TipRanks – Customized for You

How to Create an Account on TipRanks

To start your investment journey on TipRanks and to avail yourself of the full benefits of all features, start with signing up for the TipRanks platform. On the top right of the TipRanks page, you will see the Login/Join button. For a first-time user, click on the Join button that will take you to the Sign-Up page. Here, you have three options: Sign Up with an existing Google account; Sign Up with an existing Facebook account; OR Sign Up with another personal email account. If you would like to use your Google or Facebook account to sign in, you can do so by inputting the respective passwords and successfully logging in to TipRanks.

To create a login with a personal account, first, add your email ID, and then you need to check the I’m not a robot option. This will show you a small pop-up window that will ask you to verify some images. Once you are verified, you need to go through the terms and conditions page of using the TipRanks portal and then check the box which reads, “I agree to TipRanks’ Terms of Use and Privacy Policy.”

After this step, click the CONFIRM button, which brings you to select a password for your new TipRanks account. After you add a password, click on JOIN, which will send a confirmation email to the email address that you are using for signing in. When you open your email, you will see a confirmation email to click on, and voila, you have become a member of the TipRanks Community. After this step, you can go back to the TipRanks main page and LOGIN with your email account and password.

Haven’t created a TipRanks account yet? Click here to join the growing TipRanks community TipRanks | Stock Market Research, News and Analyst Forecasts – TipRanks.com

How to Use TipRanks on Your Smartphone

Do you need investment advice on the go? Do you like to keep updated with the latest market happenings at all times? Download the TipRanks platform on your smartphone and explore the benefits of TipRanks tools at your fingertips!

To use TipRanks on your smartphone, visit the Google Play Store on your Android phone or the Apple App Store on your iPhone, search for the TipRanks Stock Market App and download the same on your smartphone. Once downloaded, you can sign up/log in to the App and start your investment journey.

How to Navigate the TipRanks Dashboard and Access Its Features

Once you have become a member of the TipRanks community, the platform provides you with multiple features that are designed to smoothen your investment decisions. Read on to find out more about these unique features.

On logging into the TipRanks portal, the dashboard will show you several features, a few of which are open and available to all Basic users, while others are locked and available for Premium Subscribers only. Right on top of the page, you will see various tabs for the main features, which have numerous options under each. These features and sub-segments can be browsed by clicking on them.

- Stock Ideas – Under this feature you will find a host of unique research tools designed to improve your investment acumen. Some of the notable ones include Top Analysts Stocks, Top Insider Stocks, a Stock Comparison Tool that lets you compare stocks from similar industries or undertake customized analysis, and various Calendars including Earnings, Dividend, and Economic calendars.

- ETFs – Under this feature, you will find all the information and news related to exchange-traded funds (ETFs). You have the ETF Research Tools that include the ETF Center, ETF Screener and a tab to Compare ETFs. Similarly, you will find a page on ETFs on the Move including the Top ETF Gainers and Losers and the Most Active ETFs. And lastly, you will find the ETFs Ideas tab, which has a list of ETFs categorized based on sectors, indexes and types.

- Dividends – Next you have the Dividend feature, which includes all data related to dividends. These include the Dividend Calculator, lists of Best Dividend Stocks as well as Best High Yield Dividend Stocks, and a tab for Dividend Stock Comparison.

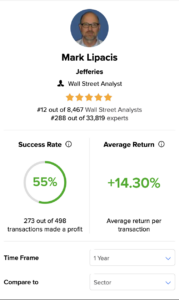

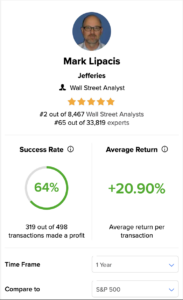

- Experts – Have you ever tried making investment choices based on an expert’s recommendations? Well, you can do so through the TipRanks Experts feature. Under the Experts tab, you will find the performance and track records of various investment gurus, namely, Top Wall Street Analysts, Top Financial Bloggers, Top Performing Research Firms, Top Corporate Insiders, Top Hedge Fund Managers, and Top Individual Investors. By studying an expert’s view on a stock, you can make an informed investment choice. You may choose to follow any of the experts from the curated list of more than 32,000 expert recommendations that TipRanks consolidates for you.

- Portfolio – Under this popular feature, you can create your own customized portfolio and stay updated with its real-time performance. You can view your portfolio’s Holdings as well as undertake Portfolio Analysis and study Crowd Insights, which lets you compare your portfolio with the Average Portfolio performance on TipRanks. Finally, you can create your own Watchlist on TipRanks, and follow the latest happenings and performance of the stocks that you like as well as set alerts for them.

