, digitalization, automation, and interconnectedness are megatrends, and onsemi has a stake in all of them through its extensive industrial, connectivity, and IoT offerings.

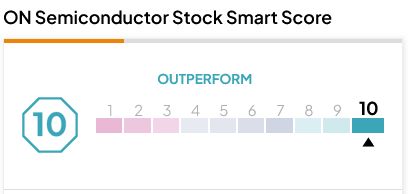

As a result of the 2023 demand weakness, ON Semiconductor’s stock has traded mostly down and sideways after reaching its all-time high in July 2023. In the past 12 months, the stock rose by just ~7%; in the past three years, it has gained 103%. However, based on the positive outlook for 2024 and beyond, TipRanks-scored top Wall Street analysts see an average upside of 21.3% for the stock over the next 12 months. onsemi carries a TipRanks Smart Score rating of a “Perfect 10” with a “Moderate Buy” recommendation:

Following a downcycle in the second half of 2023, onsemi’s stock is now trading at about a 45% discount to the IT sector valuations, and about 35% below its fair value (based on projected cash flows). When compared to its peers in the Semiconductor industry, ON comes in at the bottom of the valuation range.

ON Semiconductor features a strong business model with fairly diversified revenue sources. It is well-positioned to continue profiting from ongoing megatrends, and its track record of robust delivery supports a positive business outlook. In addition, the company showcases strong shareholder alignment and currently trades at very attractive valuations. All in all, onsemi can be viewed as a compelling combination of quality, growth, and value. As such, we believe it can be a valuable addition to the Smart Investor portfolio

New Deletion: Humana (HUM)

Humana Inc. is one of the leading health insurance service providers in the United States. The company provides Medicare benefits and state-based Medicaid contracts, as well as commercially-insured medical products and specialty health insurance benefits. Humana also offers pharmacy solutions, provider services, home-based services, and clinical programs to the company’s health plan members, as well as to third parties. Humana ranks as #2 in the Medicare Advantage market after UnitedHealth Group’s (UNH), a Smart Portfolio company. Medicare premiums make up the bulk of Humana’s revenue.

On January 18th, HUM provided a starkly negative preview of its Q4 2023 and full-year 2023 financial report, which is scheduled to be released tomorrow. The company slashed its 2023 profit guidance by 9%, blaming the earnings weakness on much higher-than-anticipated medical costs during the year, specifically during the last quarter. These months saw a strong unexpected increase in Covid-19-related hospitalizations among older adults (the Medicare Advantage recipients). At the same time, medical services providers as a whole have registered higher (non-Covid-19-related) hospitalizations and outpatient procedures, increasing insurance utilization rates. The higher utilization rates, coupled with other factors including tighter reimbursement regulations, increased Humana’s medical loss ratio (a key metric of profitability for healthcare providers).

Last year, Humana’s Medicare Advantage plans offered richer patient benefits than those of its competitors, resulting in faster enrollment growth. The pressure from the surge in medical loss ratios will require slashing benefits to recover margins, which would lead to growth rates significantly below the industry’s average. While the company has yet to reveal its 2024 guidance, it said that it expects a “significant impact” on its bottom line from the higher utilization trend and lower enrollment growth.

Slower membership growth may provide Humana with some much-needed breathing space, lowering utilization cost pressures, but they are still expected to weigh on investor sentiment. While the company’s management has not indicated a change in its 2025 outlook, to reach the target, HUM will need to perform aggressive cost adjustments. All in all, it looks like the company’s stock is slated to undergo a difficult period in 2024. While Humana remains a solid, well-capitalized, cash-generating business, we believe it is appropriate to sell the stock.

Charter Members of the 30% Winners Club

*The 30% Winners Club includes stocks from the Smart Investor Portfolio that have risen at least 30% since their purchase dates.

Our exclusive club’s member count has risen back to six, as SMCI, which fell through the threshold just last week, returned with a vengeance, surging by over 42% in the last five trading days.

Thus, the six champions now include GE, AVGO, SMCI, ANET, CDW, and ORCL.

The next in line to enter the Winners ranks are now Wesco International (WCC) with a 28.9% gain since purchase, and Vertex Pharmaceuticals (VRTX) which rose by 25.6% since we bought it five months ago. Will one of them be able to close the gap, or will someone else outrun them to the finish line?

What’s Next?

Our next commentary will come out on Wednesday, January 31st, before the market opens.

Until then – we wish you a world of investment success!

Access the full Smart Investor Archive, including all historical stock picks and original newsletters.

Portfolio Changes

|

Disclaimer

The information contained in this article represents the views and opinions of the writer only, and not the views or opinions of TipRanks or its affiliates and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices, or performance.