- News – Stay abreast with all the latest stock market happenings under one roof. Under this tab, you will find Stock Market News, i.e., the breaking news flashes, Stock Analysis & Ideas that involves in-depth research on companies and sectors, ETF News, Global Market News, and the Expert Spotlight tab that includes analysis pieces on the top recommendations of experts. Further, we have the TipRanks Labs tab that has educational content on evergreen topics and those related to TipRanks. Then we have the Earnings Reports Insights giving briefs about company results, Market Breakdowns that include the daily Futures and Stock Indices’ performance, Dividend Stock News, and Cryptocurrency News.

- More – Under this tab, you will find the About TipRanks information and contact information. Plus, you will find different ways of partnering with TipRanks such as Enterprise Solutions, Best Online Brokers, and Become an Affiliate segments, where you will see all the benefits of joining the TipRanks Affiliate Program. Further, you will find the Education feature, under which you will find the TipRanks Labs section, TipRanks’ Webinar Center (informative videos), Glossary of all the important terms, and a list of FAQs.

- Plans & Pricing– As the name suggests, here you will find all the information related to TipRanks’ Subscription Plans. Other than the Basic free plan that gives you limited access to TipRanks tools and data, we have two plans: the Premium Plan and the Ultimate Plan. You can learn about the features of both plans on this page.

Below the top navigation menu, you will see the live market data, through which you can keep up with the real-time market prices for stocks and indices. For instance, we present the U.S. Futures readings, Nasdaq (NDX) readings, a few trending companies’ price movements as well as cryptocurrency prices. As you scroll down, you can see the headlines for the latest Stock Market News, Stock Analysis & Ideas list, and your recently searched stocks list.

Below that, you can see the Stocks On the Move segment, which will show you the Top Gainers, Losers, and Most Active Stocks. Similarly, you can see the Daily Analyst Ratings’ Buy and Sell recommendations, and noteworthy Today’s Events list, which includes Earnings, Ex-dividend dates, and upcoming dividend information.

Further below, you can see the Latest Articles, Trending Stocks, Top Stocks, and Leading Cryptocurrencies. Towards the end of the page, you will see the Analyst Consensus by Sector, the Stock Comparison graphs, and the Top Expert Center.

How to Search for a Specific Stock on TipRanks

If you want to search for a particular stock on TipRanks to study it further with the help of the available tools, type the company name or stock ticker in the Search Bar provided on the top left of the page. When you type, the dropdown window will give you the available options containing that name or ticker. Click on the exact stock that you are looking for and start your research journey using TipRanks’ unique tools.

For example, if you type TSLA in the search bar, you may see various options in the dropdown including electric vehicle (EV) maker Tesla (NASDAQ:TSLA) and a few other ETF names with the symbol “TSLA” in them.

How to Search for a Specific Analyst on TipRanks

Have you tried investing with the recommendation of analysts? Before following a particular analyst’s advice, it is best to review the analyst’s past performance and stock-picking prowess. TipRanks helps you do just that!

To search for a specific analyst on TipRanks, type the analyst’s name in the Search Bar provided on the top left of the page. When you start typing the name, the dropdown window will give you the matching expert names from its experts’ universe. When you find the exact analyst’s name you were looking for, click on it to learn more about the analyst’s performance, success rate, and stock recommendations.

Another method is to select the Experts-Top Analysts tab on the TipRanks Dashboard. This will open the analyst list on TipRanks, listed according to their latest Star Ranking. You can browse through the list to search for a particular analyst and learn more about them.

How to Personalize TipRanks According to Your Investment Strategy

The TipRanks portal helps you to personalize your dashboard in numerous ways, and choose what you wish to see, the way you wish to see it! While TipRanks does not tell you where and how to invest, its tools can aid you to research stocks thoroughly and choose wisely. Additionally, the TipRanks portal allows you to set alerts for different stocks, analysts, insiders, or bloggers to receive instant notifications about new ratings. Plus, you can create your preferred portfolio as per your risk-reward appetite.

Not just that, on our Smart Portfolio, you can customize the portfolio holdings list to include the information you wish to see or go back to the Basic View anytime. Also, you can download the holdings data on an Excel file for reference. You can compare your returns against the Benchmark as well as against the Average Portfolio of all investors on the TipRanks database. This helps you to analyze whether and why your portfolio is under/overperforming relative to peer investors and alter your portfolio allocations as required.

What’s more, through the TipRanks Smart Portfolio, you can stay up to date with your portfolio performance, and read news related to your portfolio holdings. Even better, with the Ultimate subscription, you can create multiple portfolios.

How to Customize Your TipRanks Watchlist to Set Up Email Alerts

Are you interested in receiving timely email alerts that can help you make the right investment calls? Well, look no more! TipRanks has numerous useful options to set alerts for the stocks on your watchlist. Under the TipRanks Portfolio feature, there is a My Watchlist tab, where you can create email alerts for the stocks that you follow (5 stocks under the Basic plan, 30 stocks under the Premium Plan). Plus, you can customize the email frequency and settings as per your convenience. You can choose to receive alerts in real-time or a consolidated list in one email per day. To see or modify your Watchlist, click on your Account in the top right corner of the page and select My Watchlist.

Further, under the Alert Center tab, you can easily Enable or Disable notifications, and see a glimpse of the number of stocks and experts that you follow. You can even choose to set Price Action alerts such as 52-week high or low, or percentage increase/decrease in daily stock prices. You can also set Calendar Events alerts for earnings results or dividends.

You can even add experts you wish to follow under the My Experts tab and set up alerts for New Ratings of stocks that are on your Watchlist. Plus, you can add alerts for corporate insider buy/sell shares as well as for analyst consensus changes. What’s more, you can choose to receive notifications only from experts that have at least a particular star ranking.

Further, you can subscribe to the Weekly Digest, which gives you a weekly overview of your portfolio’s performance, including any latest activities and events in it. Importantly, please ensure that you add [email protected] to your safe sender’s list to receive regular alerts.

How to Use TipRanks to Find New Investment Ideas

TipRanks offers a variety of unique toolsets to supercharge your investment ideas. We consolidate the investment activities of several experts on one platform that can be leveraged to formulate profitable investment strategies. Let us look at each of these idea-generating data points in detail below.

- Trending Stocks page – You can find this page on the top menu, under Stock Ideas – Daily Updates – Trending Stocks. Trending stocks can help you understand which companies are on analysts’ radar currently, thus helping you to make knowledgeable choices. This page will show you which stocks are generating the most analyst commentary (by 3 or more analysts) in the last few days. You will see the stock’s Rating breakdown, Overall Stock Rating (Buy/Hold/Sell), Average Price Target, and 12-month Upside potential (%).

- Analysts’ Top Stocks page – You can find this page under Stock Ideas – Stock Ideas – Top Analyst Stocks. This page will show you a list of stocks on which analysts are highly Bullish. These stocks are most recommended by analysts and have a high probability of achieving the consensus price target as set by the top analysts, thus making for valuable investment advice. The list can be customized to see the stock’s price/earnings per share (P/E) ratio, yearly gain, recent stock behavior, and so on. Moreover, the page will show you the Analyst Consensus by Sector (Strong Buy/Moderate Buy/Hold/Moderate Sell/Strong Sell), featuring stock recommendations by the analysts with the best performance records.

- Insiders’ Hot Stocks page – You can navigate to this page from the top menu, under Stock Ideas – Stock Ideas – Top Insiders Stocks. The Insiders’ Hot Stocks page is a screener that focuses on those most in the know-corporate insiders. With 4 pre-set strategies, this powerful screener helps investors reveal which stocks insiders are active in. By following the trading activities of insiders, you can gauge the stock’s future trajectory and make wise trading choices. This page shows you corporate insiders’ views (Positive/Neutral/Negative) on stocks based on their insider stock trading activity.

- Stock Screener page – You can navigate to this page from the top menu, under Stock Ideas – Stock Ideas – Stock Screener. This page helps you to filter and compare stocks based on specific criteria. You can customize your list based on several parameters such as sector, price target upside, analyst consensus, insider signal, etc.

- Top Smart Score Stocks page – You can find this page on the top menu, under Stock Ideas – Stock Ideas – Top Smart Score Stocks. This page displays a list of the best stocks with a TipRanks Smart Score of “Perfect 10.” As per the Smart Score, these companies are highly likely to outperform market expectations. By investing in these Top Smart Score stocks, you can improve your chances of earning outstanding returns.

- Top Online Growth Stocks page – You can find this page on the top menu, under Stock Ideas – Stock Ideas – Top Online Growth Stocks. This page shows you a list of companies whose Website Traffic trends have shown substantial growth in the past month, thereby indicating a solid performance. Stocks with a solid online footprint tend to outperform expectations and thus amplify your returns.

- Penny Stock Screener page – You can find this page on the top menu, under Stock Ideas – Stock Ideas – Penny Stock Screener. This page shows you a list of penny stocks on which top analysts have a bullish view. Although penny stocks may be risky bets due to their relatively smaller market capitalizations and moats, these stocks have the potential to become multi-bagger investment opportunities.

- Compare Stocks page – You can navigate to this page from the top menu, under Stock Ideas – Stock Ideas – Compare Stocks. On this page, you can compare multiple stocks (maximum 10 stocks) of your choice using TipRanks tools such as Analyst Consensus, Price Target, etc. You can customize the parameters on which you want to compare the stocks. Using the tool, you can perform a comparative study of the stocks of your choice and decide which one is most suitable for your investment strategy.

- U.S. Stock Movers page – You can navigate to this section from the top menu, under Stock Ideas – Daily Updates – Top Gainers/Losers/Most Active. TipRanks consolidates a list of the 50 most active stocks based on the highest trading volume, including during both pre-market and after-market hours. On the Most Active Stocks page, you will also find tabs to bring you to the Top Gainers and Top Losers of the Day pages, which list stocks with significant price changes. This information helps you to further study why a particular stock may have experienced price fluctuations and decide whether or not to invest in it.

- Daily Analyst Ratings page – You can navigate to this page from the top menu, under Stock Ideas – Daily Updates as well as directly from the TipRanks dashboard. This page consolidates the daily stock ratings and price target changes by Wall Street analysts. You can see the Daily Buy and Daily Sell Ratings as well as the Full List of Stock Ratings for the same day and previous days. This information helps you study why an analyst has changed their stance on a particular stock and decide on your investment options accordingly.

- Daily Insider Transactions page – You can navigate to this page from the top menu, under Experts – Top-Performing Corporate Insiders – Daily Insider Transactions. This page tracks the daily insider buy and sell transactions of people most in the know. Corporate insiders are privy to information that an average investor may not know. Hence, following an insider’s trading activity can guide us into the stock’s future trajectory and help investors make appropriate trading calls.

What is the Difference Between TipRanks’ Premium and Ultimate Plans, and Which Should I Buy?

Now that you are aware of the many benefits that TipRanks’ tools offer an investor, it’s time to dive into the details of our subscription plans. TipRanks has two paid subscription plans for users: the Premium and Ultimate plans. As an Ultimate Plan subscriber, more features will be unlocked to facilitate your research journey. To see the features included in each plan, go to the Plans & Pricing tab on the main menu. The gist of the main features of both plans is described below.

TipRanks Premium Plan – Includes all features including Premium Stock Analysis, which allows you to research any stock with the help of TipRanks’ unique data sets. You can get New Investment Ideas through the Big Data-based ideas using the Top Smart Score stocks, Analyst and Insider stock breakdowns. Moreover, you get access to Smart Portfolio Research tools that include Top Analysts’ Price Targets and Consensus, Hedge Funds, Insider signals, etc. Also, subscribers gain access to all Premium Research Tools including stock screeners and earnings calendar, receive Daily Expert Insights of real-time stock recommendations and transactions, and get Premium Expert Access to the views of Wall Street analysts, Hedge fund managers, Corporate Insiders, and Bloggers. Plus, you get to personalize your email alerts or Follow 30 Stocks of your choice and have the option for PDF Export of data as well as Priority Support.

TipRanks Ultimate Plan – includes all features of TipRanks Premium, along with access to a larger set of TipRanks’ unique tools. These include Stock Risk Factor Analysis, which displays the potential risks the stock is exposed to through the reports available at the SEC. Get a list of daily Insiders’ Hot Stocks that exhibit Strong Buy indicators based on corporate insiders’ trading activities. Plus, you get access to Popular Websites Screener, which lists companies with the most trending website traffic trends and get Research Firm Rankings to choose which analysts should be followed based on the popularity of the firms they work for. Furthermore, get a list of Complete Expert Rankings to scan the best-performing experts over longer or shorter time periods, as well as compare an expert’s performance against the performance of its overall Sector or against the S&P 500 (SPX) index. What’s more, you can avail yourself of email alerts for an Unlimited number of stocks, and you get both PDF+CSV download options and VIP support for troubleshooting.

Now that you are well versed with the different features of both plans, you can choose between them depending on your investment objective. Premium is our most popular plan, as it gives you access to many tools and data you need to make data-driven investment decisions. That being said, Ultimate is becoming increasingly popular with investors who enjoy full access to all of TipRanks’ tools. Additionally, you can take advantage of our 30-day money back guarantee when you buy or upgrade to a yearly plan.

How to Use the TipRanks Research Reports to Gain In-depth Insights on Specific Stocks

The TipRanks Stock Report is a detailed report of all the pages from the TipRanks website related to the stock, which enables in-depth analysis of the company. You can study the different tools measuring the stock including its Stock Analysis, Financials, Smart Score, Stock Forecast & Price Target, Technical Analysis, Insider Trading tool, Hedge Fund Trading Signal, and more. Additionally, you can click on any news item on the stock report and open it on the browser to read further.

You can find the TipRanks Research Report on the left navigation bar on a stock’s page. When you click on the report, TipRanks will email the entire report to your registered email address in pdf format, within minutes. The pdf format enables easy downloading, readability, and study of the stock.